I’ve just filled in my French Tax Return, online, for the 8th or 9th year. So I am reasonably comfortable doing it myself. Our income is solely our pensions.

But form 3916 is needed to be filled in because we have bank accounts back in UK. Each year I have seen they are correct - indeed, a couple of years ago I had to report that Tesco had stopped our account. No probs.

I have just added two WISE accounts (opened last year) BUT cannot see any of our previously filled in Bank accounts. I am sure I’ve been able to see them other years and check all is good.

Can anyone tell me how I can see my 3916 form, showing all the accounts?

Have you perhaps accidentally deleted them by not ticking the box to activate automatic carryover from previous years?

Someone warned about this a few weeks ago.

Here it is:

“Be careful. Do NOT try to fill in form 3916 FIRST, to get it over with .

This from another source

"If it is not your first time, your bank accounts outside of France are already listed BUT wait until

you get to tick box 8UU before you go onto form 3916 or you will lose them all!! "

You will lose ALL the info you entered last year and have to re-enter it

. And if you didn’t make a separate note of account opening dates, you will have to re-find that info. If you made up some of the dates, as I did, you will have to try to remember all of your made-up dates. I could not, of course, and had to just make them up again. Hopefully that never comes back to bite me.

Having multiple accounts did not mean you were rich… We had many accounts. The reason being, if you remember, when the interest rate fell after the financial crisis, banks were offering a better rate for new clients on the fist £1500 , so if you had 15 thousand pounds savings you had to open 10 accounts.

Do 3916 last is my advice.”

Mmmmm… I reckon I fell into that ‘trap’, (not seeing a ‘tick this box if you are carrying over from last year’) so maybe I have erased them.

But how can I see what is on ‘my’ 3916?

Have you already submitted your return?

Yes I have. Online. But it should be possible to modify, I understand?

Yes, you should be able to print off what you’ve already submitted (so you can see what’s there) or go back into the return and amend it.

You should be able to print off not just the summary but also any “annexes”, including form 3916.

Just log into your “espace particulier”, tap or click on your latest submission and take a close look. You should see the ancillary forms.

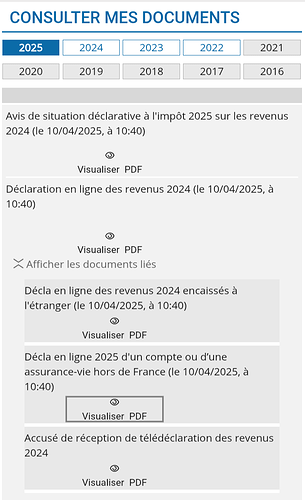

Following Helenochka’s helpful suggestion, this is what you should see, under ‘documents’ in your espace particulier…in my case the 4th document down…

Thanks George. Am in an Airbnb in Liguria with very dodgy wifi and couldn’t face trying to log into my tax account to see exactly how everything’s displayed.

As above and also - view the previous years 3916 to see your (now deleted?) bank accounts filed for last year - I hope!

Yes, that worked, thanks. But it’s bad when the site asks if you have any new 2024 accounts, - answer for me was ‘yes, 2’ - and then it replaces my former entries and I just end up with the 2 new ones, instead of adding the 2 new ones to my list.

Ah, I see what happened now. I made the same mistake a few years ago, i.e. I started adding details of a new account and then realised I was typing over - and therefore deleting - details of an existing account.

I agree the forms are very badly designed.