Our highly qualified professional accountant has made two expensive mistakes. And they take no responsibility for errors.

Which is exactly why I made reference to reading what is posted to become aware of how things work and what to ask a professional. I feel sure that the mistakes made by your professional were spotted by you as like most of us it is well worth gaining an understanding of how things work that might affect us and be in a position to cross check.

I would much rather check someone’s work they have done for me rather than do the work myself and submit it unchecked.

Several were, as we check their submissions. Unfortunately one wasn’t that obvious as related to depreciations on the profit and loss account and we missed it as we had not got our heads round depreciations. And of course even if made by the accountant all errors are our responsibility, and there is no come back on the pesky accountant.

Personally I prefer to work out how to do things myself and understand what is going on. Nothing to do with cost, just like to be able to have control of important administrative matters.

(We have to use an accountant to sign off the accounts, if not I wouldn’t bother).

Can we go back to keeping on topic please. If you need a thread on the benefits of using professionals to do your accounts or tax returns, open a new discussion thread.

Thank you.

@cat

I think this is on topic! How you do your accounts is part an parcel of the annual process. If you want a thread that just has your help sheets - which are very good - then lock it.

I wish I’d found Isabelle’s useful guide earlier. I got lost on the online website so left a message on the last page giving my (simple) details and then sent in the printed form - which took me about 5 minutes to complete - with a covering letter saying what had happened. Why do they insist on making things so complicated ? Or squeeze so much info into each page. ? BTW I made the exchange rate out as 1.12 according to several websites. I don’t recall ever getting as much as 1.14 last year - it’s barely that now.

I had a similar experience although luckily I spotted the error before submitting my declaration. Now I just take my time and double check everything.

On the question of declaring Revolut accounts, the following reference has been provided by Revolut for information:

Yes (I need to correct mine with the updated Revolut address)

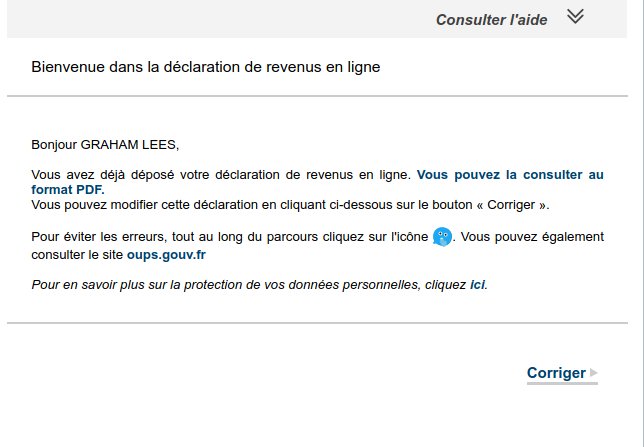

After you log in to your space on the impots.gouv.fr site, it recognises that you have completed your return and presents you with the following page:

and at the bottom is a button « Corriger » which gives you access to correct your submission.

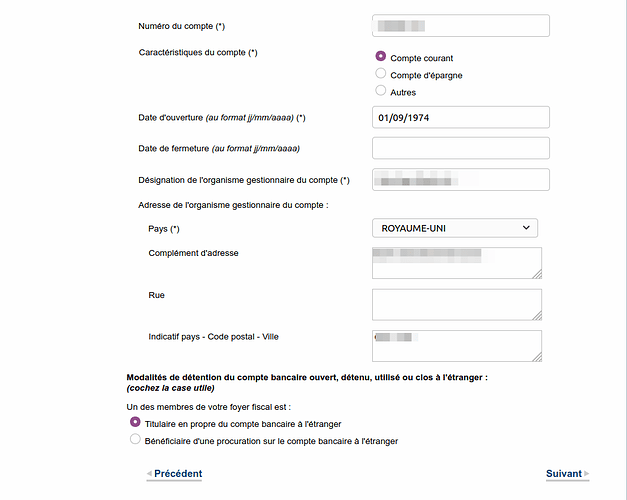

I know I’m being dense but translating last year’s 3916 entries into this year’s format is confusing me. What is Complément d’adresse ?

Second daft question - the on-line system won’t let me put punctuation in the bank account number. Since the only reference on my Paypal account is my email address, I’m wondering what other people put in there…

Would further address / additional address make sense?

I can recommend a website called reverso context because it lets you put in phrases and then gives you the English ( or French) as a phrase in context. Doesn’t always get it absolutely right, but it certainly helps.

It’s the address of the Bank you are declaring.

You need to take care about what you enter as it seems to reject the sort of characters Brits tnd to include such as punctuation marks so you may need to experiment to get round it. I’m sure there is a graphic in Isabelle’s help guid of what to write in which box on the 3916.

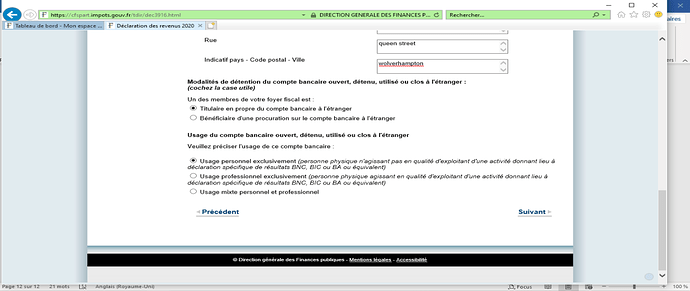

This is the graphic from Isabelle’s HOW TO DECLARE pdf page 29:

@AngelaR

I’ve just looked back on our submission.

On one bank we didn’t put anything in the complément d’adresse and it was accepted by the system and on another, we put in the street town county no commas just a space between them and the postcode in the code postal - ville box in both cases again accepted by the system.

Thank you Sue and Graham. I think I’ll just leave it blank - I’d put in the street but wondered if the extra bit should be the number but I’ve lost the will to live!

Any clues about account numbers for Paypal?.

Thanks Graham - that’s how I thought they were identified but unfortunately the current interface doesn’t permit punctuation or special characters in the relevant boxes. I’m thinking that I’d better just say “inconnu” in the number bit and put the Paypal email address in the special notes at the end of the return. Fun eh?

how about putting it in as something like “grahamlees at orange point fr” will that work? (use your own addy though)

Do you actually need to declare it? Did you read the points made about Paypal accounts, associated with French bank accounts and the minimum limit?

Out of interest @graham, what are you doing with your Revolut? I saw they helpfully put up the guide to say put the new information, but it made me wonder whether you should effectively close out the U.K. details and then on a new line have a separate account for the Lithuanian information. It seems very longwinded doing that and isn’t what Rev suggest, it just seems a little like an omission to not put it when they are so picky about you putting absolutely everything down. I also have a Dozens account, a U.K. fintech, and they got caught up in the Wirecard debacle and took all their tech in house and everyone got new sort code and account numbers. Again, same company but the account identifiers are different so I wonder whether I should again effectively close the old account on the 10th June, then have another line for the new one opening on the 10th June.

Just wondering what your wise and thoughtful mind thought…

I simply changed the London address I provided last year to the new one and the pays to Lituania. AFAIR, the account number didn’t change. This was all a new declaration of course as the system demanded re-entry of details following changes to the combined 3916 and 3916-bis.

So far as I can establish, and I’ve kept a copy of the Revolut information with my tax record for this year if challenged, I can wave the reference at the fisc and feel confident that will be sufficient. I don’t see a need to duplicate the info to account for the Euro wallet as that forms part and parcel of the base LIT account which has been declared.

In effect, the account maintains under the new regime having been transferred by Revolut so I haven’t seen a need to close one and open the other.