I wonder if there might have been a tightening up of policy as a consequence of France’s review of its immigraton legislation last year?

Perhaps like when we got our first CDS over 30 years ago now, savings were not taken into account whatsoever, we had to prove a regular monthly income for a family of four which if I remember was about Ff5000 which fortunately we could with the business registered and plenty of work coming in and me doing some part time seasonal work. The prefecture stated that whilst savings in the bank were a sign of a back up financially, they could be depleted very fast should something crop up that needed paying for and were therefore not stable.

I don’t think it was me, but French law in this exact regard is written slightly differently than the EU directive. It allows for a period equivalent to what the citizen is envisaged to have, to a max of 5 years. IMO, this can be interpreted more restrictively than the EU language and would be what the prefecture is bound to. I will try to find the law later for you. On my phone just now.

They are unfortunately correct to focus on your EU husband’s resources. That’s exactly what the EU regulations say, and it’s something that has greatly concerned me for some time, and I’ve posted about it a few times, including on this thread.

What I hadn’t realised until I just checked is that France decided back in 2010 that in cases where there is “insufficient” EU citizen’s income, they will issue a “time reduced” CdS. What their Ministerial instructions say to Prefectures is that you take the income and divide it by the monthly RSA (ie the “dole”). They use that resulting figure to estimate how long (in months) the EU citizen can support themselves and their family member and they then issue an appropriate scaled down CdS, that could be one year, two years etc…From a quick search online it seems the monthly RSA for a couple with no children is 953€ or 11436 pa.

That’s what they may be doing in your/your husband’s case. Unfortunately the only mildly good news is that this approach lasts until you and your husband have permanent residents status - after 5 years. At that point the requirements for compulsory medical coverage and sufficient financial resources fall away.

I’m afraid there’s not much more that can be done if your EU citizen husband has insufficient income in his name, and that you’ve tried to show that your pension income is paid into a joint bank account etc etc. You may well have to repeat this performance each year until you reach the ‘magic’ 5 year threshold.

I don’t believe this is a new thing (it’s in the 2010 instructions to Prefectures), nor do I believe that income is the only criteria. In my own case, we absolutely did not meet the income criteria. We had combined income of 54€ (sic) in our year of arrival, but were able to show them a bank statement that helpfully had the proceeds of selling our house in Essex the previous month, so she just giggled when I asked the Préfecture lady if this was sufficient for their purposes…

One final thought is whether - based on the methodology set out above -, they are correct to only issue you with a 1 year CdS, should for example your husband’s income exceed the annual RSA threshold…

Sorry not to have better news. Perhaps others on SF might have other thoughts that could help…

Hi George. I kind of see the logic but this is where it gets confusing.

If the figure above is correct then his pension alone covers this.

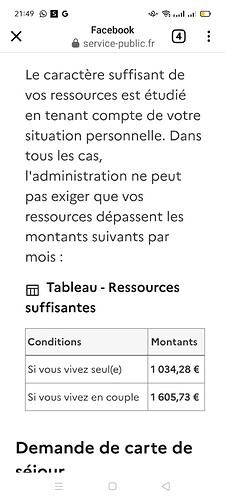

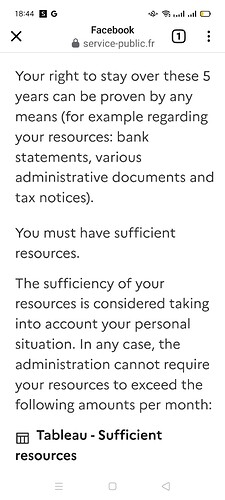

However the figures I found on the estrangers site it was listed as this

Just seen your figures are for if under 65 lol sadly we are over 65 so the above figures apply.

Which then yes he does not meet the criteria for supporting us both.

I just understood that they should take into account personal circumstances.

IE no Mortgage and own property, still have a lump sum in savings etc. (him).

As it also says this

Anyway I guess it’s finding out true figure as you quoted that one , french site says above and a lady who helps us translating quoted another figure.

Do you mind my asking but didn’t you say you were allocated a five year and yet EU spouse no income ?.

I know you had savings from sale but last year we did as well after sale of Spanish home . As card issued before we purchased.

Seems as usual it’s who you see and how it’s interpreted. ![]()

I was indeed given a 5 year card and my wife had 50% of 54€ in the year we arrived and I still obtained my card. I was aware of the lack of income threshold ahead of my meeting at the Préfecture (pre-online application) and relied on the ‘personal situation’ criteria you outlined earlier, which come from the Regulations. I can’t see what you have to lose by trying to convince them your situation enables you to have sufficient resources etc.particularly if you own your home.

Hi George

Sorry I can never work out how to message privately. Lol I thought email was private a year ago until saw replies on the forum.

One last question before we give up , sell and return to Spain. .

When you say

Prefectures is that you take the income and divide it by the monthly RSA (ie the “dole”). They use that resulting figure to estimate how long (in months) the EU citizen can support themselves and their family member and they then issue an appropriate scaled down CdS, that could be one year, two years etc…

IE if our RSA is 1605 as a couple over 65. Do they divide by the 1605 even if you have an income if say 1200 monthly so 400 short ?

I can’t even find the above you quoted.

Thanks again for all your help

Spain is no easy route now either

If you plan on taking any dependants to live in Spain with you, each will require 100% of the IPREM. The breakdown is as follows:

- As the main applicant, proving 400% of the Spanish IPREM (Indicador Público de Renta de Efectos Múltiples) means that you will have at least €2,400 per month or €28,800 yearly or the equivalent of foreign currency.

- Each family member will need to have a further monthly income of 100% of the IPREM which would be €600 per month or the equivalent in foreign currency.

Hello Jane

Yes thanks for your response. The reason I say return as we were there for 20 odd years and both have warp TIE valid until 2030. Plus even then it’s just an exchange with no need to submit finances.

So as long as we return before 5 years up no problems. I also noted that if we were moving to Spain as Spouse of EU citizen the financial requirements are must less than France, so husband’s pension would cover it unlike France.

Just so upset as I understand it’s based on EU citizen but they are supposed to take each person Into account. When we applied last year we had a very large amount of savings , plus his pension and still only issued a year.

This year we still have a decent amount of savings , own house no mortgage and his pension.

As I said seems to vary who has your case etc. I know people who received 5 year like George purely based on savings.

Anyway moot point , they just will not include my pensions.

Hi Tranmere. Sorry to hear you are even considering selling up and moving back to Spain. Hopefully this fairly drastic step won’t be needed! At least you do have this as a fall!-back though…

The methodology I set out for calculating the length of the CdS to be issued, based on dividing income by the monthly RSA figure, comes from the instructions drafted by the Interior Minister to Préfets for handling EU family CdS, which has not been (publicly) updated for 15 years! I would be quite surprised if there is not considerable variation in how individual Préfectures actually determine how they assess cases such as yours, and doubt they slavishly follow increasingly ancient instructions from the Ministry, human nature - and Prefectures being what they are.

I think from our last exchanges you were going to try to persuade the Préfecture to follow the regulations and take account of all the ‘personal circumstances’, to hopefully include as much as possible or your combined assets, income etc, even if they exclude your own pension income.

One thought. I assume from what you’ve reported that the Préfecture are still going to issue you with a CdS, albeit for one year at a time - ie they’re not going to actually deny you a CdS, are they? However tedious it would be for you, this CdS application exercise could presumably be repeated each year until you reach the 5 year permanent residence point, when income falls away as requirement?

I have to say it does seem unfair and inconsistent when some Préfectures clearly have looked holistically at the wider picture and granted CdS based entirely on assets (eg in my case) and others, like yours, seem to be interpreting the regulations in the strictest, narrowest sense.

Having read all the posts here I am wondering if I am a special case. My first Carte de Sejour was issued 23/08/2021 and is valid for TEN years - expiry 22/08/2031.

Why is that special? Lots of people have 10 year cards.

It’s just people with 5 year ones are now asking questions

From reading the posts it appears to me that most people get a 5 year card the first time - maybe I am wrong. My first card is a 10 year card, but my wife (who applied 6 months after me for her first card) only got a 5 year card.

I wonder what sort of CdS you and your wife have? If it’s an EU citizens/family member CdS for example, I agree the norm would absolutely be a 5 year card for your first application.

I think you probably are. Those of us with 10 year cards are not fretting yet, so all the comments are from the 5-year olds while us 10-year olds are staying quiet and feeling smug. ![]()

It’s not the norm. 5 years is the limit by both EU directive and French law.

I’m fully aware of that, if you’ve read any of my many posts on the subject. I was using the word norm as shorthand.

I also think you are. The rough survey done in 2021 showed the split close to 50:50 and a full 25 percent of anglos already having permanent cards.

Brits please !

Surely anglos is short for anglophones rather than a reference to a nationality ![]()