I’m trying to fill in tax form 2047 online. I’ve given details of pensions received from the UK - no problem. I’ve filled in the details of the gross interest received from the UK putting the total amount in box 2TR but when I try to proceed I get a message which says ”Veuillez renseigner le montant net encaissé selon le pays d’origne de vos revenus.” (Please fill in the net amount collected according to the country of origin of your income.). I’m at a loss understanding what other box I need to fill in. I’ve looked at the “How to declare your tax online” guide, which was posted earlier, but to no avail. All suggestions welcomed. Many thanks.

why not take a look at the on-line Notice for 2047 which explains each section… that might help… it should be available to you …

All sorted - I put a zero in the first box for Dividends and that sorted out the problem, thankfully.This year I had to re-enter all my bank accounts outside of France even though they have been automatically listed in previous years.

Hi Joyce,

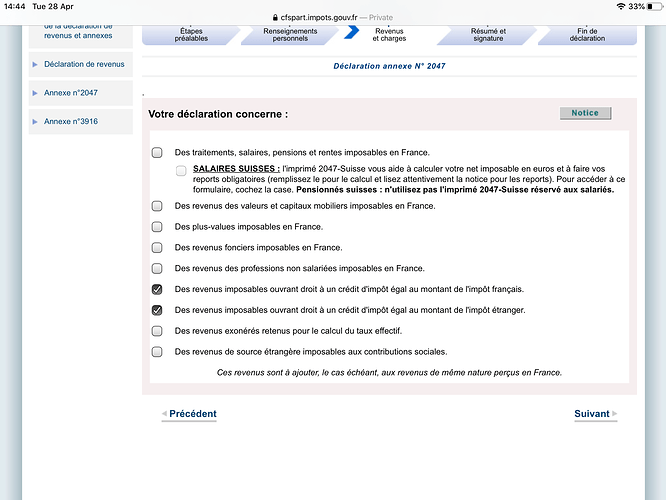

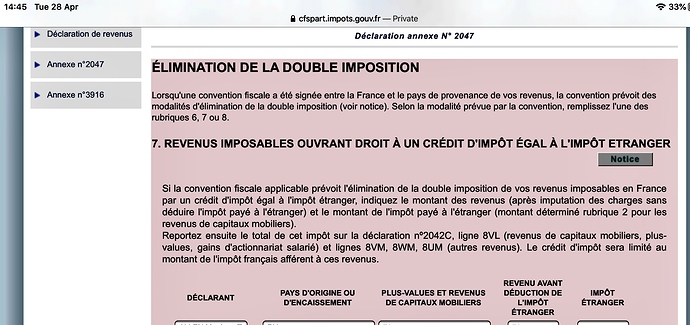

I’ve had an issue with this as well. On the 2047 selection part I’ve ticked what I believe are the correct boxes to bring up the respective sections to complete. The first box was easy and our pensions slipped in nicely. However the box below, which we believe is the correct section for interest on UK savings accounts, a pittance at €71, brings up the second picture. We’ve entered the before tax but have no idea about the after tax as our accounts aren’t taxed at source since 2016.! image|690x325

As you don’t pay tax in the UK you declare the gross amount. The amount after UK tax is irrelevant.

Hi David, I do pay tax on my government pensions but Halifax no longer tax at source

Two different things.

Your government pension is declared at 8TK and the savings interest at 2TR.

Hi David,

I know, hence the 2 photos. The Government pension slipped in with no issues, the interest from savings is my issue which is the second photo. The last 2 boxes on photo 2 ask for interest pre tax and then government tax. By putting a 0 or nothing in the box does not show this section as an input when you get the summary sheet of sections completed after signing off the return!

You have not clicked the correct box in the first photo for the bank interest. It is reported in Interéts et autre produits de placement à revenu fixé.

Oh! On the paper version that’s the heading under which the tax office in Carcassonne told us to enter it!

Hi Martin… I don’t know about online… your tax office will reply to an email.

I had 2 replies come from Perigueux… within a couple of hours… although the questions had been answered by my local Tax Office over the phone…

I’m following the Deputies’ arguments now… byee

I declare exactly the same two income sources. My government pension goes at 8TK and the U.K. interest at 2TR. The box you are trying to fill is for income that has already had tax paid on it, that is not the correct place for U.K. interest.

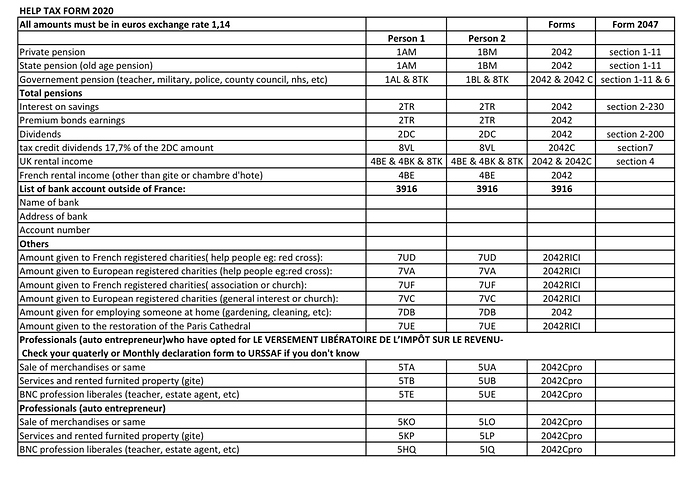

This is a useful form.

Thank you very much David. All sorted now.

It is a very useful form. Thank You.

Kindest Regards

Martin & Tracey

Yes, thanks!

Very useful.

Hi there,

If anyone can help me I would seriously appreciate it… tearing my hair out here trying to figure it out.

I am trying to declare the interest I received on my Irish account (for which I have already paid interest in Ireland). The info here seems to be for UK interest that isn’t taxed in the UK.

I’d like to avoid paying double tax… I’ve put the gross amount on form 2047 box 2TR but I think this is incorrect and I will end up paying twice… but not sure where to put it otherwise.

Thanks so much in advance!

Hi Kane… and welcome

Please would you give us your First and Last Names… Full Name is part of our Terms and Conditions.

If you’re not sure how to amend your Registration… simply put your full name here on this thread and I will amend it for you

cheers…

Hi Stella,

It’s Shiv Kane.

Cheers