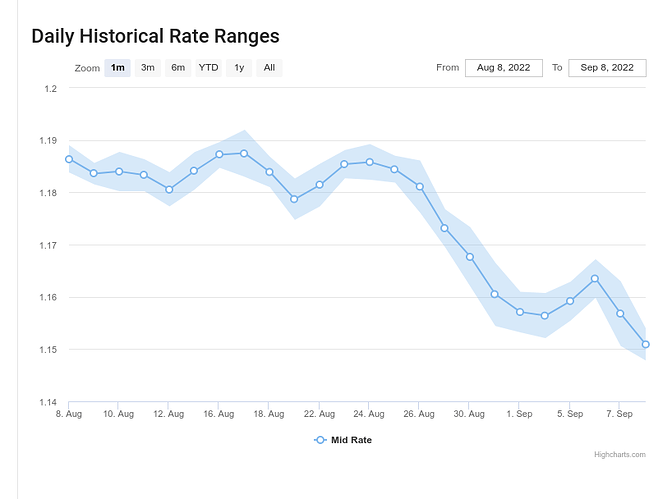

Was listening to France Info about an hour ago and they said that Sterling is plummeting today in the face of no confidence in the UK. Anyone else heard about this. I remember in the mid 90’s when we got Ff6/£1 and so many pensioners were hit hard. Anyone thinking of going to the UK soon might benefit possibly.

Just received this month’s pension into CA… 20€ less than last month… which was 10€ more than the month before… it’s a rocky ride…

It dipped below 1.15€ earlier but will probably recover a bit now that the UK government’s intervention on energy bills is becoming clear.

EDIT - On the other hand word is euro interest rates are about to rise - so that could constrain any sterling rise against the euro.

I’m sorry of course for those whose pensions are affected, but when it comes to reporting on currency there appears to be a tendency to use overly dramatic language.

Plunged, plummeted and soared seem to be firm favourites.

Not sure how France info stand to gain but I am sure that on certain news outlets this kind of dramatic language leads to financial speculation.

All the major currencies have dropped in the last few days

yes, I think the € and the $ against the £ were at parity earlier…

must confess I don’t often bother to see when the pension hits the account… I know roughly what it will be… and it’s only at times like today… that I check things out.

Its headlines no one reads the £ has dropped a penny/centime or 2 - plunged is dramatic. Don’t think it’s calculated about speculation - it’s just grab attention in the internet world. Clicks are money

Yes, exactly Chris - they do the same on most subjects, even when nobody is speculating in them.

I was a Guardian Online ‘guest blogger’ for a while - they were always changing my sober, factual titles into sexier headlines (though generally didn’t interfere in the content).

Tabloid bollocks, plummeting, its dropped to 1.15 but look at the year to date and this isnt news its click bait.

That just got me thinking about what other newspapers would do. For example:

- Geof: Modest increase in Community Interest Company registrations

- The Daily Mail: Woke brigade cancel small businesses

- The Sun: Attractive young entrepreneurs exposed!

Bought the lad a laptop (Dell XPS 15) to take to Uni, looked on Dell’s site still thinking I might get one myself (to be clear I don’t need a laptop, but y’know) - price up by a little over £50.

Thanks to the £ slide against the € no doubt.

Oddly if I look on dell.fr the price, even at yesterday’s rate, was £30 less than I paid in the UK two weeks ago - but the only option is an AZERTY keyboard, no thanks.

Dell will swap the keyboard if you ring them - or they used to …

It’s volatile at the moment. Was up around 1.19 to the pound a month ago. Some commentators today are optimistic it’ll bounce back some way, as the energy price intervention means inflation may now have peaked in the UK. But who knows? I’ve been hedging my bets and buying Euros over the past year or so. Got enough for our two months in France this autumn and hopefully a Canaries trip after Xmas.

The central question at the moment is just how weak the £ is, and how strong the €.

Interests rates are a lot higher in the US, and it is obviously far less impacted economically by the Ukraine war - yet the € has hardly fallen against the $ over the last month, while the £ has fallen a lot.

But here’s the real anomaly: UK interest rates are higher than € rates, and the UK less impacted by the war than the € area - but the £ has also fallen against the €.

I can only see 2 conclusions:

- Investors and speculators, despite Ukraine and lower returns in Europe, still see the € as a relatively safe bet; and

- They’re anticipating further falls in the £.

According to ecb.europa.eu euro was trading at 1.18 dollar this time last year and is now at more or less 1.00 dollar. Yes the pound is doing badly but the euro isn’t great either.

I was talking about more immediate issues - not the rates a year ago, which I think are pretty irrelevant.

The main factor in the fall of the € against the $ over that timescale has undoubtedly been Ukraine - but really, in exchange rate terms, that’s ancient history.

A subject close to my heart. A potential 300K house budget has just ‘gone south’ 15K euro. Or on the other hand I’ll pay £36 more rent this month. I’m happy with dramatic language!

Not the dollar, which is the problem. America is energy self sufficient and gas and oil priced in dollars. Both £ and Euro (no euro symbol - maybe I’ll buy that AZERTY kepboard) are falling against it, the pound more so, so it’s gone down relative to the euro.

Also according to various commentators the bank of england briefing last week caused the significant drop e.g.

and

the last article suggesting the possibility of parity for the £ - $ pair. There’s lots of speculation it’ll be 1.10 ish by end of year… Interesting to see if £ drops after their next delayed September meeting.

As an example of how all this is working, at the beginning of the year (I think) I could have bought dollars at 1.35 / 1.36 to the £.

Last week I could have sold these dollars for euro’s at slightly less than parity - that would have given me a £ / euro rate of 1.36, less two trading fees.

If only I’d known! ![]()

On the other hand the pound tanking will eventually push up inflation, so those inflation indexed pensions will rise to provide some amelioration of the pain. Of course there is also France inflation also needing to be compensated for.

economic vandalism and complete incompetence - more of “a good day to bury bad news” or at least suppress it by a compete buch of incompetents in spite of Quasimodo being hailed as cerebral from his days on University Challenge and just maybe we will get another “oh fuck” moment when he realises what damage he has done.

The maxim “Ministers decide, civil servant advise” doesn’t seem to apply or be understood to this Tory bunch of idiots ![]()