Question concerning my MIL. She is French and worked here until 32 (so has a French pension) but has lived in the UK for over 50 years. What is the situation if she were to move back here in terms of getting a carte vitale ? Would she be entitled to a S1 or is that not possible now? know there has been lots of discussion and do I remember changing goal posts as well? I didn’t really follow at the time as wasn’t relevant to me! Thanks in advance for your advice xx

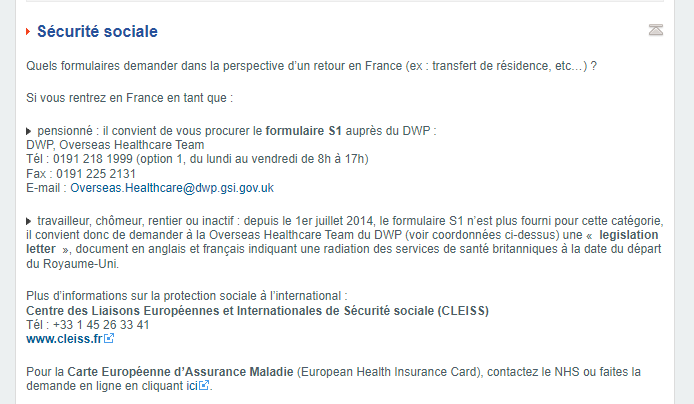

OK so just found this link on another thread:

So she can get a S1 still but just not get free UK treatment as S1s pre Brexit? Correct?

Think so….

Hi @toryroo

An interesting question particularly given the reverse situation. Some thoughts -

firstly to obtain a UK S1 as a pensioner, one would be getting a UK pension, and the UK must have accepted it’s the coordinating and responsible state for Social Security - presumably the work in France and the French pension information was provided to the UK DWP?

Secondly, is there any particular need to become ‘not UK resident’, could one not be resident in both countries for the purposes of healthcare similar to being tax resident in both countries - with a French passport one can come and go? One wouldn’t necessarily deregister from a GP ?

Thirdly, I can understand if one is seeking an S1 to reduce the pain of the French social taxes if one wishes to affiliate with the French health service, but the pain would dependent on how much income there is to tax - So maybe not so much pain after all?

Which brings me to my final thought- which is I wonder if that S1 guidance link posted is up to date because I recall seeing somewhere that anyone with an (UK) S1 can have UK treatment. Social Security coordination was included in the trade and cooperation agreement afterwards, I can’t remember exactly which parts mind you. I can say that my S1 certificate doesn’t distinguish whether it’s issued pre or post Brexit – although mine is issued by HMRC not DWP.

She worked in the UK until retirement so has UK pension as well. She is starting to talk of selling her big home so looking at options but it feels like she thinks France too difficult to return to. I’m not sure that is the case for her, just trying to get all the facts together before I call her back. You raise a good point, what would the situation be for a dual national spending her time 50/50 regarding residency and medical cover? I guess she has to make a call one way or the other!

The NHS cover is still valid for S1s prior to Brexit, not post if I understand properly.

Which country will become her competent state for healthcare is not clear-cut. It is usual that it is the last country you worked in, but there is also an assessment of the degree of rights you have built up in each country. If she has fairly similar pension rights in France and the UK, but is actually a French national then it may well be decided that France will be her competent state and she won’ get an S1.

Best to check with DWP overseas team.