It looks like I am being sent the wrong online form each year so am requesting a 2042C to fill in. I have claimed back social taxes since 2012 and it is so annoying to find that I could have avoided this. Still waiting for 2018 and 2019 to be repaid although they have acknowledged 2018 stating that it will be automatically repaid to my bank account. I will chase it again tomorrow.

I think I am alright on that as I do not have any of the newly declarable accounts. If I transfer money across it is always on a non deposit account with Currency Fair.

Apologies if this has already been talked about, but as I keep getting scrolled back to the last post on the topic I’ve given up trying to find anything relating to this.

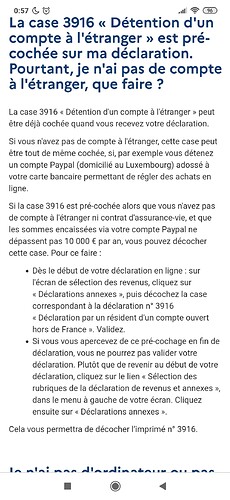

With regard to declaring PayPal accounts on the 3916, I have just read this on the impôts.gouv.fr site.

From my understanding, there is therefore, no need to declare a PayPal account, unless there is 10,000€ plus coming through it per year.

This is the link to the site: Déclaration des revenus 2021

Hi @DeTolkTW your first link is broken ![]()

You need to remove the caret accent ô in the link so it becomes impots.gouv.fr

@graham

Good morning Graham, that’s odd. When I click on it, it takes me straight to this page:

I have just copied it again… Déclaration des revenus 2023

I can’t see this in the link…but then I posted this during my insomniac hours so who knows…

GM Deedee

Yes, your second link is good but it is the first link which fails…

You can see the caret over the o on that link.

The link then takes you to the main welcome page but not to the 3916 resource you quoted.

If you can find the how to declare your tax online pdf in post number 28 above.

Well I am amazed that you have got them back! We were eligible for the first time in 2018, and despite ticking the box the social charges were deducted. We have been trying to claim them back ever since! How did you manage??

Thanks Graham, It was just because I’d seen a post saying that PayPal accounts must be declared, but the impôts.gouv site clearly states that there is no need if the amount of money going through PayPal does not exceed 10k. It was more for clarification than anything else.

@Deedee I think it is still confusing tbh.

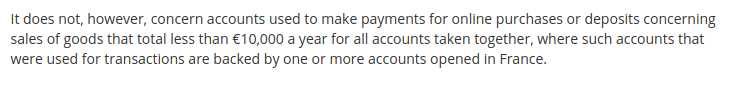

This reference in English from the fisc seems to confirm what you have written

but since it is so simple to declare the accounts, I don’t see an issue in declaring them just to be on the safe side.

I think the significant bit is “where such accounts… are backed by…accounts opened in France” and that is where some confusion could arise. Why take the risk?

I’ve also updated my tax return info sheet to reflect this information. copy here:

tax return info.pdf (55.6 KB)

I can see your point @graham

As you say, if people want to take the better safe than sorry option, there is no harm in doing so.

Quite right as next year the same information will be automatically presented to make life easier.

Sheer dogged persistance. One year I had an acknowledgement that it was valid and it would be repaid but after several months nothing had appeared in my account, so I went through it all again and received another acknowledgement. More corresepondence and it was finally paid but it was a long time after I had paid it originally.

I wondered why I wasn’t seeing queries regarding the social taxes anymore when there were so many when it was first declared to be repayable. It was obviously because everyone was filling in the 2042C. I’ve now requested they put one at my disposal so I can fill it in correctly.

Thanks for your interest.

I have just completed my 2021 tax declaration and found it quite a bit different from last year for which Isabelle Want’s guide was a big help. It has become quite compicated.

Is there any way of being able to modify it once completed ?

I meant, of course, the one on line…

Yes - not sure of the window but there is a period of several months when you can modify a submission.

Having completed our return today, it seems that there is a bug in the online software to be aware of.

If you see in the left panel that you have an annexe 2041-E

Firstly, note that it only relates to non-residents – so it should not have come up if you are a French resident. If it has and you not a non-resident, then you need to go back in to the Annexes page and uncheck the 2041-E line. Make sure it has been removed and then you will be able to proceed to the end - otherwise you you will find yourself in a deadly embrace with the system which won’t let you leave without providing information you can’t provide. As you progress through the return, make sure that 2041-E remains not listed in the annexes shown in the left pane. If it suddenly reappears then go back to Annexes selection page and uncheck it again.

The bug links to the completion of boxes 8SH and 8SI (S1 holders) on Form 2042 and dates back to the 2020 return (for revenues in 2019) which still seems to be present but doesn’t seem to affect everyone (which makes it difficult to resolve, I guess).

Analysing it, I cant help but think it occurred because I had forgotten to check 8SH and 8SI and went back to do that after which, I am almost certain, the 2041-E appeared in the left panel.

Happiness is handing all the tax forms hassle and any queries to a very competent guy who then sends me a mail saying return submitted and here is what I think you will be charged… all for the cost of a good restaurant meal out for two. If it means forgoing one of those then I’m happy!

Couldn’t agree more.

All this stressing of which box to fill in here and what account to declare there with advise coming from every angle giving layman’s opinions on what I did last year and it was fine----- .

Using a professional is stress free and unlike my experience of the UK experts here are very affordable.

Having previously worked in France for 10 years during which time my particular expertise had to be fully registered and insurance backed and with it I carried the responsibility of my advise and action then beware of perhaps not understanding what you might read and subsequently act on.

I am sure that many who fill in and submit thier own tax return will be fine and it will not a DIY disaster but for me reading the various well intentioned suggestions are best used to gain a general understanding so that I can ask questions to my professional should I need to.

Our highly qualified professional accountant has made two expensive mistakes. And they take no responsibility for errors.

Which is exactly why I made reference to reading what is posted to become aware of how things work and what to ask a professional. I feel sure that the mistakes made by your professional were spotted by you as like most of us it is well worth gaining an understanding of how things work that might affect us and be in a position to cross check.

I would much rather check someone’s work they have done for me rather than do the work myself and submit it unchecked.