Good afternoon everybody. I hope you enjoyed whatever you did yesterday.

I’ve been doing my French tax returns for more than 25 years, and over the last two years they seem to have become more and more difficult, although our situation is very simple.

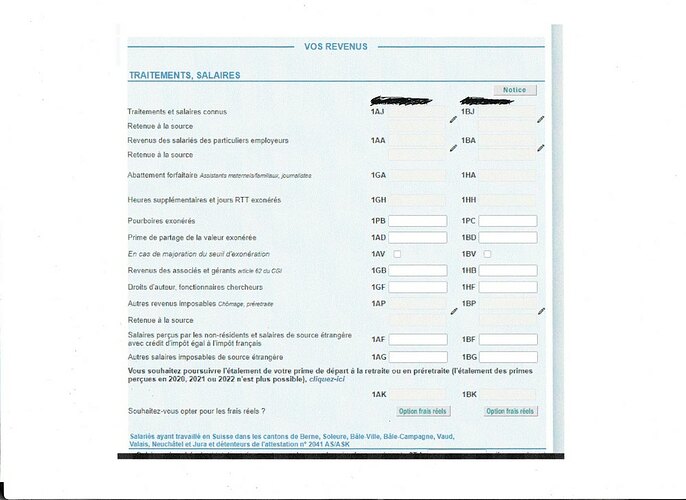

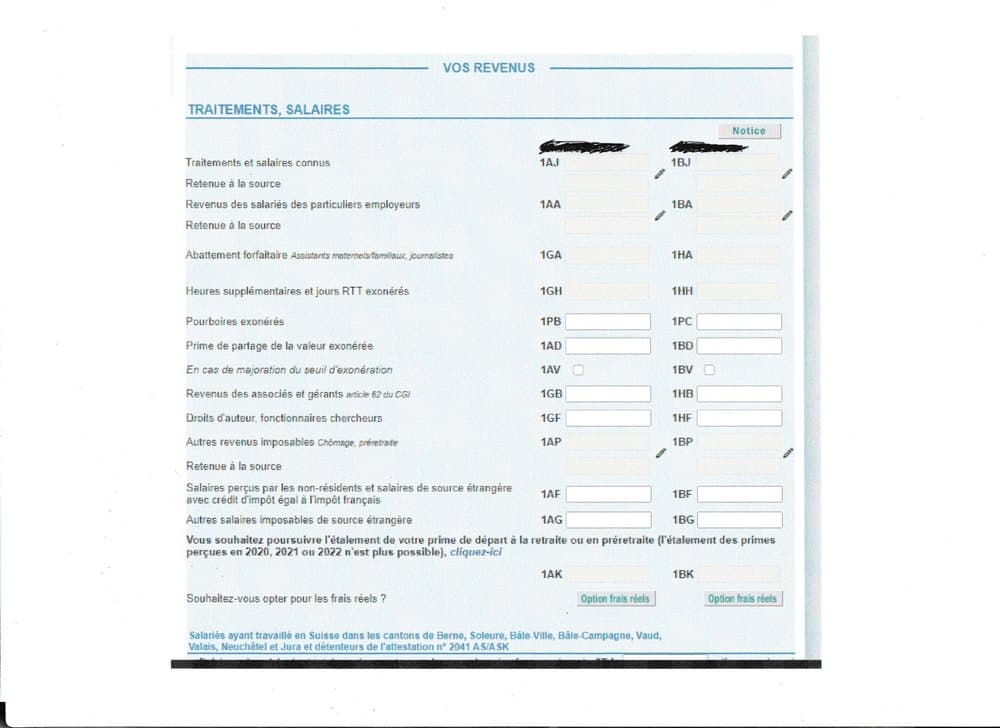

Starting with Annexe 2047, I am already stumped. Can anybody please indicate which boxes I put in our UK pensions, and a small income from a UK company? In previous years I entered in Boxes 1AJ and IBJ, and boxes 1AS and 1BS.

They are no longer an option.

On the main declaration, under ‘Vos revenues’, most of the boxes are greyed out, and none of the boxes that are not greyed out apply to our situation. I can’t even open the boxes 1AJ and 1BJ to edit them.

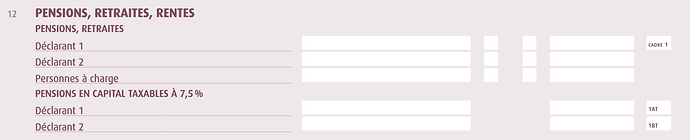

My notes for 2047 say section 1-12. Then my Local Government gross goes in a different section (can find that if it applies to you).

Thank you. However, I don’t understand what you mean by section 1-12. We only have State pension to declare, where does it go?

It’s page 1 of the form 2047, section 12 : pensions, retraites, rentes.

1 Like

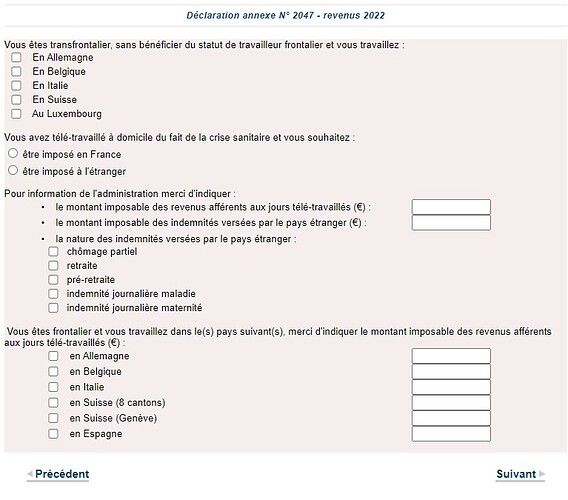

I posted a screenshot of our Annexe 2047 above (image Tax2). There isn’t a section 12 for us.

I think that’s the first page? For frontaliers - move to the next pages?

Tick ‘prive’ in section 12 for state pension.

On the main form 2042 I used box 1AM last year.

No idea for “small income from a UK company” - but I’d really like to know!

is it your own company?- how’s the income taken, is it salary or dividends? If salary then box 1AC on the 2042 is what I do - directly, not on the 2047.

If dividends, no idea. However, if it’s your own UK company, wouldn’t you be better off paying yourself a (small) salary up to your UK personal tax limit?

Hope that helps as far as…

1 Like

Thank you. I managed to finally access the right boxes on the Annexe 2047.

On the main form, the boxes to copy those figures into is greyed out. The boxes that are not greyed out do not apply to us.

‘Small income from UK company - royalties paid by UK publisher on sale of books’. The tax office told me, 20 years ago, to declare it as 'autre salaires de source etrangere. ’ I have now found the box for that, it’s 1BG.

However, there is no box IAM or 1BM visible on the form.

I think you need to tick the box for “Traitements, salaries, pension et rentes imposable in France” right at the beginning of the form? It is a while since we completed ours so I can’t be certain, but I think that is what gets you the boxes you need.

For me boxes 1AJ are autofilled only when the french FISC knows your revenue from your french employer. A bit like PAYE in the UK. That is why they are greyed out.

If you received some wages in the UK that were taxed in the UK, those would go to 1AF I believe. That is what I do.

1AG might be for income (such as pensions) that are untaxed in the UK, although I am not certain as it does not apply to me.

1 Like

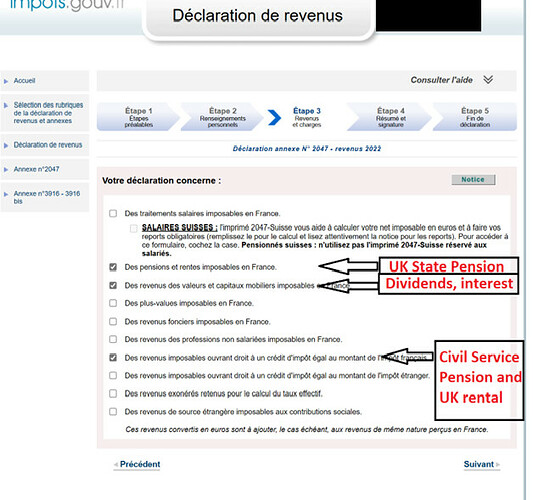

This is the intro to Form 2047. These are the boxes that need to be ticked for various pensions and other income (I believe… if I’m wrong please tell me). Many of the numbers from here are automatically forwarded to main form 2042 (blue).

UK State Pension is not taxed in UK.

Civil Service Pension and UK rental are taxed in UK.

Luck.

1 Like

I think I have it sorted out now, thanks to everybody who gave advice. I will ask the tax office to check it tomorrow.

When I went to complete the Biens Immobilier declaration, I discovered that firstly they had one property down as having 5 rooms, when it only has three, and another one, a tiny little building we used as a gite for three years at the beginning of 2000, as a 3-room house which we apparently still inhabit! In fact it only has two rooms, one downstairs and one upstairs, and nobody has lived in it since 2006, apart from the bats and swallows, a bicycle and load of stuff waiting to go to the tip.

Both of those factors I am sure would have increased our taxe fonciere liability over the last 16 years. I don’t know where they take the information from, but I recommend everybody checks their Biens Immobilier declaration to make sure you are not being taxed for a property that is uninhabitable, or on more rooms than it actually has.

I tried to change the details on the site, but there doesn’t seem to be any way to do so, which is why I have to go to the tax office tomorrow to ask them to update the information.