Could anyone help with this question. I am English with French nationality and my husband is English with a long-term carte sejour. We were married in 2018 in France régime légal de communauté réduite aux acquêts ;

We own two properties of which one bought with my mothers inheritance which is our maison principle and an apartment in a separate building which is rented at the moment on a three year contract. We would like to sell and combine our join properties to buy one property in both our names. Under the french system we are scared stiff! What can we do to ensure the security of the one of us who lives on after our other half has passed away. My husband has three daughters but none are adopted. I have one brother who has two children from his first marriage. He is now remarried. My husbands ex wife passed away in 2015; at the moment we have wills under British law but dont know if these will be of any use. Des anyone know aout the system where one person is allowed to live their life out in the property and what conditions have to be met? Does anyone know about the SCI (Societe Civile Immobiliere) and if this would help us. What a minefield! It is so simple in England! Thankyou if you have read this and especially if you can advise!

I think you will find en tontine is the legal structure. Seek advice from a notaire to be certain.

Another useful reference:

http://rrsolicitor-avocats.com/wp-content/uploads/2018/12/Joint-Ownership-of-Property-in-France.pdf

No! The tax implications are huge aren’t they?

How so? ![]()

AIUI the property passes to the surviving partner on the death of the first as if the surviving partner had bought it on their own in the first place ![]() That’s how our notaire explained it to us anyway

That’s how our notaire explained it to us anyway

To Graham… he has three children and he dies first, then should she eventually wish to pass on anything to them they will have to pay 60% tax - which is not necessarily fair but unavoidable whichever structure you use. So if you are married the tontine provides no extra benefits than using an English will. And is an expensive bugger to set up, and dissolve should you divorce.

We have an equally awkward family structure, and I would say that you must consult a solicitor/notaire about this.

Essentially writing a will under english law allows you both to do exactly what you want with your assets and bypass the french requirements about natural children always inheriting on death of parent. But you can’t avoid french inheritance tax forever. So depending on who goes first there will be tax to pay by next generation/other inheritors. (Personally we’re aiming to leave as little as possible…)

We have English wills which specify that we wish our estate to be handled under English law. In out case it is because we wish to disinherit one of my husband’s children which is not possible under french law.

To simplify the position, we have specified that on the first death everything goes straight to the other person, apart from each person making some small cash bequests. We trust each other to then do the right thing, On the second death the assets are then divided up, and french inheritance tax paid where required.

Your brother and nephews/nieces are irrelevant under English law.

You can do a french will where the surviving spouse has the usufruit of the assets, but we decided this was over complex…

Didn’t cost us any extra to set up and we won’t be getting divorced any time soon ![]()

This is our first (and only) marriage and we only have one son between us so things are less complicated here. But you are right, if we wanted rid of the en tontine clause, it would be a costly exercise as to do so would involve “re-purchasing” the property with all the associated costs, fees and taxes involved in doing so. That it is in effect as much as the inheritance rights under English Law is fine in our case - we each have an English will but it saves all the faff of resurrecting it during a time of stress as French Law will suffice in this case.

What’s it like on the slopes at the moment?

Should a couple have the majority of their assets in France (eg bank accounts and property) and English wills, then obtaining (English) probate might be lengthy.

Irrespective of the division of the estate, there is of course the matter of inheritance tax. Which jurisdiction prevails? I have no idea whether this would be dependant upon residency or the jurisdiction of the will.

An interesting article is here>> https://europa.eu/youreurope/citizens/family/inheritances/planning-inheritance/index_en.htm

Nigel… I think you will find this has been thrashed about a bit already with the following understanding

A Brit living permanently in France can choose to distribute their estate under Inheritance Laws of the land of their birth (UK)… meaning they can choose to leave to the Dogs Home if they wish to…

BUT

Inheritance Tax will be applicable on the Estate according to French Inheritance Tax Rules/Laws

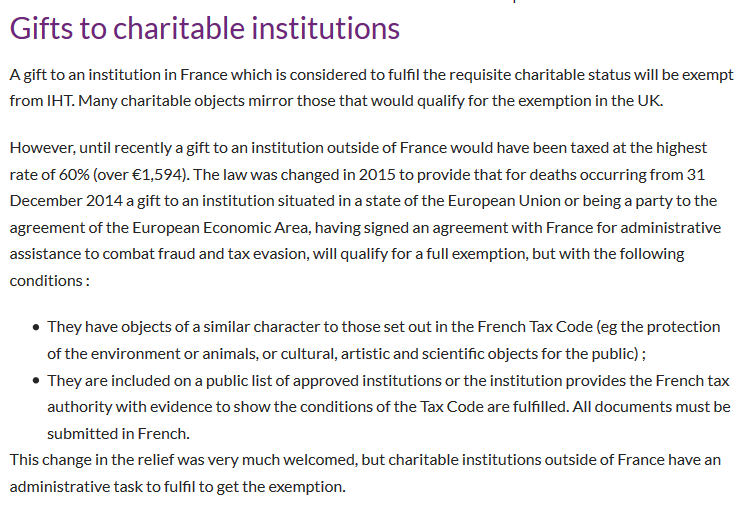

(which, in the case of the Dogs Home… would mean around 60% IT would be applicable on the value of the estate).

Won’t this cease next year?

Not necessarily, since UK never signed the 2015 EU Agreement … France simply included UK, since to leave them out was judged discriminatory against Brits living here.

As I understand it… and I think there is something somewhere in the withdrawal agreement… have to take another look.

Just done a quick google search which has come up with this:

The pertinent information is:

" A Grant of Probate issued by the Probate Registry for England and Wales is for use in England and Wales only - not for the French property. However, the notaire appointed to deal with your father’s French property may well ask for a copy.

In France, when an owner of property dies, there are various “succession formalities” which the deceased’s heirs must arrange via a French notaire . Often this will be the notaire who dealt with the property purchase although any notaire can be instructed.

Given that there is a Probate application underway in the UK, this means your father must have left a valid English will. Since the EU Succession Regulation (often referred to as Brussels IV), came into force in August 2015, the French notaire will ask to see a copy of the English will and may insist on a certified translation."

I believe your example is for a “UK Resident” with property in France…

the Option I was quoting was for a (Brit) who is Resident in France… using an English Will … where the heirs cannot escape French Inheritance Tax.

that was the condition for allowing UK Wills to be used … that France still got its Taxes…

Why wing it with a potential nasty surprise Fiona. Professional advice may well be money well spent.

When my wife passed away suddenly in 2013 I was launched into a multi jurisdiction succession. My heartfelt recommendation is get professional advice. A mistake can cost a fortune.

Giving credit where where it’s due HSBC had organised our finances appropriately,

You always seem to seek UK sources. For someone who is resident in France it is preferable to look at things from a french perspective. If you are resident here your estate will be subject to french inheritance tax.

@anon88169868 the Brussels IV financial agreement is nothing to do with Europe/Brexit. It shouldn’t change.

(stella, you can give it to the dogs home and pay less tax as they are a charity so get exemption… )

)

But overall, get professional advice from someone with experience in cross-border estate planning!

We bought our house here en tontine - it didn’t cost anything to set up, just included in the normal conveyance by the notaire. This would fulfill Fiona’s aim of securing the house for the surviving spouse on the death of the other.

It does not avoid the possibility of an inheritance tax liability arising on the death of the surviving spouse - but nor does using an English will, does it?

ha ha ha… you know what I mean… you can leave it to whoever… whatever… in whichever country… but Taxes still need to be paid to France…

No, but why use a complex structure that is hard to unpick when a simple UK will suffices? If you are married there is really no issue.

That’s good to know - in our case the French side of the estate is simple but it would be easier to just have one will.