Good Morning,

This is my first post and I hope somebody can point me in the right direction.

I sold some Orange shares on the UK stock exchange in 2020 and need to declare the income on this years tax return.

Does anyone know which form and which boxes need completing?

Thanks

hi Christopher

To avoid the random ferrets problem last year when everyone’s tax questions were all over the place and to ensure information is shared there is a specific tax thread here to post questions and answers on.

@graham can this be moved?

Happy for it to go to right section but please explain how I can move it. Thanks

I’m not sure we can have a one size fits all tax thread Karen, it could get very complicated to navigate. This is a capital gains issue, not an income tax issue.

Karen, why have you included a comment I made agreeing to a comment made by Jane Jones here?

It has no relevance to your post.

This is one downside of social media when comments can be abbreviated by others to make it mean something totally different.

Apologies @JohnBoy no idea. I copied the link off the header line of the browser on my phone having clicked on the Tax Thread on the topics list. No idea why it would do that. Sorry.

IMHO @KarenLot has nothing to apologise for.

She was merely trying to point the OP to the topic where the reply to his question probably already lies.

Whilst Discourse (the software used bt SF) does generally provide for moving posts, it requires moderator intervention which, it seems, the SF team have chosen not to implement.

The link Karen posted would, if selected, take the OP to the topic so there is no need to question her motives @JohnBoy it was an entirely innocent attempt at helping the OP.

Thanks Karen for your response.

Like you technology seems to be ahead of me.

It’s going to be hot today everyone, not worth fretting over taxes on a fete weekend, be French and enjoy the weekend.

Bon weekend

Good morning @Christopher_Maydom !

And welcome to SF, great post and question, please don’t be put off by the negative comments! I don’t know exactly where you would put this on the form but it’s just a capital gain. Perhaps someone can advise?

Hi @Christopher_Maydom and I echo @james welcome to SF.

The answer to your question is complex and beyond the simple narratives explained in the Tax 2021 topic designed to help in the most general of circumstances - UK pensioners and AE’s income.

If you give me a little time, I know where to find the answer for you and will post it here a little later after some research to check the facts for you.

@Christopher_Maydom

I found the reference I knew I had seen somewhere. It actually relates to share holdings in Revolut and where to declare them on the French online tax return (I don’t have any so it fell off my radar, so to speak) but the same will apply in my view to the shares you sold on the UK stock exchange on the “same meat, different gravy” principle.

If you are employed at a French entity that grants you stock-options , the year that you exercise your stock option, if the plan is not qualified (which is my case), you have nothing to declare, as it is treated and taxed as salary on your pay slip.

Secondly, when you sell stocks, and your broker, like Revolut Trading, Trading212 etc does not give French tax authorities any recap of your stock trades, then you have to declare it yourself using the form 2074, know as the green form . The online declaration is limited to 9 sell-offs of stocks. If you have more, then you will need to declare using the paper form, and attach an Excel sheet detailing your gains (I made a template if anyone is interested can PM). Note that, for your cost of acquisition, you must use the weighted average price per share.

The total value of your gains that will be taxed is in line 945 “total of gains”. You will be taxed at the flat tax (30%). Note that the reduction of tax when you used to hold your stocks for more than 2 years, is no more present in the current flat tax scheme. In other words, there is no more tax incentive for holding stocks for more than 2 years.To declare your dividends of US (foreign) origin , you use the form 2047, know as the red form (not to mistake with the 2074 above). For US dividends, normally your broker (I know that Revolut and T212 do this) already deducts the 15% released to the US tax authorities. Example: let’s say that you received the equivalent of a gross 100€ of dividends. You should receive 85€ on your account, your net dividend. In the online tax declaration, in form 2047, check the box “Des revenus des valeurs et capitaux mobiliers imposables en France.” Then fill row 203 with the net value (85€ in my example), row 204 with 17,7% (for US), row 205 is automatically calculated (15€ in my example), and put 15€ in row 206.

In theory, when you receive dividends, if your “revenu fiscal de référence” is above 75k€ for a couple, you must, before the 15th day of the following month, fill-in the 2778-DIV-SD form and send it to your local tax office with a check worth 21% of your perceived dividends, as an advance you are making to the tax authorities. And do this every time you receive dividends. To be honest, my advice is that you can skip this and just declare your dividends of foreign origin once a year, you should be fine with this approach.

Finally, this article is a bit old, however gives some good use cases: Déclarer les gains d’un compte-titres ouvert à l’étranger (MAJ 2020) | Améliorer sa culture financière pour mieux gérer son argent

On the other hand, someone else wrote in that thread:

In my opinion, you are using the wrong form. You said you want to declare your gains and loss, that should be completed in 2074_cmv form

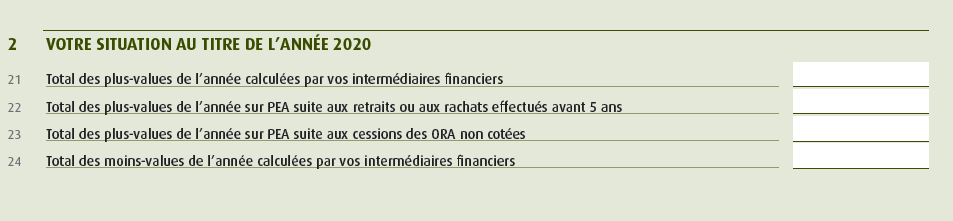

You need to fill these lines from my screenshot

and then:

The online tax form 2074 has severe limitations like whole number for number of stocks, also the stock price can only have 2 digits after the comma, which makes the calculation false if you sell thousands of stocks.

I took the decision to use the wrong result given by the calculation of the online form. Eventually the difference is less than 20€ with my calculation, so it is OK.

In 2021, I already sold more than 9 stocks, so the online form won’t work anyway, so I will file my taxes in May 2022 on paper, and I will print my own calculation. Side benefit is that I will put the exact number, not rounded like in the online form.

I told you it was complex!

If you want to read through the topic you can find it here

Mine is actually a key start and it needs plenty of choke when cold