Will need to change pounds to euros in the near future for property purchase. Would welcome any advice.

Buy time machine, pop back to mid 2015, exchange at circa £1 = 1.40€

Failing that any of the usual suspects for low cost foreign exchange - TransferWise, HiFX - search old messages, plenty of suggestions.

and TorFX an affiliate of SF in the Currency banner at the top of the page…

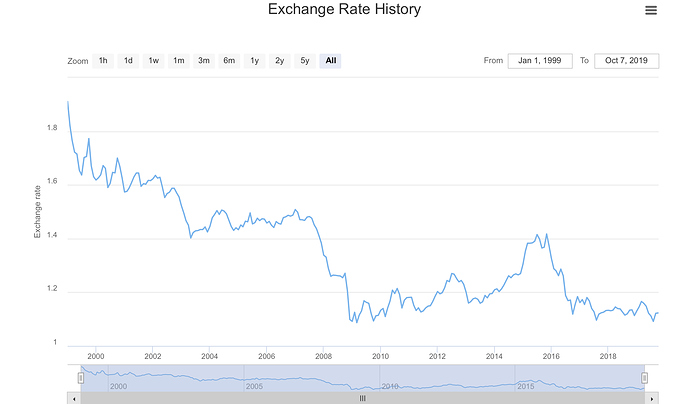

THanks for that, Paul - will have a look. However, the 2015 figure was a bit of an anomaly - the average for the five years before that was not much higher than it is now.

![]()

Virus-free. www.avast.com

My preferred currency exchange company is CurrencyFair whom I’ve dealt with for several years and have always received excellent service. Good luck with your purchase - exciting times!

Perhaps it’s better to look st the complete picture. I wouldn’t set out thinking that today’s rates are anything except bad if you’re looking to change pounds for euros.

True, but if you have the time machine… ![]()

![]()

![]()

Even better would April or September 2000 where it briefly touched £1 = 1.70€

Could’nt agree more to all comments about previous rates. I suppose we could delay until after 31st October, and hope for better rates- could it get much worse,?

![]()

Virus-free. www.avast.com

If we leave without a deal, probably quite a bit worse, yes.

Everyone has their favourite, of course.

Curremtly CurrencyFair (according to their website) will translate £10,000 into 11,151.00€ compared with TransferWise’s offering of 11,166.60€

It’s only 15€ more with Transferwise, or 0.135% - but it is more ![]()

Did you know, by the way, that financial institutions expend considerable amounts of effort, very expensive powerful computers and some extremely fancy uber fast networks into the process of arbitrage - basically exploiting millisecond by millisecond differences in exchange rates between different markets to make a profit out of currency transactions (or, actually, just about any type of transaction).

It’s basically “free” money once you’ve invested in the systems.

This is how those who play the market see it Tick-by-Tick

I now use Transferwise.com. Very good rate of exchange and VERY fast.

TransferWise seems quick and easy, even the phone app, and I have never had any problems sending money, nor had any annoying emails or calls from them.

Consider Revolut - à whole different way to transfer and then use the money.

Could be complicated.

You can’t escape the fact that revolut.com have made considerable waves in the traditional banking model and I can well understand the reasons for briefing against them.

Fact is, like @Mat_Davies I have a revolut.com account and the account I hold is based in the UK with a UK account structure and proper UK banking approvals.

I don’t use the account for “dodgy” trades and any monies held in the main (base) account are in sterling with a Euro wallet which is funded directly from identifiable sterling sources (Govt pensions). Euros from the account are either transferred directly to my French bank account or spent directly using the Revolut pre-paid card. The rates of exchange are updated second by second and surprising close (if not spot on) to the interbank shown here.

In the transfers I have done from my UK bank chequeing account to the sterling Revolut account, the transfer has taken place within seconds of hitting the send button on my UK sterling bank account app and the transfer of sterling to euro within the Revolut app happens instantaneously. From my Revolut euro wallet to my French Bank account typically takes a few minutes.

At no time have I been concerned about my funds in the Revolut account nor had any reason to doubt the safety of my funds.

I don’t have sufficient funds to test out a large transaction - sadly - but I am content with the conduct of my Revolut account.

So far I have not been able to fault Revolut - I am now using it as my main current account in Sterling & Euro - it seems light years ahead of traditional banking.

I have just used Britline Int Payments (HiFX). I have used Transferwise and Revolut before but they can struggle with larger amounts due to their process of peer to peer trades. I.e. they need the same amount going the other way by other people at broadly the same time. If they can’t match then they need to buy in the open market so rates can suffer. This also means they can only trade Spot and can’t do future.

My daughter who is spending six months working in Europe uses a different bank that operates like Revolut giving her instant access to, in her case, Swiss Francs. The trouble is I can’t remember it’s name, it was a very straightforward word that made me think of flora or fauna. She was showing me how it works and keeps a record of her actions. At the time she said it was similar to Revolut.

It’s interesting that Martin is comparing HiFX and TransferWise, I’m signed up with both and always compare the bottom line before exchanging money and it’s been literally years since HiFX has been the better choice. Since TW became so straightforward to use through the App and the speed that transfers go through it really has become the standard.