Ive been racking my brain trying to work out how I realised that the VIN on the V5 was incorrect. I’ve remembered, when I applied for a CoC from the manufacturer using the VIN on the V5 they replied to say the car did not exist. After that it was easy to find the problem.

Dominic, Mark,

Its very interesting the in-depth knowledge you both have for this topic.

I’m still though feeling a bit vague as to what to do.

I’m thinking that a replacement V5c to my father’s address in the UK, and for him to send it out to me, is one way forward.

Though I’m tempted to just go ahead with filling in the export certificate application, but am afraid that then I could be left with a car that no longer is registered or can be registered in either country.

My MOT is soon out of date too and yet i need to use the car till after the MOT date and was planning to sell it to my brother who’s is the true french inhabitant not myself, but he could be left with a car he cant register.

Still not sure what to do really, its an asset i don’t want to just scrap.

Regards

Roger H

For somebody in your position the correct route is to apply for a certificate of permanent export and use that to register your car in France. It is the correct document to use and contains all the relevant information. Google will confirm that from both the DVLA and the French government’s point of view. Mark has anecdotal evidence that the CPE is not accepted in France, despite what the DVLA and French regulations state, I am telling you that it is not only accepted but I used one successfully myself. The person at the prefecture didn’t even question why it was offered instead of a registration document, they knew it was appropriate. Why wouldn’t they?

Dominic

Okay many thanks

Its convincing my brother now

Regards

Roger

I would go for the duplicate logbook route & put it on a sorn (& don’t use it). Then send off the export notification slip while preserving the rest of the logbook. As soon as you have sent off the slip you can insure the car & organise a CT provided that you have the c of c number under section K. The presence of the number does not on its own guarantee the logbook’s acceptance as proof of conformity for registration purposes. As it is your own vehicle you know its history. I have recently applied for a V5C for a car I bought from someone who had to surrender the old one. I used a friend’s address.

@Dominic, my anecdotal evidence is based on many years of assisting customers with their importation process when they have not been able do it themselves & importing a few myself. I am aware that the government web site says that a CPE should be accepted, per my first post - “…document officiel l’indiquant ou certificat international pour automobiles en cours de validité délivré par ces autorités”. But as many of us have found out, what the government web site says & what the government agents interpret it as can often be very different! It is not wise to argue too strongly - I did once on this very issue & the official then decided that he needed to see both a V5c AND an export certificate!

I was pleased that you managed to have your CPE accepted as this may at last hail a standardisation of documentation acceptance but I would take issue that “It is the standard issue to people who need the information usually found on the V5 who live out of the British Isles”. Very few people need one as most have brought over a car which they already owned in the UK & have retained the V5c. The use of export certificates for registation is very much in the minority.

I should point out that I am a garagiste & advising customers is part of the service but the recent changes in the process have left me without personal experience with the actual online system for imports so I rely on experiences such as yours to help me. I cannot categorically state that CFEs will ALWAYS be accepted until I have used one sucessfully myself.

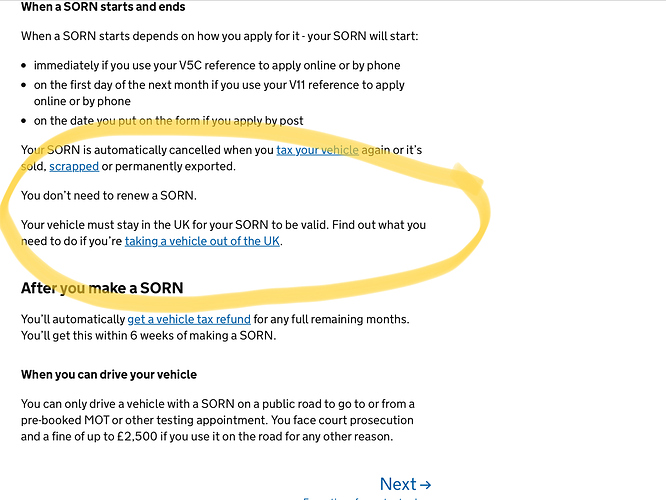

Why are you recommending that somebody SORNs a car that is in France? Yo can only SORN a car that is in the British Isles.

I stand by what I have written before. The COE is the correct document for a French resident who wants to register his car in France but does not have the V5 or has an incomplete V5. The system works. Don’t set yourself up for failure.

I’ve only been here for 18 years & as a garagiste I have successfully helped to import about 86 vehicles over this time. This may pale into insignificance against your no doubt vast & lengthy experience in this field but it has worked up to now. During this time I think 3 people tried to use a COE in my area & they were all rejected in their application for a Quittas Fiscal. This despite the french government web site saying that it SHOULD be accepted. Practice has in the past been vastly different from theory.

This may not be representative of others experiences in different departments or even different towns.

I was therefore very pleased to hear of your success with using a COE under the new system as it hopefully means that future applications with just this document might well work. This does, of course, depend on the year of manufacture of the car in question as I am sure that you know the dates & types of vehicle affected by EU conformity.

I’m sure that you know what sorn means but the “off road bit” applies to any road, even those abroad.

Mark, you might be the forum expert with donkeys’ years of experience but… You have contradicted the DVLA’s advice for French residents who need a replacement V5 and now you are misrepresenting the rules for SORN.

https://www.gov.uk/sorn-statutory-off-road-notification

The link to the gov.uk site clearly states that for SORN the vehicle has to be in the U.K. You are doing little more than amplifying the expat myth that it’s perfectly acceptable to use a SORNed car in France.

False advice. Bad advice. Dangerous advice.

Twice now in a week.

You are quite right. Like many things, the DVLA advice has been changed since I last checked it& I stand corrected. It is just that though, advice. It is not law. However, I have not amplified “the expat myth that it’s perfectly acceptable to use a SORNed car in France” as I specifically said " put it on a sorn (& don’t use it)."

Perhaps you can answer this for me? If you have declared a vehicle as exported then it is no longer legal for use as a UK car in the UK & therefore in Europe too. The car is not french registered either so cannot be legally used on french roads either. How, then, can you get to the port of departure without carrying it & then get to your new french address also without using it on the road?

If your car has been exported from the UK & is therefore not legal there & it has not yet been registered in France so it is not legal here, then it is not legal anywhere & should not be on the road, obviously. How did you move your car about while you only had an export certificate?

The info from the DVLA is only what they would like you to do not what you have to do. As you are so keen on reproducing the DVLA pages you might care to read this :-

If you’re taking a UK-registered vehicle out of the country for 12 months or more (also known as permanent export) you need to:

- Tell DVLA before you leave by filling in the V5C/4 ‘notification of permanent export’ section of your V5C registration certificate (logbook).

`* Send it to DVLA, Swansea, SA99 1BD. Include a letter if you’ve moved abroad and want your vehicle tax refund sent to your new address.

- Keep the rest of your V5C registration certificate - you might need this to register your vehicle abroad.

You’ll usually get a refund on your vehicle tax in 4 to 6 weeks.

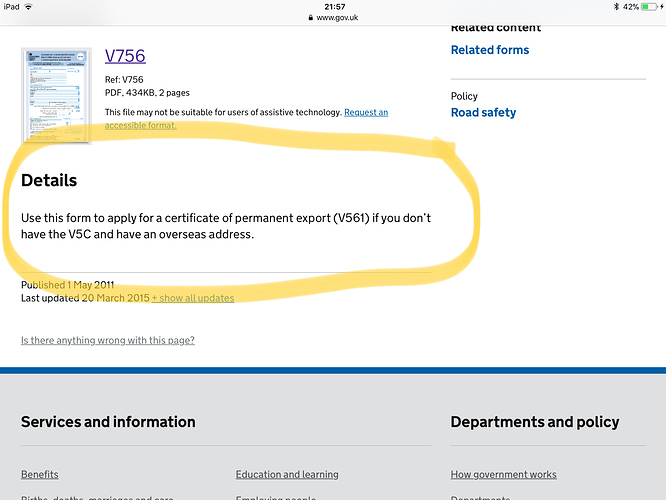

If you don’t have a V5C registration certificate-

You’ll need to get one using form V62. The address to send it to is on the form.

If you’ve already left the UK

You’ll need to get a V561 certificate of permanent export. Apply for one using form V756. The address to send it to is on the form.

So if you don’t have a V5C the DVLA say you must get one. They also say that “if you have already left…” you can apply for a COE. All the above concerns permanent export.

Just to remind you what you said about SORN Mark

I will write a précis;

I brought my car to France with a V5C.

As part of my preparation for registering it in France I applied to the manufacturer’s U.K. office for a CoC using their online application form.

They got back to me to inform me that no car with the VIN I’d provided existed.

I discovered that there was a mistake on the V5C, the VIN contained a 5 where there should have been an S.

I sent the correct VIN to the manufacturer who sent the CoC.

I asked the DVLA for a new V5C, they told me that I couldn’t have one because I was a French resident but that they would send me a CPE which I could use to register the car in France.

At that point I left my car in the garage for the three months it took for the CPE to arrive. No big deal I had another.

The day the CPE arrived I went to the prefecture and registered it. No V5C, no problem.

Next question?

I did not drive my car illegally in France, when the car arrived from the UK it had a V5C which, like anybody else I believed to be perfect, it was not. I might never have noticed the error if I hadn’t needed to re-register it in France.

Coincidentally my other car had a similar mistake on its CG. I got it registered in France but it came from Germany not the U.K. I used it for nearly two years then took it to my local VW garage to be serviced. When they entered the VIN from the CG onto their computer it was rejected, the prefecture had given the first three letters as www when in fact they should have been wvw. An easy mistake, one, in fact, that my spellchecker just tried repeating. The prefecture changed my CG without fuss.

Interesting. Censorship?

Keeping things on a calm and friendly footing…

Fair enough but it was a valid point. I was taken to task on three points and the photos above show that that was unnecessary. Hopefully it’s finished now.

I thought that the SORN was used so it wasnt necessary to pay UK road tax if the vehicle was off the road in the UK . The french dont have road tax, and the gendarmes have no way of checking now there isn’t a paper disc, and they don’t care anyway. The British insurance companies don’t care if your car is taxed or not, just that it has a valid MoT.

This is from personal experience in the past, including an insurance claim (total loss, paid in full), and yes, it was a SORNed car .

I do agree this is another of those grey areas, not entirely by the book but not illegal either.

Your first sentence sums it up. A SORNed car must be kept off the road in the U.K. It is impossible to have a SORNed car in France, on or off the road. There is no grey area here.

Did you know that you can ask for your French immatriculation to be annulled voluntarily here in France… (French equivalent of SORN, with slightly different procedures and ramifications)…

When you are ready to put the car back on the road… there are a specific set of hoops to jump through … in order to regain an immatriculation …

Not something to be undertaken lightly…

Surely there should be some common sense here rather than ‘rules are rules’? As long as a vehicle is insured then does it matter whether DVLA think it’s exported or SORN’d, will the French authorities know or even care?

@tim17 Insurers (in any country) generally have small print… which talks about the vehicle being legal… and that is their “get-out” in time of accident/claim…  it is a very dodgy area…

it is a very dodgy area…