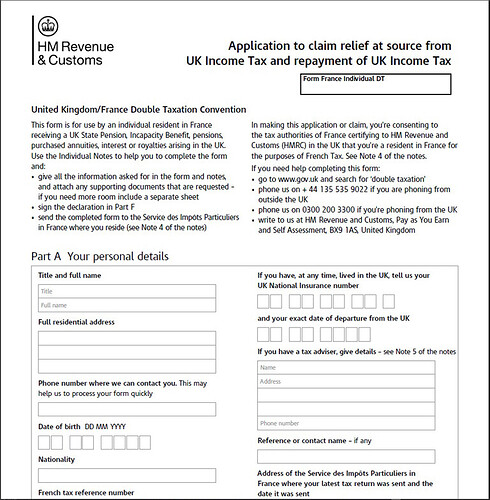

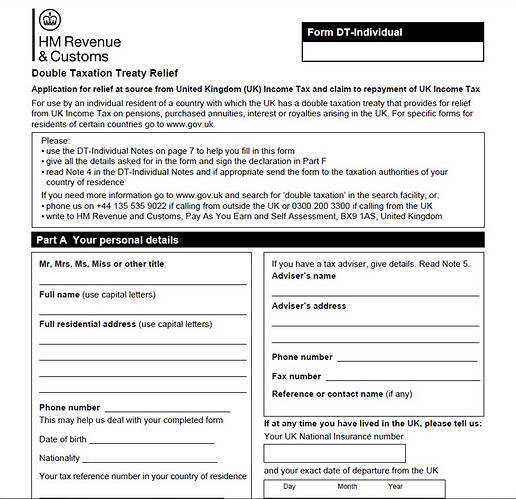

Ah - you’ll need to lodge the DTT form, yes download, print out, take it to impot office and have it stamped and signed, you then post it. Keep a scanned copy. You’ll probably need to give an explanation for the timescales.

Plenty of posts about the process on the forum. Give HMRC a few months then ring and request the technician - they’ll see it and you might be able to get it processed.

You’ll see on the form there is a tick box for state pension. You can ask HMRC to calculate the tax refund owed. Hopefully they can do it by amending the tax code back to 12570L but you’ll likely miss the tax year end so maybe not. If you get it in the post quick - maybe, but you only have a month.

So, what has happened is for some reason HMRC has blissfully ignored your state pension for the purposes of taxing your LA pension all these years - and then there was some trigger to make them sit up and take notice. I presume you have had the LA pension for at least the same time as the state pension, so it can’t be that.

There’s many people I think who receive a UK taxable pension and when their state pension comes into play haven’t needed to send a DTT form for it - at least till now.

Also if the UK taxable pension was small then there wouldn’t have been a need to send a DTT form for the state pension, e.g. if the state pension was 8K and the UK taxed pension 4K, it would still have been below the 12570 tax free allowance, so no tax.

But state pensions are going up, so bringing more people into that net.

With yourself of course it seems you would always have been above the tax free allowance with both pensions.

It seems just plain weird that they ignored your state pension all these years - maybe they ignored it for everyone and have now made a policy change -Thoughts anyone?

I’m tagging @George1 here coz he did deal with HMRC inspectors / systems in a previous life, maybe you have a theory on this ‘wierdness’ George?

Good luck Bonzocat, I hope you don’t have to wait too long for a fix!