Thank you all in advance for sharing your knowledge, highly appreciated. If someone is a French resident and has rental income from outside France (but within EU; Netherlands) and is under 65 years old, would you say that no French social charges at all have to be paid on this specific kind of income?

Talk to your local hôtel des impôts.

If you are a french resident without an S1 from another country ýou may have to pay.

You need to check the tax treaty between France and the Netherlands.

There is no EU-wide arrangement (as far as I know) and your age is irrelevant.

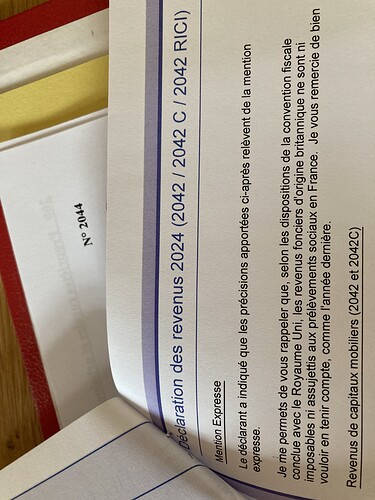

Under the UK-France treaty, certainly UK rental income is not liable to either tax or prélèvements sociaux in France. But I always include a politely worded reminder in the Mention expresse.

Thank you very much Helenochkha for sharing your knowledge, greatly appreciated

I think you will have to declare your rental income in the Netherlands and be taxed there.

Then in your French tax declaration you should mention this income for a tax credit.

I took a look at the France/Netherlands treaty this morning (what better way of spending a rainy Saturday!). Rental income from a Dutch property is only taxable in the Netherlands under the treaty. It is exempt from tax in France. No credit for the Dutch tax can be taken against the French liability (logically since that income is exempt in France).

However France includes the Dutch income to set the rate of overall tax, which is then applied to the proportion of French taxable income over total income (incl the Dutch rental income). It’s known as exemption with progression, or taux effectif in French.

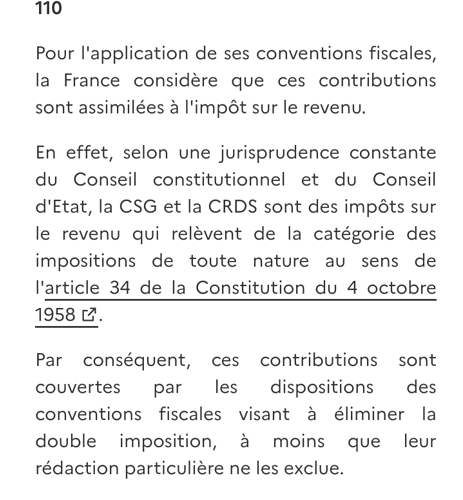

Having done a little more research, it seems that France treats CSG/CRDS as taxes for the purposes of tax treaties…In other words, if the treaty exempts the particular income from French tax, that is taken to include CSG etc, unless the treaty specifically says anything to the contrary…which the NL/France treaty doesn’t. Therefore my conclusion is that Dutch rental income is exempt from both tax and CSG etc…for a French resident.

Extract from Tax Bulletin below.

forgive me for throwing my thoughts/misunderstandings ?.. into the mix… but doesn’t one need to be affiliated to an “outside” health organization (like with my UK S1) and thus NOT a burden on the French State… to be totally exempt from the CSG type contributions??.

I always tick the box on my Paper Declaration, to confirm our status (ie S1)… and get the amount of CSG which is taken at source here in France the year before … refunded to me… ![]()

I think in this instance we’re talking solely about an exemption for one specific item, ie overseas rental income, under one specific tax treaty, rather than a total exemption on all income. This is similar to the treatment that Helenochka comments on above, concerning UK rental income, also exempt from social charges (irrespective of an S1 etc).

The logic (if such a thing can be applied to tax!) is that Dutch rental income is exempt from French tax under the treaty. As CSG/CRDS are, to all intents and purposes, taxes that go into general funds, as opposed to providing actual benefits, it is logical to exempt the rental income from them too, under that treaty.

Becoming intrigued by CSG/CRDS, I enquired a little further and found this which explains where the money goes …

Les fonds générés par la CSG sont distribués aux régimes d’assurance maladie, au fonds de solidarité vieillesse, aux prestations familiales et à la caisse nationale de solidarité pour l’autonomie. En ce qui concerne la CRDS , elle a été mise en place pour financer la caisse d’amortissement de la dette sociale (Cades).

"The funds generated by the CSG are distributed to Assurance Maladie, the old-age solidarity fund, family benefits and the national solidarity fund for autonomy.

As for the CRDS, it was set up to finance the social debt amortization fund (Cades). "

Superattentive of you to dig in this topic for me, thank you very much. Can I add some karma-points for you anywhere ![]()

Seriously amazed how kindhearted it is from you to share this with me, thank you very much, really helpful

Does anyone have the official legal text regarding not having to pay impot or CSG on UK rental income … or is the tax treaty meant to be sufficient? There is so much contradictory information on this and it just seems like the authorities are interpreting the treaty differently. Our reading is that UK rental income is not taxable in France (and by that it includes CSG) so we put it into 4EA of the 2042C. Reading the treaty again it seems even thought it isn’t taxable they want it declared and give a credit. So while we got that wrong and will correct it, they’ve come straight back to say he has to pay CSG and put his income into 4BA, 4BL and 8TK. We referenced Article 6 of the treaty but they aren’t buying it. They are saying CSG is payable. All advice gratefully received.

Ask your tax advisor.

This is serious stuff, stop winging it. Get advice ![]()

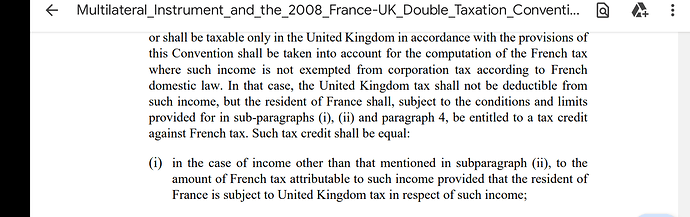

Your local tax office is right on the fact that your UK rental income is subject to tax in France (see below) but wrong on CSG. The UK rental income is reportable on your French return but France will give you a (‘free of charge’) tax credit exactly equal to the French tax due, to prevent double taxation.

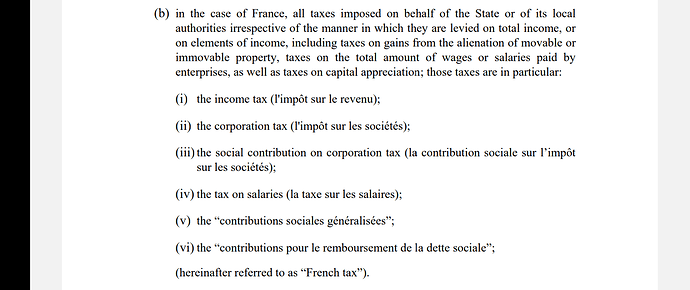

This is where it gets interesting technically. If you look at my post above (#8) you’ll see (in its official Tax Bulletin notice) that France treats CSG and CRDS as ‘taxes’ in its treaties. France goes further in the UK/France treaty and specifically calls CSG and CRDS ‘French tax’. See screenshot below.

Then you turn to the elimination of double taxes article (24) in the treaty which sets out that France gives you a tax credit equal to the ‘French tax’. As set out above, the definition of ‘French tax’ specifically includes CSG etc, so the tax credit France gives you also in effect eliminates the charges to CSG and CRDS.

This interpretation is also confirmed in various technical guides too, for what it’s worth.

I would summarise the above in French and politely respond to your tax office. It is reported that some tax offices do regularly get this point wrong in connection with foreign rental income.

Do let us know how you get on. Best of luck.

Good morning,

The Conseil d’État has already wrestled with the issue of whether UK rental income should be subject to prélèvements sociaux and given the following ruling in response to questions from the Administrative Court of Cergy-Pontoise:

https://www.legifrance.gouv.fr/ceta/id/CETATEXT000041569463/

You should read the whole ruling - and quote it to your tax office - but the bit that stands out is the Conseil’s reply to Question No 1:

“L’expression en cause ne saurait permettre à la France, s’agissant des résidents de France personnes physiques, de ne pas appliquer le crédit d’impôt prévu à l’alinéa (i) du a) du paragraphe 3 de l’article 24 aux contributions sociales françaises, au motif qu’aucun impôt sur le revenu ou sur un élément du revenu de nature équivalente n’existe au Royaume-Uni.”

Our tax office tried to charge us prélèvements sociaux a few years ago but were happy to correct their mistake when I went to see them.

I’m surprised, though, your friend’s tax office got back to him so fast, immediately after he submitted his return, pointing out he’d done it wrong. I’m not expecting to hear from ours until we get the avis d’imposition in August.

Thanks very much George1 and Helenochka. That’s what I thought.

Helenochka: You could’ve knocked me down with a feather when he said he’d had a reply. I’ve never known anything in France to be this quick! It took ANTS six weeks to reply to a simple(ish) query about a car!! Yes I looked at the decision 435907 when I realised this is a long running saga. Hopefully if we go back with reference to that on the corrected return it will hold some weight.

George1 - I think quoting the Article 2 may be needed (we just referenced 6 and 24), and summarising it is a good idea. We just didn’t want to be too officious as to get their backs up. But that plan didn’t work anyway! ![]() So we’ll go and put it in the right boxes (assuming 4BA/BL/8TK are correct) and then do the Article refs and Decision. We already filed a reclamation request on his CSG for last year so it will be interesting if they reject that outright. I’ll keep you posted.

So we’ll go and put it in the right boxes (assuming 4BA/BL/8TK are correct) and then do the Article refs and Decision. We already filed a reclamation request on his CSG for last year so it will be interesting if they reject that outright. I’ll keep you posted.

But this raises a query on my own return. I declare English income that I was led to believe (by the tax office) is subject to CSG. Dividends, which I think is right but also UK salary - and before anyone gets excited ![]() it is work for a UK Ltd Co which is only carried out in the UK, I have my own French business that I do most of my work through. The Treaty says they are taxable in the contracting state … so does that mean any CSG they’ve charged against that is wrong as well? I get a tax credit but then get charged CSG. I assumed it was because I don’t pay NI in the UK. But now I’m delving on the rental side of things I’m thinking maybe I should be claiming back the CSG charged against my salary. I do pay plenty of cotisations and taxes on my French income and am happy to do so, but if I shouldn’t be paying CSG on the UK income … then I shouldn’t.

it is work for a UK Ltd Co which is only carried out in the UK, I have my own French business that I do most of my work through. The Treaty says they are taxable in the contracting state … so does that mean any CSG they’ve charged against that is wrong as well? I get a tax credit but then get charged CSG. I assumed it was because I don’t pay NI in the UK. But now I’m delving on the rental side of things I’m thinking maybe I should be claiming back the CSG charged against my salary. I do pay plenty of cotisations and taxes on my French income and am happy to do so, but if I shouldn’t be paying CSG on the UK income … then I shouldn’t.

There was me just happily paying my taxes until I got involved in this! ![]()

So my friends UK rental income is sorted and I’ll let you know the outcome; but confirmation on my thinking for my UK salary would be appreciated. I really appreciate your ‘facts not opinions’ approach. Many thanks.