perhaps you need to look at what Sunak has on the horizon re recouping the billions of Covid payments… and it’s not the rich who are going to pay but a raid on middle Englanders with second homes…

Just something to be aware of if you are France resident. Extracted from the Blevins Franks 2020 Tax guide:

What about selling your property?

In France, the gain on the sale of your French main home is always exempt from capital gains tax provided that the property is your actual home at the time of sale.

However, under the UK/France Double Tax Treaty, if you are French tax resident, gains arising on UK properties are subject to French capital gains tax at 36.2% including social charges (plus a surtax of between 2% and 6% where the gain is more than €50,000). This would apply even if the property was your main home before you moved to France. You could also be liable to UK capital gains tax and in this case, to avoid double taxation, you would get a tax credit in France for tax paid in the UK.

There are alternative methods of investment available to residents of France that are much more tax- efficient. Even where a property is not selling or being sold, it is worth taking advice to see if there is anything that can be done to mitigate taxes and social charges.

Thanks for your email peter.

This a long-term investment for our pension. The children will inherit the properties when we die and will have to pay the tax, there will still be a big lump left for them! They do not want us to compromise our income now just to increase their inheritance

Best Regards

Glad to hear it

Thanks for that name…I have called them and seemed to have an interesting product “International SIPP” smooth talking kind of guy so need to check it out,… did you deal with them or have a contact who did ?

…and was at school with a guy called Brian Clapham !

quite so…but who, spent most of yesterday surfing the web!

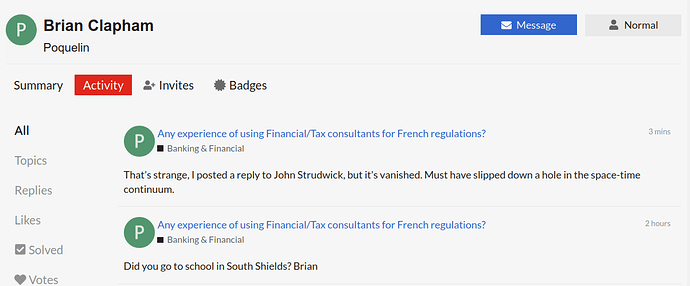

Did you go to school in South Shields?

Brian

That’s strange, I posted a reply to John Strudwick, but it’s vanished. Must have slipped down a hole in the space-time continuum.

no…Stamford , South Lincolnshire.

what do you know about Harrison Brooks.

There was another one answering John’s question. I wonder what happened to it? No problem, I’ll repost it. Thanks.

I posted a response to you earlier, but it has vanished. I’ll repost it.

As I said before, John, I bring no direct experience to bear. This name came to my attention whilst researching Investment Platforms in the EU in case my UK platform could no longer deal with me post-Brexit. Their fees, whilst still a bit expensive imho, are lower than most alternatives, there are regrettably many companies out there whose objective seems to be to extract maximum cash from investors for the minimum of effort.

As with all financial intermediaries, you should check them out very carefully. In particular, check the fee-structure – are they taking more than a fair share of your investment earnings? Also very important, are the funds they offer proper independent funds, with checkable prices? Many firms offer their “Own name” funds, which are totally obscure and impossible to verify, so your money can leak away through indifferent performance.

If all the above checks out, I suggest you could try them with a small amount first, dip a toe in the water and see how that goes over time.

I’m sorry if this sounds pessimistic, but it’s always prudent to be super-cautious before making any major investment, too many people are losing their savings to unscrupulous advisors these days.

You might also like to refer to these websites for further ideas:

We were in a similar position a couple of years ago and spent a lot of time looking into this.

Various English-speaking financial advisors we spoke with were either going to be very expensive and/or seemed to be trying to pull a fast one on us. (We had one guy tell us that the steep set-up fee on the Dublin-based assurance vie he was trying to sell us would work out to 1% after various rebates if we kept the investment for a minimum of 5 years. I put all the numbers in a spreadsheet and it came out to a cost of 2%. He said that was “good to know” but was pretty unapologetic about having given us incorrect info. Needless to say we didn’t invest with him!)

We spoke to some French financial advisors too and they weren’t much better. Our bank (Credit Agricole) was sort of helpful, but had some weird set-up where it was more expensive to get their assurance vie direct than to do it via some third-party web-site, so we gave that a miss too.

If your French is good enough, you can find out a lot about assurance vies online, and there are several self-managed ones with relatively low fees (no entry/exit fees and 0.5-0.6% annual charge) and a reasonable range of funds - eg https://www.placement-direct.fr/assurance-vie/darjeeling was one that we were happy with.

Many thanks to you and Brian C. Started to do some investigation and the more I look the more nervous and uncertain I become, and I have some understanding of investments etc. As its a personal pension I don’t think i can just move a small amount , all or nothing. I may well decide to hand it over to my current managers, apparently they can take on via a fully managed scheme. I just tell them my risk profile and that’s it…I just have to trust them to get it right.

I’m not an expert, but, for investments that are already in a SIPP in the UK, it may be that you don’t necessarily NEED to do anything. As far as I understand it, from the French point of view a SIPP is just another pension scheme, so gains and losses inside it are ignored and any money you draw down from it is just treated as taxable income - a bit like in the UK. Of course, you’re taking a foreign exchange rate risk by leaving your investments in sterling – though I’d imagine that’s lessened if the underlying funds are investing in companies outside the UK – but the upside is you get to keep lower management fees and access to a wider range of funds than in any equivalent French instrument.

yes you are partly correct, I can just leave it with current managers (Killik & Co…very good) but they cannot give me advice as I now live in France.

So I can have no imput into actual funds its in, I just give them a risk level and approx how much I want in cash each year.

One point regarding an Assurance Vie is that we had to take out ours before we left the UK financially.

Ours is based in Luxembourg but is accepted by the French tax authorities as being acceptable to their regulations.

Make sure that this is the case.

You also need to work out an acceptable risk profile.

If you are high risk adverse, holding on to your financial assets is just about the best you can get nowadays.

Also if you want to take advantage of avoiding inheritance tax, you cannot touch the capital for eight years.

A few years ago we wanted advice about how to rationalise our various savings/investments.

We had some savings (bank accounts, pension plans, unit/investment trusts and straightforward shareholdings) in the UK, bank accounts and rental property here in France.

Eventually we had to give up on finding somebody who would advise us on how best to ratiionalise/consolidate it all.

A number of problems emerged including:

a. finding an financial advisor here in France who wasn’t tied to a particular company’s products;

b. finding an advisor who could advise on the Anglo/French nature of our savings/investments;

c. finding somebody who would advise on how to plan and progress the changes rather than just advising a “big bang” solution.

We got close to finding a solution but it involved an advisor here in France and another in the UK but they both wanted client agreements that insulated them from anything the other one advised and the one here in France could only advise on buying the particular products.

In the end we resorted to doing the research ourselves, getting the appropriate tax advice and then deciding what to sell and how to consolidate it all.

And how did that work out Grahame?