Hi I have a complicated situation. Recently my art - paintings have been accepted by an online gallery based in England. I am a permanent resident in France and belong to an association which permits me to sell my paintings in France. Would anyone know if and or how I should declare my earnings in England ? Do I also need a VAT number. This is all hoping that I will sell something although I am hardly likely to earn more than a few hundred if anything! Let’s be positive though! Thanks Fiona

I’m surprised someone hasn’t chimed in… so I’ll give you my thoughts.

You are French Resident… I believe you only need to register for VAT if your Sales are over a certain threshold… so, as you don’t expect to be selling much… I would not think it worth the bother of getting a VAT Number…at the moment.

The on-line Gallery… mmm… they are just a “link” through which folk buy your paintings… yes ?? Could end up being worldwide sales (live in hope  ).

).

So, if you are sending your paintings from France to whoever buys them … I cannot see that you should become involved in Declaring Income in any country other than France. (but I may be wrong).

I would have thought the On-line Gallery will declare in UK any commission they get… as they are UK based… (again, I may be wrong).

I have made these assumptions on the info you have given… hope they make some sort of sense.

Just a thought… you say you can sell through an Association… will selling through the on-line gallery be within the “rules” of the Association??

cheers

Hello Fiona

I attach a couple of links for you. You may want to contact them for further advice as it is a very specialist area.

Hope this helps.

Well done Mandy… very interesting links…

For a moment, I thought my artist friends had fallen foul of some Law until I saw this phrase…

“Artists may benefit from a VAT exemption regime if their turnover does not exceed € 42,900 per calendar year. The franchise regime applies to original works produced by the artist, but also to limited reproductions, provided they are signed by the author and numbered. This regime does not apply to the sale of works of other persons, the artist then becoming a trader.”

I reckon Fiona needs to be clear about how much money is involved…

and whether or not her Art is actually being imported into UK… which the second link talks about…

Yes Stella. It really is a very specialised area in terms of taxation and the only way to get proper advice is from a professional adviser.

Heartily agree…it looks to be a minefield… involving any Gallery sounds like Fiona means business…

One friend does sell her artwork over the internet… but it is direct sales from her home here in France… only small-fry… and all declared…

Thanks so much

I have passed it by the association and they are clear they can process Paypal and online bank transfers. My problem seems to lie with the English tax law.

More research needed I think!

Thanks! Looks like I need more info. I havent sold anything yet and may never do but best to be prepared!

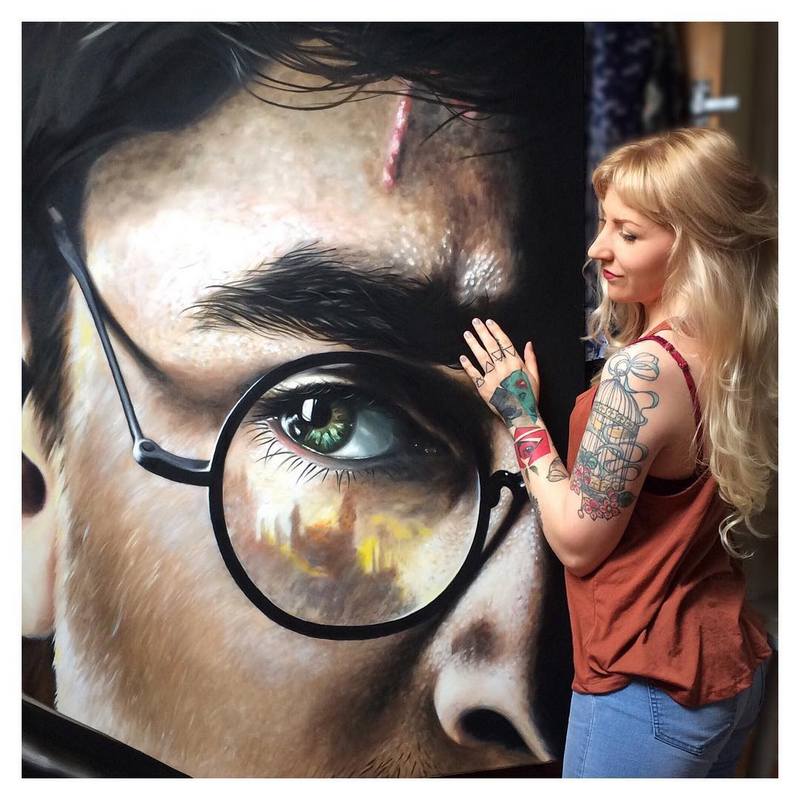

This is an example of Artwork, painted by my friend (blondie), collected by the Carrier and stolen before it could be delivered to the Purchaser.

We are still hoping it will turn up…

Fiona… can you show us an example of what you do… please…??

I was about to post a link to a site, that I’ve now realized is as old as Methuselah

sorry…

Hi of course would love to!

I will post here and then try on the site to post some.

Painting you have posted is fantastic! Hope it turns up.

Le lundi 7 mai 2018, stella wood survivefrance@discoursemail.com a écrit :