Hi Harry

When we first changed sterling to euros 18 months ago we used SmartCurrency who were very helpful but could not match the rate we get with Foreign Currency Direct (recommended by an agent from French Character Homes) we always use them now (every 3 months) and deal with a broker called Jonathan Watson who is quick and efficient.

XE.com don’t charge a fee so must be making money on the difference between the rate they offer and the prevailing market rate.

Their website claims that they would have converted £10000 to 11239€ had the transfer been done on Tues 9.1.18 - it’s pretty hard to compare a past transfer because rates are volatile but the average mid-market rate that day was 1GBP = 1.1335EUR, almost exactly the same as the current spot rate (presumably from close of market yesterday).

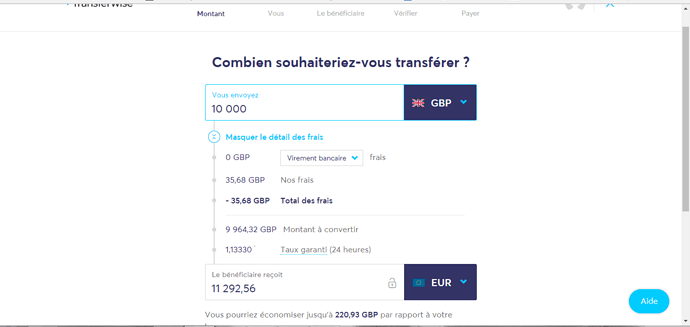

Transferwise currently quotes a fee of £35.68 for the transaction yielding 11,292.56€ at a rate of 1GBP = 1.13330EUR.

In short I reckon that £10k transfer on the 9th of Jan would have left you 53€ better off through Transferwise. Not much but enough for a meal out if you pick your restaurant and menu carefully.

In the interest of balance I’ve used HiFX as well and found them to be reliable and pretty much the same rate as Transferwise when I was moving money to pay for the house. I’ve mostly used Transferwise since because it is just a few mouse clicks and the money is there. In fact I’ve used Transferwise to pay for a few bits in Euro in preference to using the CA account because CA/Britline charge extra for being able to make payments electronically to an IBAN and I don’t want to pay for that service (is there anything CA/Britline dont charge extra for?).

Hi Paul

We change approx £11,000 at a time and Foreign Currency Direct charge £15 only.Free if you have a birthday!

What amuses me about Transferwise is that if I transfer a few K euros now, 11:40 CET, using my CA bank card, the money will be in my Halifax account by 11:41 CET and it will not appear to leave my CA account until next Tuesday/Wednesday/Thursday. I can pretend I’m rich for a few days!

I don’t know if this is the same the other way round or if UK banks are more prompt to show the debit.

Ultimately it is a question of what works for the individual so I’m not trying to say “look, what you use is rubbish, use TW its miles better”.

That said one thing I like about TW is it is really easy to see what a given transfer will cost and the net amount at the other end - you don’t even have to have an account. So, even if you don’t use them from the transfer you can have the TW website up and have an idea of what they would charge at the same time as you’re on the phone to the broker.

simon the transfer by bank cost me around 61€ so i got 61€ 23cent less than the quote my friend got for me. bank was barclays

Hi, I had a bad experience with xe.com - they quote you a rate to draw you in and then, just at the point your need to confirm (having spent time putting all the details in) they drop the rate by around 1% in their favour. When the money arrived it was EUR25 less the confirmed amount. They claim its my bank but my bank says not and I’ve transferred to my bank since without this problem. very annoying, not transparant at all.

Use Revolut. You’ll save a fortune. You get the inter-bank rate and can transfer funds very easily, quickly and safely.

Start up company without a banking licence at the moment. Might wait and see how they do before trusting them with my millions😣

Sensible to wait, I suppose. I have been using the “virtual card” for several months now to transfer funds from my UK bank account onto the card, then convert to euros (at the inter-bank rate), then transfer the euros to my French bank account. I was cautious at first, but I have now got a “real card” and use it like a debit card in shops. I reckon I am saving approximately 4% on currency transactions compared with Currencies Direct and the like. This soon mounts up over a few months.

Good luck with your research!

Regards.

Keith

D[quote=“Platty, post:33, topic:18909”]

was cautious at first, but I have now got a “real card” and use it like a debit card in shops. I reckon I am saving approximately 4% on currency transactions compared with Currencies Direct and the like. This soon mounts up over a few months.

[/quote]

Am I missing something but how can you be saving 4% when CD and TW only charge a fraction of a percent? And how do Revolut survive if they charge nothing?

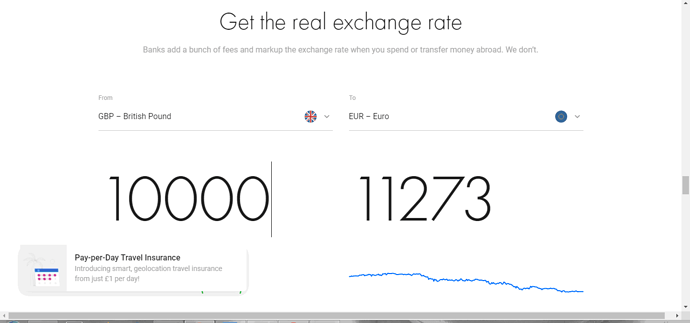

I just checked and at 12 noon Revolut is showing £10,000 = 11,273€, TW is showing £10,000 = 11,292,56€ after fees (exchange rate 1,1333, less 35,68 fees). Hmmm.

The savings derive from the fact that they do not charge commission and give you the inter-bank rate. How they make money I do not know, but it is by far the best way to convert currency I have found. I hope this helps.

Keith

already moved

I’m still not seeing it Keith. If they are going to give you 11273€ for your 10k,and TW is going to give you 11292€, how is 11273 better than 11292, no matter how the figures are arrived at? Or, do you not have to take the rate it says on Revolut the web page, is there another procedure whereby you haggle and get a better deal? Top image is Revolut, bottom image is Transferwise.

Revolut currently charges no fees for the majority of its services (but for a capped usage, see “fees” section), and uses interbank exchange rates for its currency exchange on weekdays, and charge a markup from 0.5% to 1.5% on weekends [4][5][6].

This is taken from Wiki and may explain Anna’s lesser exchange rate. Keith’s post is very interesting and Revolut might well be worth a second look.

Yes a weekend markup would explain it, thanks for clarifying. I never heard of that before.

So the answer could be Revolut during the week and TW at weekends. You have to keep your eye on the ball to get the best deal, don’t you…

Anna

I have just remembered that Revolut do charge commission at weekends, but not during week days. Try again tomorrow and compare the rate with a live Forex site such as http://www.currencies.co.uk/live-exchangerates/. Please let me know what TW is and I’ll check tomorrow. I was very sceptical at first. If I’m wrong I’ll put my hand up. Let me know how you get on.

Keith