Hi All

We have been permanent residents in France for the last 8 years. Last year we sold our UK house that had previously been rented. There was no CGT to pay to the UK has we had owned the house for 34 years and I think I am right in saying that the same stands here in France, at least I hope so.

My question is on this years tax form do we have to declare that it is now sold and if so in which box & what do we need to do to prove that we had owned the property for 34 years.

Many thanks & keep safe everyone.

Hi Ann and welcome to the forum.

I have to ask… no offence, but is “anng” your surname???

You may well have missed that full name is required…" first and last"…

I can amend things for you if you wish to put your last name on this thread.

cheers

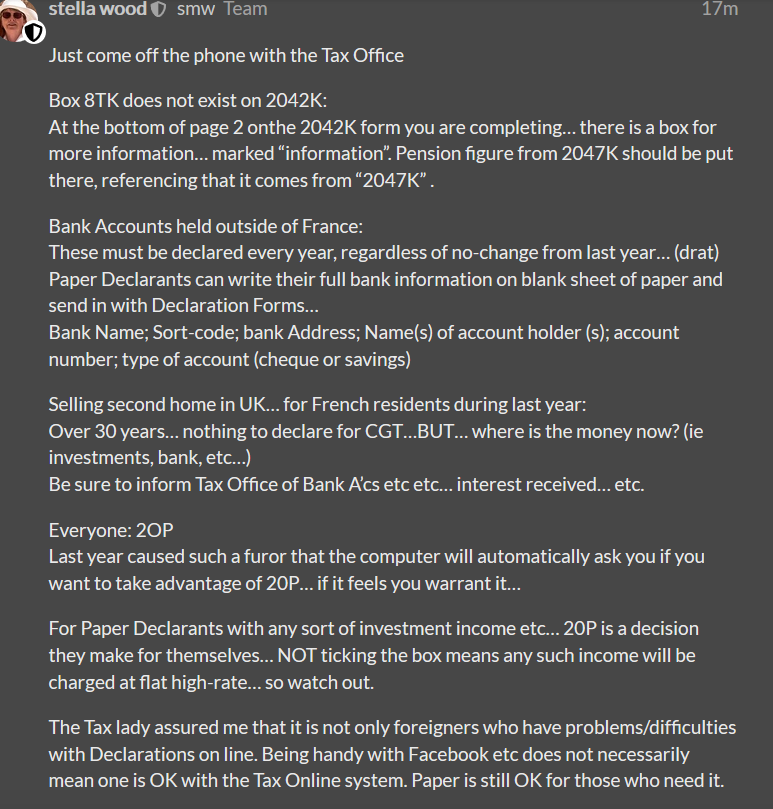

No need to declare anything here.

Oh sorry Stella, Its my first posting. Anng is my nickname. Brown is my surname, if you could amend it for me that would be fab. Mant thanks.

The property was your second home… although rented out … and, presumably you’ve been declaring the income on your French paperwork these last few years…

Now the second home is sold… you will need to Declare the Rent you received in 2019 up until the Sale…

As far as I can see… if you’ve owned the house for 34 years… by the various equations, there should be no Capital gains tax CGT in France (as Tim says). the equation is slightly different for Social Charges… but the chances are you will be outside that as well… but it will doubtless need to be declared/mentioned/explained.

I presume you can prove that you have owned the property for 34 years??

there will be a Box to put the amount in… even if it is not going to attract tax… let’s see what the options are…

I’ll be back…

and I’m sure others will chime in …

No CGT after 22 years, no social charges after 30 years ergo no need to declare the sale but as Stella has said 2019’s rent does need to go on the tax return.

Can you point me at that one… Tim…

You have to declare selling a Classic these days (over a certain sum) and provide the documents to prove you’ve had it long enough to escape CGT… (or not to escape as the case may be…)

Thank you to you both for the information. There was no income earned in last years tax year has the tenants moved out in November 2018. Before that all rent was declared on previous tax forms.

Thanks again to you both

sounds nice and straight forward then…

Will this suffice -

looks interesting…

As it says… selling a property might put one into the ISF range …

You and I do not know the full story… and we don’t need to…

If the figure is substantial… I do feel the question could be asked at the local Tax Office… they are working by email…

And…just for those reading this thread in years to come…

Anyone gaining benefits/reductions of one sort or another…should certainly be mentioning the sale of anything substantial… as those funds will need to be taken into account…

ISF has been abolished Stella, IFI came in in 2018 and relates to net property wealth only.

Hi Ann and welcome from a fellow newbie. I was just wondering if you are absolutely sure that you don’t have to pay tax in the UK on the sale of your house. Length of ownership in itself doesn’t determine whether or not you are liable to UK capital gains tax and as you have been non-resident in the UK for 8 years you may not be aware of the rule changes in the last few years. As you owned the house for 34 years I imagine the increase in value has been enormous so I hope you have sought and received professional advice on this. Forgive me if I’m butting in where I’m not needed but I wouldn’t want you to make an innocent error.

All the best

Izzy x

Ha ha…

that’s great… if one can have millions in cash/ investment and not be considered wealthy…

My understanding is that up until 2015 there was an CGT exemption for non UK tax residents selling UK property, from 6/4/15 CGT is payable on any gain using the value of the property at that date as the starting point so if you sell a property today for 100K and the value on 6/4/15 was 90K the gain of 10K will be taxable less any relevant fees.

That’s how it worked when we disposed of my share of my mother’s house. Gains from 2015 only, and with an amount that was free of CGT.

This is fascinating subject …

Just outline where the money is invested… bank etc… etc as appropriate

Thanks Izzy

We are absolutely sure has we paid an accountant in the UK to act on our behalf to complete the Non resident Capital Gains Forms to ensure that they were completed accurately. They also took in to account all the work that had been completed on the property within the 34 years of ownership.

Thanks

Ann