Hilarious - so what about the other 199?

You must have been unlucky or had a complicated claim.

I rang them four weeks after submitting the double taxation refund claim. And they gave me the week 8 weeks hence in which i would get a refund or queries…and true to their commitment the refund popped into my uk bank account in the week indicated.

I was impressed with the efficiency even if I was in a 12 week queue.

Does anyone know how I finalise annex 3916? It just keeps wanting me to add more accounts that I don’t have and then I have to log out to get it to go away!

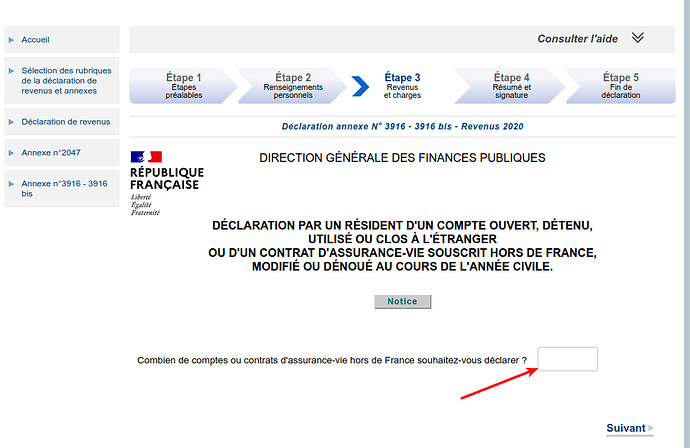

You start off the 3916 by inputting the number of accounts you are declaring… did you do that?

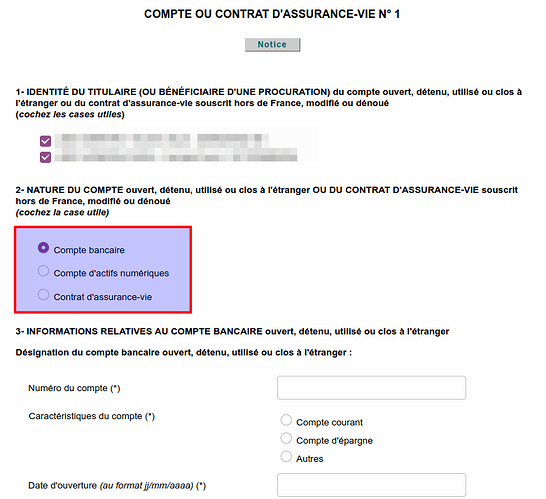

after which you then indicate the nature of each account:

Yes, I filled in the number of accounts and filled in all the details.

So, are you sure that it’s asking you for more account information or is it perhaps a different problem as to why you can’t progress to the end… such as:

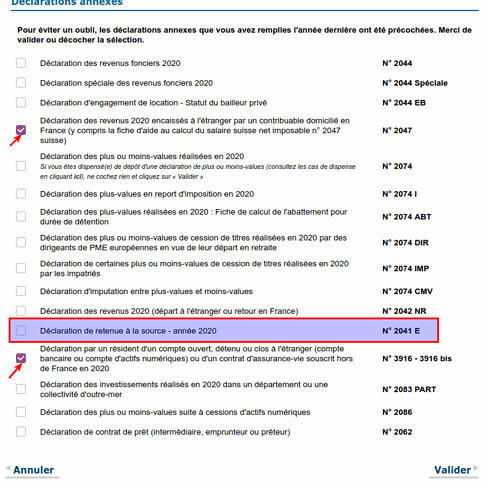

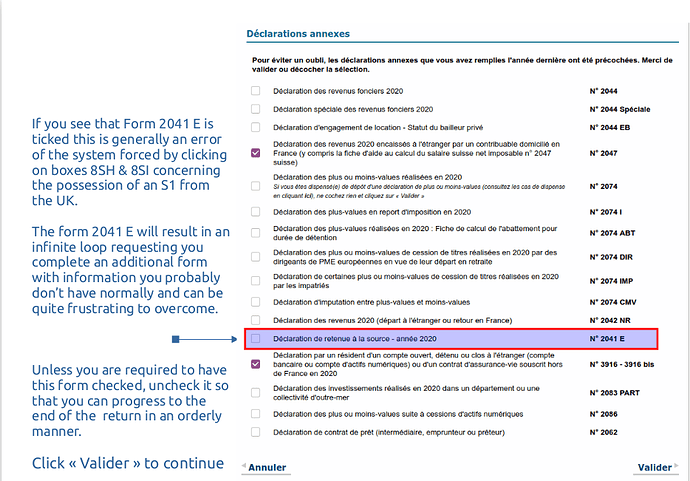

There is a known issue with the Form 2041 E being checked by the system (after selecting he boxes relating to the S1) If you se the 2041 E in the left pane, you need to go back to Annexes to uncheck it if this is the issue.

I had already unticked 2041E. I have finished the form called tax return, checked 2047 and filled in 3916. When I try to move on from the initial form tax return it tells me that I haven’t finalised 3916. I go to that and it gives a summary of accounts with a box at the bottom asking how many other accounts I want to fill in. I have tried leaving it blank or putting zero, neither of which worked. I eventually tried putting the total number of accounts and then it wants me to fill in more. I just can’t seem to move from that screen. What is the difference between 3916 and 3916 bis? Is there something I am not filling in? Thanks fo r your help. If I can’t do it I intend to add a comment, delete 3916, and send the details of the accounts on paper to the tax office.

3916bis is to do with declaring online accounts and electronic funds such as bitcoin. You can leave a message when you first log in to your tax account with the secure messagerie.

I am going to try again, fingers crossed.

Good luck. I didn’t have an issue with the 3916 but someone else up the topic said they had similar but I think they said the problem went away after re-entering the data.

I am just trying again and what happens is: I click on 3916 and it gives a summary of my accounts; when I click following without filling in a number at the bottom it just takes me back to my first account and then I can’t leave that screen. I will try inputting the info again to see if it works. Thank you.

Is it perhaps to do with the address? ISTR that we had an issue initially with that aspect and it not accepting part of the information.

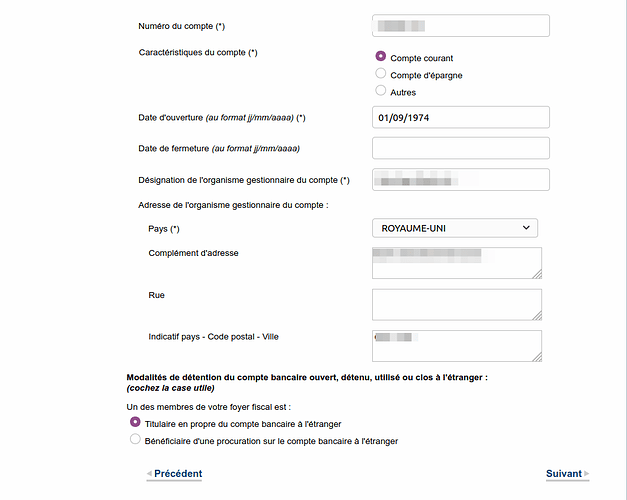

In the end, I re-entered info in Pays, Complément and Code postal as in this graphic and it allowed me to move on (I didn’t put anything in Rue)…

I’ll try that, thanks.

Yes, that seems to have done the trick. You are a genius. Thank you so much.

I never let the computer get the better of me. It’s just a machine after all

Hello all,

I have discovered your forum during my annual fight with the dreaded French tax declaration!

The info posted here is very helpful and much appreciated - thank you.

Especially the particulars about Paypal (which I have managed to declare in a roundabout way!) and Premium bonds (would never have even thought about declaring my childhood account!).

So thank you again and good luck to everyone still wading through the form!

Kate

@Kate22

Hi Kate and welcome to SF

Given the closing dates, it must be pretty much done by now. I think this year was a bit more of a challenge on account of the changes - particularly to the combined cerfa 3916/3916-bis and the challenge of the 2041 E loop.

A couple of recent articles which might be useful.

Re first link, that’s what we do. And for us it works, as pay accountant less than we would otherwise pay in tax with a micro-bic.

Does anyone know if birthday gifts from close family count as income?