not quite true. In the Revolut app you can set a price alert and fix an auto-exchange. The former notifies you when the rate hits your chosen level and the latter will automatically do the exchange for the amount set at your chosen rate without the need for further interaction.

Would that have been internal bank Euro exchange? I can’t remember very well (I was a bit busy as my daughter was born on 4.01.02) but I am fairly sure I only started using Euros from the start of January 2002.

Yep, I can remember paying in francs for a coffee and the barman giving me the change in euros, January 2002 on my way back to the school near Saint Brieuc where I taught after the Christmas break.

You are both correct - while the € was introduced in 1999 paper notes and coins did not begin to circulate until 2002 - however, presumably one could convert Sterling to a “€” account in 2000 and then leave it there to be collected in 2019.

Of course, even if you had a time machine, how to get 2019 Sterling back to 2000 given that the paper money design has changed (so today’s notes would not be recognised) is left as an exercise for the reader

I use these people and have always found them lovely to deal with:

https://www.smartcurrencyexchange.com

And if you can sweet talk your bank out of charging you for doing a CHAPS payment, it’s win win!

How much money are you needing to transfer to need a CHAPS payment?! FPS payments are free & nearly instant, and some banks allow you to transfer up to £100k.

Hello Matt un

I think the original poster said he was transferring money for property purchase. We found that FPS was capped at £10k - £12k but if they’ve increased the limits, well and good. It’s just the bit where the Bank says they can’t get your money back if you make a mistake in the account details of the receiving account …

Cheers

F

Open an account with Transferwise. After using other companies I was one of their first customers many years ago and have never looked back. Download their app, do it all on your phone or PC, transfers made the same day, and in my long experience the best rates with no hidden charges. I use them twice a month to transfer pounds to euros. And, no, I’m not one of their staff, and I’m not being paid for writing this !!!

Think I’ll stick with Transferwise.

Revolut’s raison d’etre seems to be to fly high and conquer the world but that’s way too risky for me.

granted but you can still have one hell of ride in the meantime ![]()

It’s all about risk management. The account is free so you have nothing to loose there.

Hedge your bets by transferring sterling to euros and then the euros to your normal French chequeing account - deal done with a good exchange rate in the meantime, take advantage of the tax free interest ![]()

Hedging you bets is fine if you’re into betting in the first place.

For simple souls like me that work, earn mostly in € but occasionally in $ and £, use what I earn to pay bills and buy stuff and take so little interest in exchange rates that I couldn’t even tell you what rate I got yesterday, betting and speculating and risk management just ain’t on my radar. I can see why folks who get a kick out of squeezing a few extra euro out every transaction are enthusiastic about Revolut but I still don’t see it as a good fit for folk whose priority is their job or business activity, who when they need to move money for functional reasons, want to do it in a couple of clicks and then forget about it till next time.

as is the case with revolut ![]()

Yes but do you then put it right out of your head until next time you need to move money? Seem to me that Revolut wants higher user engagement. Could be wrong. But I get the strong feeling that providing a service to little fish like moi is not what the owner set Revolut up for.

They have 2 versions of the app; one for “little people” like you and me and for business (which carries a cost). They recoup some of their costs by charging for hole in the wall transactions above a certain level but the main “profit” base for them is their capital base.

There is a staggering paranoia about Revolut.

It is very easy to use and the best exchange rate.

But you can take a horse to water…

I’m not paranoid Mat.

I just don’t like some of the things I read about it.

Therefore I prefer drinking my water from a different trough.

Horses for troughs, as they don’t say.

We used Moneycorp when we purchased our Brittany holiday home in December 2016. The pound was weak as a result of the June referendum but we found them competitive on large sums and the process itself is pretty straightforward. We have continued to use them since.

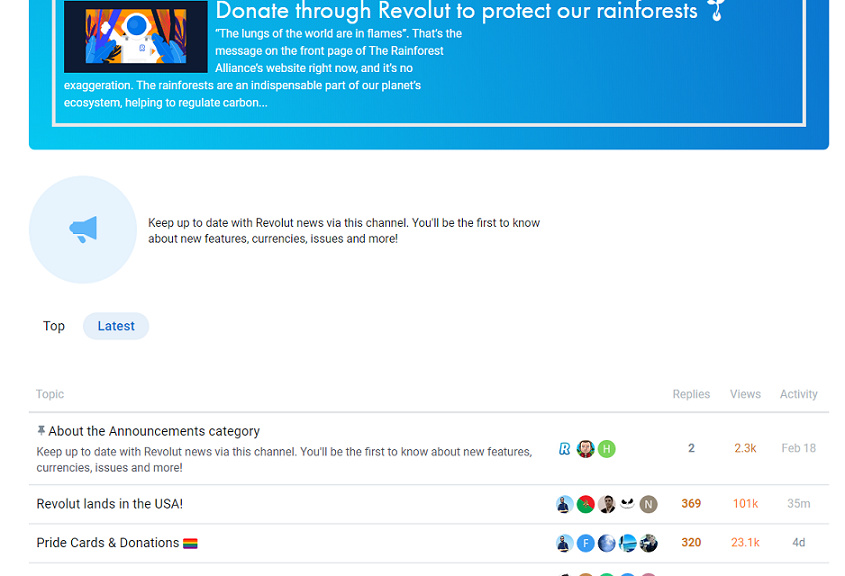

I like the fact that not only do Revolut support donations to the Rainforest Alliance and the WWF.

They also have a Discourse based forum Community like we do!

Yup, I use it a lot