That’s what I do. The income is when the money is paid, not when it is transferred.

I take the point but I’m of the view that it is what appears in my French bank account that requires explanation rather than a notional value converted at the time of payment in GBP.

Same meat, different gravy perhaps.

Either way, its academic since the amount paid (usually) is below the tax threshold in both UK and France.

It’s splitting hairs but I do it that way because the French tax people can gain access to my UK bank accounts and could, in theory, see that I’ve declared less than I’ve received if I only used the figures transferred.

It is splitting hairs David, of course, but as the amount is likely to be small, I doubt the fisc would challenge it but if they did, the value declared would be defensible (either way) and that generally is what the fisc are more reasonably interested in. I’m sure they have ‘triggers’ after which they would enter a challenge.

The UK would likely impose a £100 penalty for under declaring by 50p!

Vive la France

(For anyone coming into the Thread at a later date…)

IMO if we all work at declaring our income (whatever/however) without intent to defraud/mislead … we should be OK.

It is well worth remembering that ALL Bank Accounts (worldwide) and Monetary Investments etc etc should be Declared every year… leave nothing out… leave nothing to chance… and sleep easy.

If you are in doubt… speak with your local French Tax people… they are there to help and advise.

Anyone with extensive assets… will probably have an accountant working on their behalf… and anyone with too much money… can feel free to send me some…

Would you need to declare such a gift stella?

I’d be quite happy to discuss such a happening with my local Tax Officers.

I’d be quite happy to discuss such a happening with my local Tax Officers.

If someone wants to set the ball rolling… PM me for my Bank Details…

In a simple comparison, the BdF rate and ECB rates match exactly.

That said, taking Simon’s point about the annualised average rates, what is the effect of taking the closing rate in year 1 and the closing rate in year 2, adding together and dividing by 2. Does it average an already averaged rate?

And from what is the INSEE rate derived?

Moreover, in further response to David, isn’t it better to declare a rate actually achieved rather than an interbank rate which may be not achievable for the average man in the street?

A really interesting discussion. Thanks for your contributions.

One year, when the £ /€ was very volatile… I did the comparison on the “actual date” rate and the BdF Annual Rate… and it worked in my favour to declare using the Annual Rate… so I did… but, even so, I was uneasy… so have used the Actual Date rate ever since…(I’m such a coward).

As you say… for many of us … we are below the threshold anyway… so it is probably not worth worrying about.

Non-declaration… mmm… that is a different thing altogether and folk do need to watch out for that. I have heard folk/friends muttering about not declaring this and that… and (being me)… I step in… poke my nose in… and advise them to Tell All… what they eventually do is up to them of course.

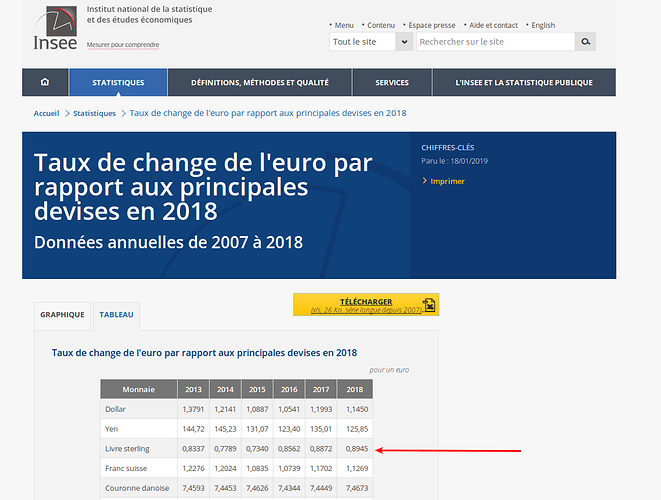

The INSEE site has been updated (10 days later than last year).

The closing BdF rate for the end of Dec 18 and the annualised rate from INSEE appear to be the same at 0.8945 which seems to suggest that taking an average of the BdF rate over the course of the year is unnecessary (ie closing Dec 17 + closing Dec 18 divided by 2) as the two rates (BdF closing and INSEE for 2018 equal each other).

So, if I have it right, averaging an already averaged figure is incorrect and unnecessary.