@toryroo I don’t know whether this article (in French) on filling in an ME declaration will help? La déclaration d'impôts 2022 des revenus 2021 (2042 C PRO)

I believe the above new requirement for reporting “manual gifts” is concerned with non-electronic gifts, ie gifts made hand to hand. so the Impôts want to capture these as they wouldn’t appear on the bank accounts etc., that the Impôts already gets reported to them. Just so they can tax them etc.

My question was more about small cash gifts received from family for birthdays etc. In my case these are electronic, not manual and perfectly visible to the fisc as appearing in French bank account. I just can’t find any mention of waiver for small amounts of this type, such as you might find in the UK

Perhaps then this reference is more relevant

Ta Graham. Done a bit more digging, seems I’m fine as counted as cadeau / présent d’usage so no form necessary and no tax.

Don manuel seems more concened with succession and not just things like Christmas gifts.

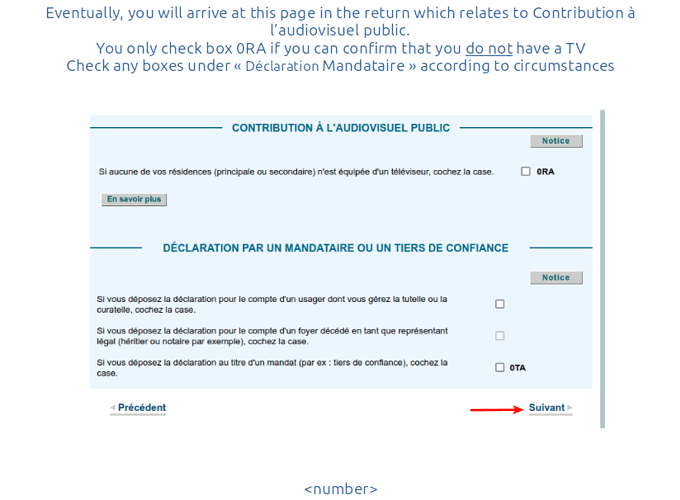

A quick question, for the paper forms, does one have to tick a box for saying one doesn’t have a TV?

Did a very rushed paper form with the tax inspector last week and forgot to check if a box needs ticked, I recall I might have ticked one last year?

Didn’t fill in the property page on the paper form. (renting)

Not sure what the “property page” is but I believe it is box 0RA that has to be ticked if you have no TV.

Thanks I’ll have to e-mail the inspector to ask him to tick the box for us!

Hi @KarenLot

I pitched that contributions to the employers scheme and supplementary pension scheme (personal pension) are fully deductable from salary in the UK to provide relief from tax. When in payment, these pensions will be taxable in France. Obviously these would be up to the UK limit, didn’t say what that was…

I quoted:

Article 83 1.0 B

https://www.legifrance.gouv.fr/codes/article_lc/LEGIARTI000023378435/2011-01-01

1° 0 bis Les cotisations versées conformément aux dispositions du règlement CEE n° 1408/71 du Conseil du 14 juin 1971 relatif à l’application des régimes de sécurité sociale aux travailleurs salariés et aux membres de leur famille qui se déplacent à l’intérieur de la Communauté ou conformément aux stipulations d’une convention ou d’un accord international relatif à l’application des régimes de sécurité sociale ;

and added that it would seem to me the general principle being described is where the foreign government legal tax code allows for a deduction from salary to provide tax relief for a pension contribution, such a deduction is allowed from declared salary for the purpose of the calculation of the effective tax rate.

I provided my UK personal pension contribution record, with the apportioned deduction from salary for the first year in France (1/12th here).

My further research this year with foreign income declarations also pointed to the need for ‘equivalence’ with foreign regimes and I noted the assurance vie is NOT available to be treated for the 7.5% flat rate disposal, so I’d suggest it is not equivalent to a UK HMRC pension.

That said, I do wonder what particular French pension arrangements is the 7.5% disposal available for / targeted to?

Apologies for delay in responding.

I think I settled on this argument in the end…

From the tax bulletin BOI-RSA-BASE-30-10:

10 Sont déductibles sans limite de la rémunération brute :

- les cotisations de sécurité sociale (régime général et régimes spéciaux, y compris les cotisations versées aux régimes étrangers de sécurité sociale par les salariés restent affiliés dans leur pays d’origine ou, dans certaines conditions, par les travailleurs frontaliers conformément aux dispositions du règlement (CE) n° 883/2004 du Parlement Européen et du Conseil du 29 avril 2004 ou aux stipulations d’une convention ou d’un accord international relatif à l’application des régimes de sécurité sociale.

Frankly, it seems best to get some sort of Declaration made within the time limits if at all possible… as one can amend later on… so get something done NOW and discuss or send a message as and when (if) things need amending.

Remember… the final deadline for all Departments is the middle of next week.

Paper versions were extended to 31st May which has now passed.

Thanks @Sandcastle @graham @Stella

madames paper return is submitted, tax inspector provided photocopy with stamp! I shall e-mail and / or update M. Tax Inspector / fisc accordingly for TV. (Seems the fisc didn’t process / receive her paper return from last year, even though in the same envelope as mine?)

Also thanks to some monarch deigning to give me a day off, (Long live the republic!) I’ve hopefully got time for my own on-line return this weekend, which will be an interesting one (Complicated, but hey…)

Please remain on standby

@larkswood12 Yes.I think this is the key legslation by the looks of it. How on earth did you find the BOI-RSA-BASE-30-10 source?

Unless in future years inspectors here or at EU level deem securité soc.= government schemes only, BOI-RSA-BASE-30-10 almost looks as though it is written for the British case. At some point it could be worth my looking at the EU legislation referred to just to make sure it’s not referring to something different.

Also I take it you were able to use that piece about allowing the social security deductions of other EU countries to be deducted from gross income reported in France, only because you are resident under the Withdrawal Agreement? I doubt people whose residence in France started after 31Dec2020, would have the right to invoke that legislation so as not to declare pension contribs as part of gross income anymore, in an EU country.

And of course presumably it’s even better if your UK setup is the contribution of up to £40k being made directly by your employer to your fund, and not going via your salary thus reducing NI.

There was something about this very early in the official France “Brochure” too.

Thank you very much for taking the time to explain your source, this is much appreciated and I will remain interesred in anything on the topic. Many thanks.

Doubly so, Stella.

I sent my first declaration, so on paper, on Monday 30th. I walked to the Post Office even though it’s a very long walk, just so I could hand it over the counter and have it sent Recommandée and Avis de Réception. I didn’t want to take the risk of it landing on someone’s desk who might find a first-time English frontalier daunting to process and it get buried.

On the 31st, having done that, I realised I had made an elementary but serious calculation error that would be very detrimental to me, to let stand. So, wanting to be within the deadline, still on the 31st I emailed details of the error with evidence to the local tax office’s email and asked for it to be corrected.

Yesterday a lady from the Fisc called me. So at least I know they’ve got it. Despite my having enclosed passport, CDS, S1, taxe foncier and an old taxe d’habitation so that they could identify me, as well as EDF attestations of contract at my address currently and for end 2020, she wanted proof of fulltime residence.

This would have been much harder to prove if we hadn’t had Covid as I’m a frontalier so working would have meant away 5 or 6 days a week!

She stated even a holiday home will have an EDF contract and also mentioned water and insurance. What she was looking for was evidence of a pattern of consumption proving residence in France. We settled on me trying to get EDF info showing a pattern of consumption ie the new EDF info graphs, or me asking EDF if they can provide a statement electricity was being used from January through to December 2021. I also volunteered copies of my bank statements where frequency of groceries buying here is easily seen - as the one thing we could still do in covid was buy groceries (having told her the bags of receipts are too big to send!)

I am quite certain I am able to provide the consumption things she’s looking for since I do live here. She said not even a CDS is sufficient. And apparently it’s ‘not just the English’ they are asking for this.

She also seemed to comment my declaration won’t be able to be corrected - which would be quite serious for me - but I shall satisfy her on the proofs she wants and then we’ll see. I did see something somewhere that said if an innocent error is detrimental to the peson then they have to have a very good reason to refuse to correct it and I did advise them and request correction before the submission deadline so we’ll see.

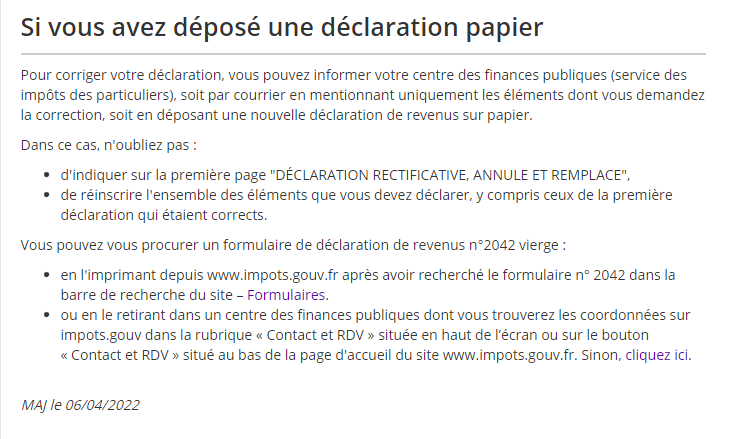

I wonder if there has been a misunderstanding… you can do corrections to a paper declaration. The quote below is from the impots gouv site…

Sounds to me that they have already noted the changes you emailed to them… but perhaps best to get this confirmed. (I might even be tempted to send the actual changes outlined in a letter…sent recorded delivery etc)

I’m wondering if the lady was saying that the date is passed-by for doing a “replacement” Declaration, but you are certainly well in-time for Corrections…

Has she taken on board that you are a frontier worker?

Because it seems to me that if a frontier worker is in France full time then they cannot be a frontier worker.

In what I call “the good old days”, a first-timer/newbie could turn up at the Tax Office, with a case full of papers etc… have a lengthy chat (questions/answers) face-to-face (often with much fumbling through the dictionary)… and finally the Tax folk would be satisfied that the first-timer was real and above board, all details (personal and financial) carefully noted… and the Declaration was done… hurrah.

I’ve sat-in on several such occasions and seen at first-hand the anxiety turn to relief. Phew…

I still advocate a “visit” for first-timers, if at all possible.

Edf et Moi app gives you consumption charges by hour, day, week, month or year…