I am a UK citizen, tax resident in France since 2011. Prior to that date I made a very simple will on a document bought cheaply at the UK post office and subsequently witnessed by 2 neighbors. Does this still have any sort of validity now? And if so, can I update it if I get it witnessed twice again?

Or I’ve got to make a French will now?

Thanks

If it’s really simple, it’s probably best to make a French one as all your worldwide property comes under French law. The only difficulty is if you want to invoke British law for your will, which you are entitled to do. A notiare will sort it out for you. We did ours recently and it wasn’t all that expensive but obviously more so than the post office form! We explained what we wanted, the notaire gave us a template (really simple as we have no children) and we had to write it out by hand and sign it.

Great answer Angela and very helpful. So my old UK post office document can be thrown away, it no longer has any legal value?

I have no children, same as you. I have property and savings in France and in another country. I would ideally like to distribute in my will to a mixture of French residents and people resident in other countries + some to charity (it should be a French registered charity?) The beneficiaries would probably be family and non-family members.

Any further points to make that could help me? The notaire way as you did it is the only realistic way to do it?

Thanks

Your old will remains your last will and testament, and remains valid, until you make a new one. It will just cause the French adminiatration to scratch their heads a bit. We have valid English wills.

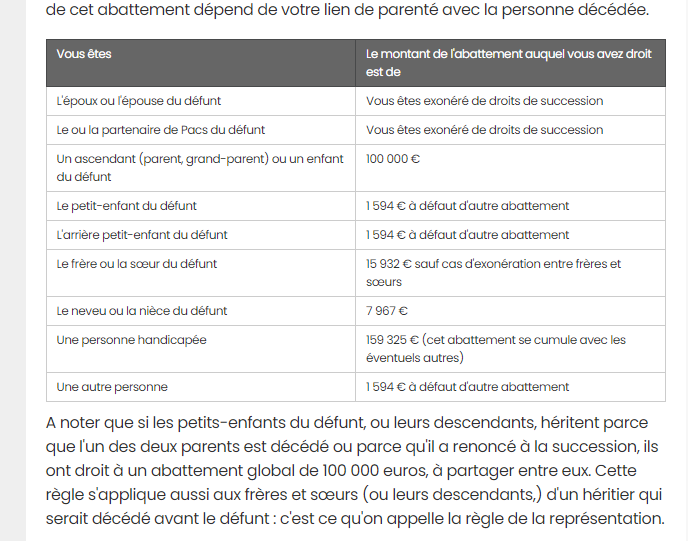

You need to consider who you wish to leave things to before deciding one way or another. Especially if there are family members that “should” be included under French succession rules and whom you are ignoring. French law does put some constraints on who you can leave things too, and is quite miserly about what you can give without incurring inheritance tax. Which is punitive.

It sounds as if you won’t have that problem if no children. But parents and brothers and sisters count.

If you need to get round that hurdle you make a will citing that it should be administered under English law. Which leaves you free to give things to whoever you wish - but they still pay French inheritance tax. That can’t be avoided!

Charities within EU all count the same. And humanitarian ones get more tax relief than donkeys. UK registered charities now don’t attract tax relief for income tax, so quite possibly the same with inheritance tax. You would need to check that.

It is normal in France to handwrite a will, so you can do it yourself with a bit of research. But best to lodge it with a notaire anyway. I seem to recall (again check) that it is a notaire who acts in the administration of an estate, so might as well make sure that yours understands what you want if it’s not that expensive.

I forgot to mention about lodging the will with the notaire. It does make the process simpler for the succession if we do.

I thought that parents and brothers and sisters no longer counted in the inheritance laws? I’m probably wrong there though as I know you are usually good at this sort of thing

The notaire said we should handwrite it but her providing a template for us to copy out made it a great deal easier! She checked it when we gave it back to her too

We’re both right! If you aren’t married and have no children you can write a will to give everything to whoever you like it seems. But if you don’t write a will then you are stuck with legal order of succession.

I remember this as when we bought our first place together there was the possibility of it ending up being shared with my mother, and my partner’s daughter. Not a happy thought for either of them!

This is true, but unrelated beneficiaries (including step children) have to pay 60% tax on anything over the “abattement” of approx. 1600€.

If you have been left a property the tax people can demand their share, regardless of whether you have sold it or not (or want to live in it).

60% !!! That’s huge!

Discussions on this forum have always made it clear that French Inheritance Tax Rules apply, regardless…

and here’s a brief glance… but not the complete story…

Yup…that’s why I said “French law does put some constraints on who you can leave things too, and is quite miserly about what you can give without incurring inheritance tax. Which is punitive.”

Yup…that’s why I said “French law does put some constraints on who you can leave things too, and is quite miserly about what you can give without incurring inheritance tax. Which is punitive.”

You did indeed, but not in the post that I replied to. I must have skim read your earlier one.

To save all the hassle, sell up “en viager”, spend all the money on cars, holidays, enjoying yourselves whilst you can and plan to leave bugger all to be fought over and taxed.

Our daughter has asked that we simply leave her “no debts”…

To save all the hassle, sell up “en viager”, spend all the money on cars, holidays, enjoying yourselves whilst you can and plan to leave bugger all to be fought over and taxed.

That is my plan…Maggie Thatcher spent her last days/years at the Ritz.

Selling to crystallise, in that kind of way or something similar, if you’ve owned for 30 years does seem to make sense.

Not sure how the French exemption for CGT on primary residence works.

there is no CGT on main residence

So have I understood correctly, The rate of succession tax is the same rate for money, property or whatever and irrelevant if the beneficiary is a french resident or not, it’s just the “abattements” in the table above that control the level at which tax is started?

That means theoretically that if you give to many people, but don’t pass the “abattement” rate for each person, there is no tax?

And what is the “abattement” for giving to charity? I suppose it must be a french registered charity?

European charity, but also wide range of other things can be exempt - religious associations etc. And if you leave a legacy to a public interest company the tax is reduced - things like the Scouts, and geology societies (there is a list)