I only did a single transfer last year and used the exact ammount I received. Just calculated the rate I got, and it was 1.1588, so it was actually pretty close to the 1.158 quoted by DrMarkH. Don’t think the fisc will get too upset about this ![]()

For a few years I caused myself a bit of grief until I discovered that I could email the local tax office to get the exchange rate (and at the same time wanted to know if I had to include Paypal on the 3916. ) However because I found that for a couple of years the rate the tax office gave me was higher than what I’d actually received I decided to make a chart on the pc and so now on the day(s) the pensions arrive into the account I check the conversion rate (using currencyfair - I signed up to have the daily rate drop into my email box ) and then I enter the converted amount onto the chart. At the end of the year I’ve got the amount for each of us to enter on the tax form leaving one less thing to have to fiddle about with.

Here’s the exact calculation I did -

| BDF 3 Jan 22 | 0.8414 |

|---|---|

| BDF 30 Dec 22 | 0.8869 |

| Average | |

| 0.86415 | |

| 1.15720650350055 |

and the two screenshots of the bank rates

BDF Exchange rates (daily) - 03 Jan 2022 | Banque de France.pdf (430.4 KB)

BDF Exchange rates (daily) - 30 Dec 2022 | Banque de France.pdf (427.0 KB)

Poses me a bit of a problem does that, do I take it as the figure for the year or should I be honest, as they will know if they want to, and use the rate when I actually transferred on the 19th of January 2022 when I got 1.19? ![]()

Out of interest, did you find that you have to include a Paypal account on the 3916 ?

I just found the answer … Aussi, si vous détenez un compte Paypal qui ne sert qu’à régler vos achats, ou encore via lequel vous avez encaissé moins de 10 000€/ an, vous n’avez pas à le déclarer.

I’m still working up the details for my first rental declaration under regime real, at least one forumite has mentioned the need for completing form 2044, having not done in the past but now being requested to do so by impot - however there is (as ever?) several views expressed on the forum.

In the thread

@aquitaine states ‘You do not need form 2044 for U.K. income.’

The Isabelle Want guide from last year has NOT to tick 2044 in the annexes page, to put the declarable Uk rental in 2027 box 4, AND Box 6. Perhaps confusing, the screenshots do show Annexe 2044 on the LHS!

Then 4BE and 4BK on the 2022. That shows as Micro Foncier (under 15K) so maybe that’s why her guide doesn’t mention 2044, because she’s not declaring ‘regime real’. Or maybe one just uses the equivalent ‘regime real’ boxes.

Someone asked Aquitaine if he was using regime real and he sent them a private message.

Any thoughts anyone?

In any case. I’m working my way through researching the 2044 form.

If anyone has filled in a 2044 for Uk rent, would they be willing to share which boxes they have filled in on it and the 2022?

Thanks.

Aquitaine has not posted for a few years … so things might not be as they were then… no idea, just saying…

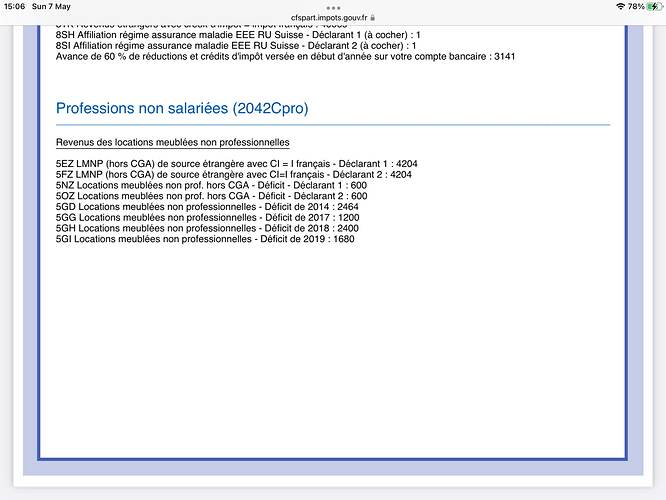

Do you mean regime reél in the French sense, or is this just reporting your net UK rental income? Our French regime reél income is declared via the accountant who has to certify the profit and loss account. This is where we enter UK rental income 5EZ and 5FZ (Ignore other lines as this is the adjusted loss from France after depreciation ![]() )

)

Thanks, yes it’s just reporting uk NET income, so I just want to declare a figure to be used in the effective tax / france tax rebate calculation, with tax credit equal to French tax. As I want to deduct actual expenses from gross rather than have the 30% flat rate deduction the ‘regime reel’ would be the closest ‘France’ approach?

Yours is an interesting approach - I think I see what you’re doing - as you run a gite, you are declaring the UK rental as part of that, on a 2042 Pro? As non-professional furnished rentals. You already have a SIRET number?

Sorry, I forgot that we we declare it alongside the french business (gîte & rental) it wouldn’t be the same as for you. Whoops!

@larkswood12 I’d be very interested to know if you finally managed to conclude on where to add your ‘net’ UK rental value as planning to finally attack the tax declaration today.

I had an accountant complete my first two years declarations. I was rather hoping that I could access the complete previous returns on the French tax website, but it appears that all they include are a couple of summary pages ![]()

Is this something you are able to share with the forum, pending the arrival of ‘Graham’s’ tax guide this year?

I had expected to see my URSAAF declarations pre-filled in the tax return - have I missed something?

Hi Mat. For example, forme Urssaf for artiste auteur has to be filled in the Urssaf artiste auteur site. That is only available from 11 may according to the website. This will then be pre-filled into the tax return.

Does this mean that I cannot do the declaration on the Impôts site until after 11th May?

Well you can start it, which is what I’m doing. The numbers for URSSAF will populate later when you have filled them in on/after 11th May. But yes you’ll have to wait until then before you can send the finished declaration.

Note this is for artiste-auteur. Not sure about other URSSAF categories.

Re URSSAF cotisations paid by early retirees under PUMA, are these tax deductible and if so where are they reported on the form? Have heard conflicting info and can’t find a definitive answer?

I think I’m a bit away from the where at the mo, as no one’s commented yet on regime reel and form 2044 - except Jane!

I’m presuming you also want to declare ‘net’ - otherwise the Isabelle Want method method I mentioned will I’m sure work for gross - which gives the 30% reduction for expenses. If you’re doing that make sure the amount is included in 8TK which I din’t mention above.

Myself, I’m tending towards doing a 2044 as this is actually mentioned to do in the impot guide for the 2027 in which case I presume it’s the same place for the 2027. But still not sure.

Here’s some of what I’ve found so far, quickly put together for you so a bit rough and ready… Do please let me know what you decide and what happens if you have a go online today!

I hope that helps at the moment.

In summary, first identify whether to do a 2044 or not.

If so, follow the boxes for that (mentioned below).

In any case -

Enter net income in 2047 as per Isabelle Want and Impot 2047 guidance

For net income -

On 2042 boxes 4BA, and 4BL.

For gross (no need for 2044)

4BE and 4BK

And for both net and gross, 8TK.

My first research is below.

Firstly note I’ve also seen posted in other forums not to bother with a 2044 and to declare net income in 2027 and 2042 only - any subsequent appearance of a 2044 can be suppressed by unticking it in the initial return appendix list. I quote one post -

“I think what’s happening is that when you are faced with the page that asks what your return concerns the rental income box is ticked. This seems to happen if you have reported UK rental income in the past, despite not filling in 2044. Untick this box and you won’t be presented with 2044, leave it ticked and you will get 2044 thrown up and, as you say, you’ll have to fill it in or the system will not be happy. There’s no need to fill n 2044 for UK rental income. I never have and all has been an oasis of calm with the Impots.”

You could ask your impot office about this? However the 2044 does not look particularly onerous.

So for the France impot guidance -

First from the 2047 France guidance (google translation from the 2020 guide) -

Property income

Specify on the 2047 address of your properties located outside France.

Determine the income from these properties on the 2044 , under the same conditions as income from French sources, except if your income is taxed according to the micro-foncier regime.

When your property income from foreign sources is not exempt from French tax under the applicable tax treaty, you must declare it, where applicable with your property income from French sources, in 2042 , line 4BA if you have completed a 2044 or line 4BE if your income is taxed according to the micro-foncier.

You must also enter line 4BL or 4BK the amount of your only income from foreign sources giving rise to a tax credit equal to French tax. They are outside the scope of the SAP and will be excluded for the calculation of the SAP.

If your property income from foreign sources is exempt in France under the applicable tax treaty but used for the calculation of the effective rate, you must indicate their amount in box 8 of the 2047 and line 8TI of the 2042C .

(NB for Uk tax treaty we use the 8TK box)

I would also suggest to have a read of the 2044 guidance and paper form. The 2044 form on my first sight looks straightforward enough with sections corresponding exactly to the HMRC return property pages - gross income, and total deductions (= expenses on the 2044).

On the form is also a box for Finance which corresponds to the finance costs in the HMRC return - I have read the impot guide for effective tax which does say explicitly one is allowed to use France allowances! Remember UK does no longer allow deduction of finance costs against France income - it’s now a general 20% tax rebate.

The 2044 impot guide (my google translation from the 2020 guide) has, for the sole mention of ‘foreign’ -

Withholding tax

As part of the implementation of withholding tax

(PAS), land income from foreign sources giving rise to the right to a

tax credit equal to French tax (outside the scope of the PAS),

included in the property income declared in line 4BA, must

also be declared line 4BL so as not to be subject to a

contemporary installment under the PAS.

In addition, if you no longer receive property income after the

December 31, 2020, tick the 4BN box. Thus, your property income of

2020 will not be used for the calculation of the down payments

One 2044 box I also saw was a fixed expense deduction of €20 per room for small expenses - phone costs etc - in addition to standard expenses:

222 Autres frais de gestion

Les autres frais de gestion représentent notamment :

– les frais de correspondance, de déplacement et de téléphone; – lesdépensesd’acquisitiondematériels,d’outillages,demobiliers

de bureau, … ;

– les frais éventuels d’enregistrement des baux et actes de location. Ces autres frais de gestion sont déductibles pour un montant forfaitaire de 20 € par local.

Par local, il convient de retenir chaque bien donné en location, y compris ses dépendances immédiates dès lors qu’elles sont louées au même locataire que celui du local principal.

Pour les immeubles non bâtis, en présence de location de plusieurs parcelles, il convient d’apprécier le bénéfice du montant forfaitaire pour chaque location à un même preneur.

Précision : le montant forfaitaire de 20 € est réputé couvrir l’ensemble des autres frais de gestion non déductibles pour leur montant réel. Dès lors, vous ne pouvez recourir à un autre mode de déduction des charges réputées couvertes par ce montant forfaitaire, et en particulier procéder à un complément de déduction, lorsque leur montant réel est supérieur à 20 €.

Google translation -

222 Other management fees

The other management fees represent in particular:

– correspondence, travel and telephone expenses; – expenditure on the acquisition of equipment, tools, furniture

Office, … ;

– any registration fees for leases and rental deeds. These other management costs are deductible for a lump sum of €20 per room.

By premises, it is appropriate to retain each property rented out, including its immediate outbuildings when they are rented to the same tenant as that of the main premises.

For unbuilt buildings, in the presence of rental of several plots, it is necessary to assess the benefit of the lump sum for each rental to the same lessee.

Clarification: the lump sum of €20 is deemed to cover all other non-deductible management costs for their actual amount. Therefore, you cannot use another method of deducting the charges deemed to be covered by this lump sum, and in particular carry out an additional deduction, when their actual amount is greater than €20.

I don’t think I can post the document George but hopefully you can get it from the thread last year or hunt it down online?

This google sheet I’ve made might be of use for those BdF rates if you want to use the rate on the day.

Just go to the second tab and enter the date you need. I’ve only put the last three years of data.

https://docs.google.com/spreadsheets/d/1tgL2P9YrVMlXRNuQMWQFL_biOxxCSKry2S26-MuWEzM/edit?usp=sharing

Note: I’ve only whipped this up for myself, so I cannot garantee its accuracy.