What happens if you just use your French debit card? There are different mechanisms for moving money through Wise.

Why do I suspect the French bank is credit agricole…

The trouble is, Credit Agricole is made up of different regional Caisses which seem to sometimes have different rules.

I have a valid complaint about Credit Agricole. But as the French banking system feels like it’s still in the 1970’s, I’ve hesitated to start the formal complaints process in case of victimization by the bank if I do. They have done wrong, but repeated informal requests for them to sort it have been ignored.

Do you think I need to be wary of going formal? I think all French banks, at least the bricks and mortar ones, seem to be as bad as each other. So happy to stay. But annoyed they haven’t sorted it out after multiple requests including mentioning within emails in the process they messed up as well as verbally to my contact there.

Hi Sue. Yes I also tried my debit card - same result.

Hi Karen. Just researched my Bank - it is a subsidiary of CA ! I too am not happy with my bank , but how easy ist to change (not like UK i’ll bet ) and to whom ?

My Credit Agricole in Lot et Garonne is just fine. And always has been (15 years). ![]()

Shame. Sorry to hear it’s part of Cred Ag. I don’t think it’s hard to change banks.

CA. Sigh.

I recently opened multiple accounts with Wise to get the cost of fx down when I went to Australia. Inefficient banks like CA have to make high charges. Wise , who seem to have studied the market don’t.

It was an uphill battle to get there but in the end CA gave in and allowed me to do what I wanted with my money.

However what remains unanswered is if the banks make up their own rules about transfering money within the Euro zone or is it the dead hand of the Bank of France?

I have banked with CA Languedoc since I moved to France and the only reason that I still use them is that the others seem no better. French retail banking seems doggedly stuck in the twentieth century.

We ditched CA years ago after they told us lies and stole our money. I simply walked across the street, literally, into La Banque Postale and they did the whole thing for us. Never looked back, best move we ever made.

Yes, as @David_Spardo helpfully points out… changing banks in France is a very straightforward affair (regulated by law) and much is achieved seamlessly and without too much effort on your part.

But like everything in France, you have to check that they do everything correctly. The Banque Postale “forgot” 2 standing orders when we changed.

always wise to keep tabs yourself on these things - a good reminder.

Corrected that for you ![]()

![]()

This has been a slightly confusing thread . . which has unwound to some extent as the contributions flowed.

But you seem to be left with a couple or three fundamentals that arise from your startpoint.

- It appears that you are fiscally resident in France (ie. you pay your taxes here). But you have managed (despite Brexit banking rules) to retain a sterling account in a UK bank. You transfer €uros via Wise only ‘every 2 or 3 years’ to pay £sterling funds into this UK account, for the costs of UK visits. Why? (see my answer to (3))

- You say that ‘our UK pensions are paid into our French (bank) account’. Do you mean by transfer direct from your pension provider? Or into your UK account and then by transfer to CA?

- You do not have a banking account with Wise.

The fundamentals are in relation to a] exchange rates; and b] simplifying your UK/French banking arrangements.

Regarding a] - it sounds like your pensions are transferred monthly direct from your pension providers to your CA account. If so, you are at the mercy of the crap exchange rate provided at the moment of transfer by the pensions providers’ bank, every month. Unless you are without any reserve in your CA account, this is not wise.

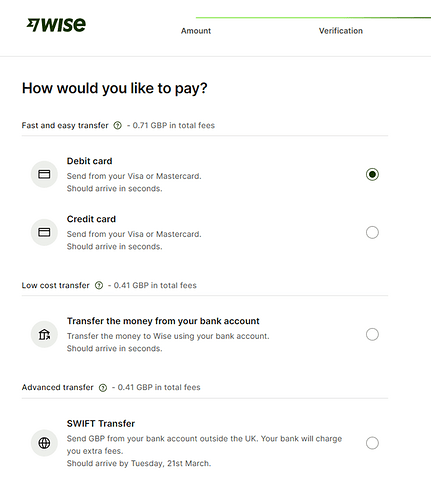

b] - Why do you not have a Wise banking account, to work alongside their tranfer facility? It is cost-free. It pays interest on your daily balance (currently 3.7% on euro funds, I think). You can hold £sterling with a UK IBAN facility. You can therefore hold your pension money in sterling until you choose when to convert it to euros, when the rate is right. You then transfer this to your euro card account. You can use your Wise bank card to pay your way in the UK. Simples!

Don’t know what you are talking about “Brexit banking rules”? We have lived in France 15 years and have French AND British bank accounts. Here in France: Cred Ag. In UK: NatWest, First Direct and HSBC. All three UK banks know we live fulltime in France.

I would also be interested in these Brexit banking rules as I use Fr Cred Ag and UK Santander, Revolut.I move money around seamlessly between the three accounts, Santander are aware of me being in France and they have no problems with me. Possibly another Brexit myth such as not being able to use uk sims in the EU?

Not really. For those of us who regularly move money between the UK and France, it works out perfectly well and we fully understand the process.

A bit of a wild statement without knowing the OP’s full facts unfortunately.

Our UK State pensions are paid in EUR direct to our French Bank at very much the headline rate for the day. HMG move a considerable amount of EUR on a daily basis and thus can command decent exchange rates.

OTOH, we checked with our two Govt Service Pension providers some time ago who, if we elected to be paid in EUR by them, would charge a fee for the transaction and the rate would not be at peak so in those cases. we have one paid to Revolut in GBP so we can convert to EUR when the rate is good and the other to a UK bank we have been customers of for nearly 40 years with no issues whatever (as others have said). The UK bank one is used to obtain goods/services in the UK for family who remain there - birthdays and Christmas etc and any excess of GBP funds over our family requirement is transferred seamlessly to the other Revolut account in GBP (we have an account each) and later converted to EUR as we see fit (when the rate is favourable usually).

What is not to like in this arrangement?

Thanks, Graham - but please don’t lose sight of my basic concept (nothing ‘wild’ about it). The OP doesn’t demonstrate that his arrangement " works out perfectly well, and (he) fully understands the process".

My main point is endorsed entirely by your own arrangements with Revolut. Thanks for that. It’s not what he’s doing.

The “brexit banking rules” are, I suspect, meaning that still to this day there’s still absolute confusion within the financial services industry whether because there is no specific agreement in place for financial services as part of the Brexit trade agreement, and no passporting of licences, whether it is actually possible (legal?) for EU residents to have products at UK businesses and for UK residents to have products at EU businesses. It’s this confusion that’s scared UK banks to close accounts of many EU based customers. Some have interpreted the situation to be ok and so have kept the status quo, others have taken a much more risk adverse approach and decided that because they’d have to set up a branch (in a legal entity sense, not a bank branch sense) or such in some countries to ensure they’re operating within regulations it’s easier and cheaper just to remove the accounts from the small number of customers affected. Some banks decided that because there was no pan EU agreement deals would have to be done with each individual country, which again makes it more complicated and more of a business decision as to whether there are enough customers to make it viable and just how easy countries make it. Barclays I think it was (but maybe it was another) kept accounts open for Netherlands based customers for example, partly I suspect because their financial regulators are known for being forward thinking and helpful/ willing to work with banks, but closed them for French customers.

So as I read there isn’t a specific Brexit rule, just certain banks being cagey about there customer bases in Europe, Thanks for your interesting post which explains things to me

in a clear manner. ![]()