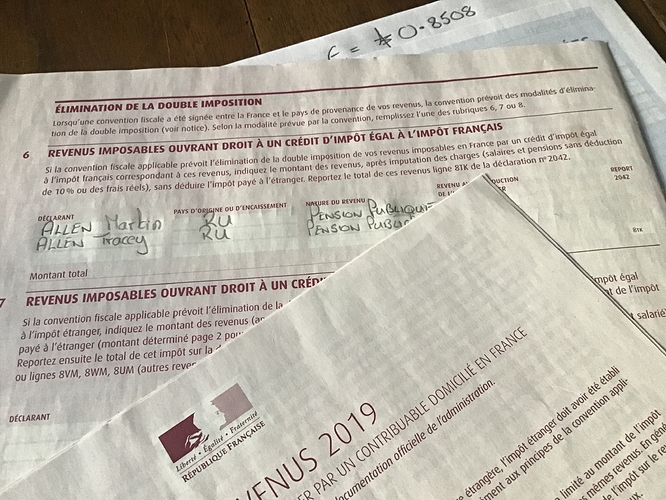

Hopefully someone can assist with this issue. We sat down to complete our French Tax returns this afternoon. No issue with the 2047k Revenus de source entrangère, no issue with the 2042 ck pro but something is amiss with the 2042k. We went to put in our UK Government pensions, which according to the guidance notes is entered, as we have the last 9 years, in box 8tk. But there is no box 8tk! So I read over the guidance notes for both the 2047 and 2042 again and it definitely says enter this total in box 8tk. Has anyone else come across this?

Are you using paper copies or doing it online?

there are multiple threads on this same subject…

If you read those… you will see which boxes have been suggested…

Paper.

Stella,

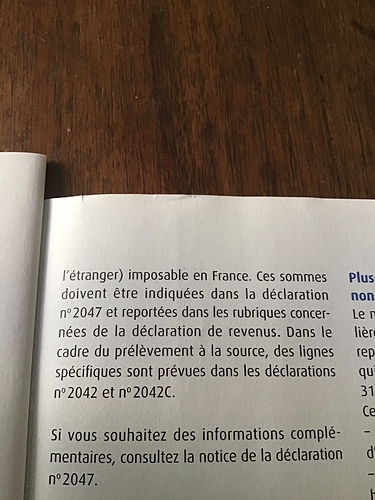

Thank you for your response. It does seem strange as the “box 8tk” has been there for the past 8 years and now…gone. However, all the guidance notes supplied with the 2047k and 2042k refer to 8tk!

David Mathews,

I’m using paper, however, bizzarley we may have a go with the online version this year.

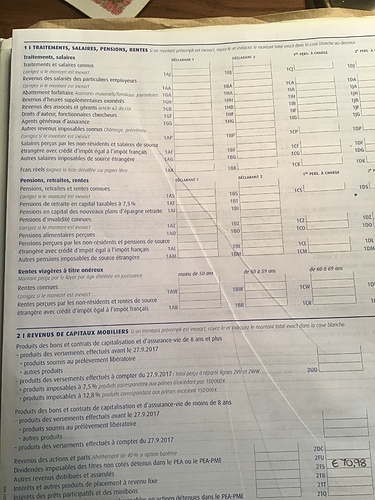

Actually I think 2042 talks about Cadre 1 and if you look at Section 1…

and read the brief description alongside each box… you should be able to work it out.

that is as far as foreign pensions are concerned… there are 2sorts and you have 2 brief descriptions - 2 choices…

Stella,

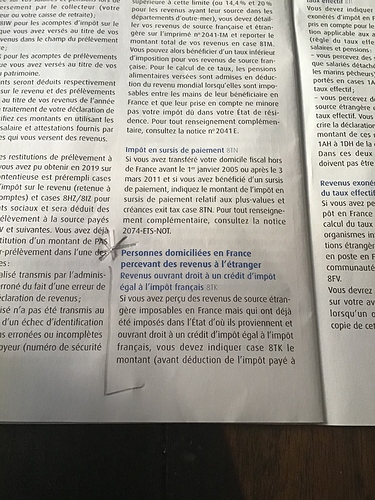

The first 2 phots, blue print, are from the 2042 guidance, the 3rd phot is the 2047k with the note to input the figures in the 2042.

Look at the form you are trying to complete… 2042… has boxes for the amounts and a brief description on the left hand side… for each of the boxes…

Look at section 1 on that document…

can you do a photo of your 2042 section 1 ??

I did mine online and it all went smoothly. I have had a confirmation that the information on my 2047 has been to 2TR and 8TK on the 2042.

Well thank heavens for that.

so it happens automatically for you online.

folks with paper forms do seem to have something adrift though (paper not people)

cheers Martin…

the document clearly shows that 1AL 1BL is the place for me to put our UK pension… I got it right… on-line at that…

pensions de source étranger avec crédit d’Impôts égal …

Government Pensionie Serviceman, Teacher etc?

Pension that is!

As everyone can see… there are two different lines across the page…

1AL etc for foreign pensions which can use the Tax Treaty

1 AM etc for foreigh pensions which cannot use the Tax Treaty

Isn’t 1AL for Non Residents?