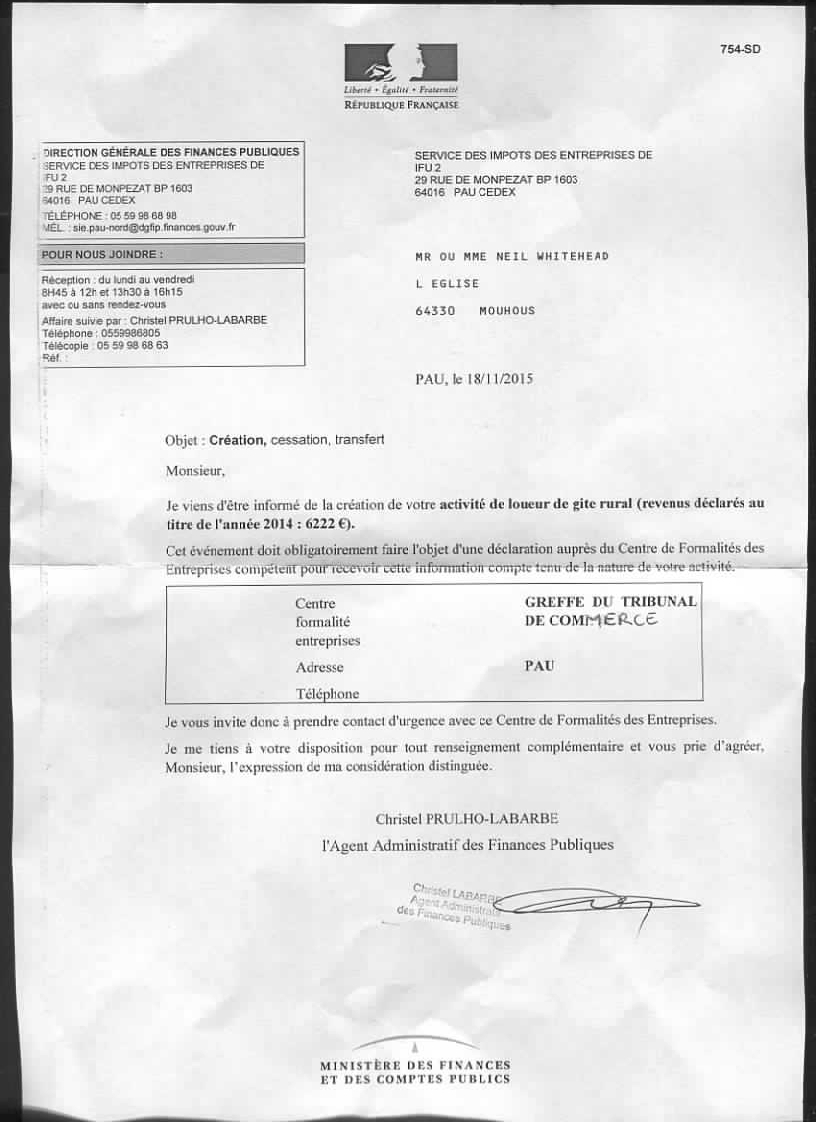

Received today. We have been operating for 10 years, registered with the mairie and making returns. Not sure what we are required to do but I guess will involve us giving more money to the government.

Received today. We have been operating for 10 years, registered with the mairie and making returns. Not sure what we are required to do but I guess will involve us giving more money to the government.

Thanks for the info - I think we will need to gird our loins and pay them a visit. The lady who sent the letter is not in the office until Tuesday so we will call her then. The tax office has us registered under auto-entrepreneur and calculate the tax payable each year. Our situation has changed - we are now both retired as of 2013 so this may have some relevance to the situation - who knows?!

Hello, I don't know if this helps, but I'm wondering if this is a case of mistaken terminology! We also have gites (as a generic term), but French officialdom is very precise on this. Generally I believe that 'gite rural' is for professionals: you have to be registered at the Chambre de Commerce and have a SIRET, the revenue from the property must form the largest part of your income, and you should be 'labelisees' with Gites de France, Clevacances or whichever! 'Meuble de tourisme' is more appropriate for the non-professional not fulfilling the above conditions, so it would seem that you were perhaps wrongly classified at the mairie.

The other thing to add is, do you already pay CFE [Cotisation Fonciere des Entreprises] (the old taxe professionale) on the 'gite', or taxe d'habitation?

We have also been operating for around ten years and originally it was our main income so we registered at the CdeC under the micro system. We have recently de-registered the property as we want to sell it, but according to the Centre des Impots, we should still pay CFE, not move to taxe d'habitation (it's a completely separate property to our home so no one 'lives' in it). It's also registered at the mairie as 'meuble de tourisme'.

Good luck.

[Our thoughts we we receive something from the French state are always the same as yours, and may also involve a head and banging it against a suitable wall!!]

Hi Neil

I had to register earlier this year as part setting up as an auto-entrepreneur for Meubles de Tourisme (not gite rural though) but received an general email from La Ram earlier this week with the following wording:

Yes, you need to register when the activity is regular.

Google found this : http://www.entreprises.cci-paris-idf.fr/web/reglementation/activite...

Une immatriculation au registre du commerce et des sociétés (RCS) est alors obligatoire si l'activité est exercée à titre de profession habituelle (c'est-à-dire de manière répétitive dans le but d'en tirer des profits).

The registration can be done online http://www.cfenet.cci.fr/

Many people choose the auto-entrepreneur status, because of it simple and straightforward when it comes to declaring and paying social charges and taxes.