Trouble is, these banks are considered ‘too big to fail’ so the poor old taxpayer has to ballena’em out.

While the fat cats on the boards continue to have a whale of a time.

Trouble is, these banks are considered ‘too big to fail’ so the poor old taxpayer has to ballena’em out.

While the fat cats on the boards continue to have a whale of a time.

‘cats’ or ‘catfish’?

You introduced crustaceans into the thread and now you’ve brought in cetaceans too - what’s the porpoise?

C’est assez ![]()

Not that Catfish are ![]()

Yeah, the banks learned that when they were bailed out in 2008. They take more risks because of it.

“banking” can be more like a casino these days, not banking at all really.

More “banco” than “bank”, then

More angling than dealing.

As one does ![]()

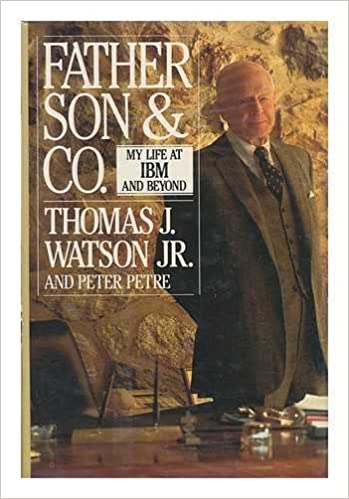

I seem to remember the story of an employee that had screwed up big time and cost the Company a lot of money being summoned to IBM CEO Tom Watson jr’s office. He was expecting to be fired but he wasn’t, Watson said “it’s just cost me $Xm to train you, why would I let you go now”. Obviously HSBC senior management have read… ![]()

equally, I remember a story about visiting a supplier in Eire and in the MD’s office was a big hole in the wall…

“What’s the story behind the hole Noel?” I innocently asked -

“Ah be jasus, that was where my safe was - one of lads broke in a couple of night ago and stole it”

“you sacked him I guess”

“Hell no, anyone who can remove a safe so cleanly as that deserves to be working for me!”

Another one bites the dust… Saudi won’t be happy (which is one small upside to this debacle).

A exceedingly rare glimpse of accountability in the Banking Sector, and in Saudi of all places. There must be something else behind it. Hope he keeps his head.

As Credit Suisse’s biggest shareholder, Saudi National Bank chairman Amar al Khudairy said his firm would not provide further assistance.

Ammar Al Khudairy, the chairman of Credit Suisse’s largest shareholder whose comments recently helped spark a slump in the Swiss lender’s shares ultimately leading to its takeover by UBS, has resigned.

He will be replaced by Saudi National Bank chief executive Saeed Mohammed Al Ghamdi, according to a statement on Monday.

Speaking earlier this month, Al Khudairy said “absolutely not” when asked if Saudi National Bank would be open to further investments in Credit Suisse if there was another call for additional liquidity.

The Swiss bank’s stock plunged to the lowest level on record and its credit spreads surged following his comments. That helped drag all European banks lower as investors shied away from risk following the collapse of three lenders in the US.

UBS agreed to buy Credit Suisse in a historic, government-brokered deal aimed at containing a crisis of confidence that had started to spread across global financial markets. UBS will pay 3 billion francs (€3.2 billion) for its rival in an all-share deal that includes extensive government guarantees and liquidity provisions.

Saudi National Bank, which is 37 per cent owned by the kingdom’s sovereign wealth fund, acquired a roughly 9.9 per cent stake in Credit Suisse for 1.4 billion Swiss francs last year as the anchor investor in its capital raise.

Bloomberg

I suppose it’s the sort of thing Elon Musk says (and gets away with).

The bank turmoil hasn’t gone away. Just heard Bloomberg’s Kristine Aquino say on W@1 it could be worse than 2008, first time I’ve heard that ![]() She said the speed due to technology and social media means that bank rushes now develop far faster…

She said the speed due to technology and social media means that bank rushes now develop far faster…

The FT seems a bit spooked too ![]()