I am of the opinion that the two houses were knocked through into one in the past, possibly 1975. So, not maybe legally.

Other works carried out in the 90’s were “cosmetic”, new windows etc.The Notaire and agent knew there was 2 properties on the cadastre, with their own numbers. It would appear to us that everyone knew about it being one house, the local marie issued one number for the new postal address.We don’t get 2 bills from utility companies. The agents are no longer in business. If I don’t get anywhere with the impot people I will take it to the Notaire .

There was a similar situation in our village… Brits bought a semi-detatched house and, some years down the line, the house nextdoor came up for sale. They decided to buy it… rather than risk noisy/whatever neighbours.

so they had 1 Residence principal and a 1 maison secondaire (possibly for family to visit)…

however, they decided they needed/preferred more space themselves…

Via the Mairie, they got permission to knock-through and form one big house…

which is how it is now identified on all documents…

At least they got permission!!

Every other agency has us down as one residence.

Well, the Impots now know it’s not.

I completed one a couple of months ago after downloading the form. I posted it to our local tax office and waited for the bad news. After a couple of months I still hadn’t heard from them so sent an e-mail through my account asking them if they had received it and how much more would we have to pay. They told me that they had received it and that it would not have a higher charge levied until next year. That give me a whole year to save which will probably be needed.

Had you hoped for a reduction?

We’re being charged for 2 properties and I’m awaiting their response. Previous owners knocked two houses into one and I’m wondering if they told anyone😞

Normally you would have to go to a Notaire and register it properly so new title deeds can be drawn up for future sales reference and obviously the tax people are informed. We knew some people who had a house which was built many years before they bought it but on the deeds all that was registered was a field with no buildings and nothing else. It turned out the Notaire just let it go and then they wanted to sell and couldn’t because they had no proof of any house on the parcel number and had to start from scratch which took months and a lot of money to legally register the house as a residence and not a piece of land.

Not at all. We knew we would have to pay more as we have added rooms from an unused area, although the overall building has not been enlarged.

I hope you get a reduction as the rental value would not be as much for one house as it would be for two, which is the criteria they use for the rateable value I believe.

Keep at it as I am sure it is easier for the authorities to ignore you than it is to sort it out.

Yes, it could be a lengthy process. As a comparison, a friend lives in the village in a larger house, 4 bedrooms , with large garage and courtyard and he’s paying half of what we are paying…

when was his TF last reviewed (if ever)?

It’s often the case that additions are made to a property and never notified until matters are reviewed. I’ve heard of circumstances from the past where a one bed house has been extended in to the attached barn surreptitiously and dishonestly without formal permission or application. It’s why many houses keep their shutters firmly closed on the street side to avoid prying eyes ![]()

It usually ends in tears when the property is sold and an H1 is demanded with the TF going up through the roof and the new owner telling the old one “but you said the TF was only so-and-so”!

He moved to France a few years after us. The house has not been altered structurally but “modernised”. The barn/garage

was re-roofed.

It’s more about what happened before he moved there Ian.

The notaire has no professional interest in the calculation of the TF when performing his duties so not surprising.

He may be in for a shock though if/when the Fisc call for an H1.

Of course, you could always ask the Fisc why he pays less than you but I’m not sure your friend will last long as such if you were to do so, mind

No names, no pack drill. I was looking at our house documents yesterday. One room at the top of the stairs was named as a Palier ,on another doc it was called a bedroom. A bedroom without doors? No a Palier ( landing)

I was looking at our house documents yesterday. One room at the top of the stairs was named as a Palier ,on another doc it was called a bedroom. A bedroom without doors? No a Palier ( landing)

Anyway, we will see what they come up with.

just a word of warning to Everyone…

make sure the house insurance has everything clear…

there was a huge ruckus when Inspectors/whatever investigating a house-fire… noticed the remains of a bed on the wide landing… (@renard )… which was obviously used as a “bedroom” yet not counted as such in the Insurance stuff… (something along those lines…)

It was a few years ago, so things might have changed… but it nearly cost a 20% deduction in figures/payout… ooops… let alone the threat of washing their hands of the whole affair… “what else hadn’t been declared?”

Agree, our chimney has a problem. We got a sweep out a couple of years ago and he refused to certificate it. The flue does not pass up to the top of a brick chimney. I phoned the insurance company to remove the log burner. Luckily we have central heating and had planned to ditch the annual log stacking anyway.

always useful to have another form of heating though… will you be getting the chimney liner sorted or blocking the chimney…

We were considering a pellet stove at one time to replace the log burner as they only have a small diameter flue which would reach high enough. I’m glad we didn’t as the price of pellets has rocketed.

The wood burner ran the central heating, bought that because the old oil burner that was in the house when we bought it was on its last legs.

So, we bought a modern oil burner ( condensation ) 4 years ago. Now the price of oil has shot up. C’est la vie !

at least we are living in France… I feel that beats many little niggles…

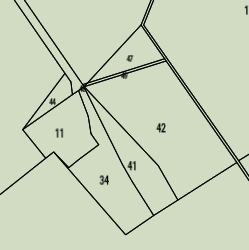

Oh wow, we are not in that situation thank goodness. we are on the village cadastral map with two cadastral numbers, when it should be just the one.

Damn right.

Why should there just be one? Ours has about 7 different cadastral numbers. ![]()

In fact it is seven, I’ve just checked.