Hello,

I have several life cover life insurance policies in the UK. How do I go about declaring these on the 3916 as they aren’t really savings accounts - one is a decreasing mortgage term cover type, another is a fixed sum life cover policy. Which heading do I select?

Many thanks

Rose

Hi @Rose_Holt and welcome back to SF

Have you looked at my guide on how top complete your tax return?

There are references to how to fill in cerfa 3916.

You can link to the guide by clicking on this link here.

The guide helps with the 3916 forms whether you are filing on paper or on line.

You might also find some help in this guidance from the impôts.

Hopefully those will help you complete your task.

Hello Graham,

I have looked but it doesn’t mention how to handle life insurance policies I.e. what category do they fall under.

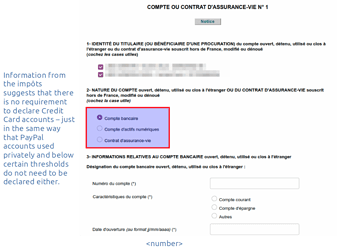

Page 39 of the guide provides a graphic.

Select « Contrat d’assurance-vie » (life insurance contract translated)

Ok but a UK life insurance policy is not at all the same as an assurance vie.

Hi @Rose_Holt

If you feel @graham’s Thread doesn’t quite fit your situation…

Why not contact your local Tax Office

You might be able to simply “join the queue” or need to make a specific appointment.

Armed with your “bits of paper” you can talk things through (face to face) to ensure that both they and you are on the same wavelength… and then they’ll tell you how to declare your bits.

best of luck

It’s your choice - declare or not as you see fit.

but, if you declare it (as a contrat d’assurance) and the Fisc don’t (won’t) have regard to it, is that not better than not declaring at all in circumstances when it should have been declared?

Remember, if you want a definitive answer, there are two places on the online submission where you can ask the Fisc a question.

Absolutely they need to be declared and I am very grateful for your help. My frustration is simply that the French government paperwork states (in English) that life insurance policies must be declared but as is often the case the French tax form doesn’t match up with UK financial activity.

I have frequently found that the local tax offices are none the wiser with regard to the intricacies of the UK system hence asking if anyone had had experience with this very specific question.

The paper version of 3916 gives more clarification for option 3 as Contrat de capitalisation ou placement de même nature, notamment contrat d’assurance-vie https://www.impots.gouv.fr/sites/default/files/formulaires/3916/2022/3916_3823.pdf

In the online version you should select Contrat d’assurance-vie and then add short additional information in Nature des risques garantis

That will be enough for you to make a declaration. They are very unlikely to have any more interest in the details of the account.

Presumably this very specific question rarely arises, if the French Tax Officials haven’t decided where/how they should be declared in the French System.

It’s not easy, but we’ll all get our declarations done in the end, so keep the faith.

(just wondering, did you try to declare them last year and did it throw up any wobblies with your Tax Folk…??)

Just bung them on as life assurance - basic details/dates and use one of the text boxes to say UK … Don’t over complicate stuff -

![]()

if they were French, would they be declarable on the 3916?

The 3916bis is a different animal but I don’t see a basic AV falling into that category…

AVs are available from outside France - my main two are both Irish domiciled.

So they do go on the 3916 - my boursarama one doesn’t.

Get a note every year reminding me they have to be declared on the 3916

And mine are in Luxembourg.

As an aside, I know from experience, in the past life assurance based in Isle of Man and the Channels Islands, did not have all the French tax benefits of an European Economic Area, (EU +Norway, Iceland, Liechtenstein)-based life assurance.

I believe that now also applies to UK life insurance policies.