I used to get this xmas bonus as part of my RSA benefit which I did not receive in it’s entirety as I did a part time job but I can tell you, when you only have €525/month to live on and pay for everything, it is a welcome bonus especially towards the end of year water and electricity bills. Without the RSA, I could not have survived after the death of OH who was the main breadwinner and at my age then, I would not have found work to replace it! Its not a huge amount in the scheme of things and gets ploughed back into the economy but I always looked forward to getting it and being able to buy something nice for the xmas meal!

The Assemblée nationale yesterday voted to increase the ‘flat tax’ that you pay when receiving dividends, gains, interest etc. If eventually passed by the Senate, it will raise the flat tax from 30% to 31.4%, the increase comprised entirely of CSG. The stated purpose is to finance the suspension of the increase in retirement age, and would bring in €2.8bn in 2026.

Politicians seem to have belatedly discovered that, shockingly, non EU foreigners can access PUMA, at no cost.. This is part of the Social Security Budget discussions.

Some pensioners and others on various benefits get £10 at Christmas.

Something in the budget discussions that needs attention to close the loop hole!

The focus on certain Americans (on visa long séjour visiteur) who don’t pay for the right to enjoy and maintain coverage under PUMa clearly continues to excite députées. 2 résolutions establishing a charge were tabled to address this, voted on, and passed on Saturday according to the below. Obviously any measures voted on by the Assemblée nationale have to survive both discussions in the Senate, and then agreement between the two chambers. The measures seemingly include a requirement to demonstrate private medical coverage of up to €30000 expenses.

I imagine it would need to be a pretty substantial charge to reduce the incentive for Americans in search of - among other things - cheap healthcare to come to France. Certainly healthcare does seem to loom large in inquiries from Americans considering the move so it’s clearly a factor in their decision. I didn’t realise they paid no income tax here.

The article got that point completely wrong! US citizens resident in France do pay French tax - mainly on French source income and gains. However it is true to say that the tax treaty between France and the US is particularly favourable to US citizens in some respects. For example, US citizens do not pay French tax on their US Social Security pensions (similar in concept to UK state pensions, but rather more generous in scale).

So they don’t pay French income tax then.

Most of the individuals concerned.

Or as good as.

30,000 euros compared to US medical costs is bvgger all coverage requirement. To be serious the required cover would have to be, guessing, somewhere starting 1 million ?

Why would you compare it to US medical costs? The €30000 figure is the health insurance requirement for anyone requiring a visa.

My point is that compared to insurance coverage needed in the US it!’s ridiculously low

I’ve felt nervous visiting there with $5 million coverage, normally would want at least $10 million these days. Horror stories sbout how quickly costs can mount up in US even for small things. So any sensible US person will be used to coverage really being needed in the $millions and certainly not trivial amount of 30k that even here for quite a lot of conditions could be easily exhausted.

Reply to Tim & Karen - re UK christmas ‘bonus’. Originally introduced by one labour chancellor - a certain Gordon Brown - he with the midas touch and who gave away UK’s gold; he insulted pensioners with only increasing their pension by 50p per week - yup - 50p. There was such a back-lash that he was more or less forced to introduce this christmas ‘bonus’ -as a sop measure which wasn’t much help - and pensioners felt even more insulted. Good old british labour chancellor - steal from everyone - and then throw our gold away. In fact he was also the one who has led to the dramatic decline in people’s workplace pensions……………

Aren’t labour chancellors wonderful !!! And as for the present one - words fail me at her sheer spitefulness - being advised by that nutter lefty Torsten Bell - who seems to ‘hate’ anyone who owns property , savings or a pension. Sorry - slightly off post……

Who would you have instead, Concorde?

American piping in here; I do not live in France as of yet, still working for 3 more years ( maximum) but I have two accountants in the family who deal with international tax law. The French-American tax treaty is to avoid double taxation on the same income source; Americans do pay taxes to France on world-wide income. The tax paid to France is then considered a “tax credit” applied to US tax obligations so citizens do not get a double tax on the same income. I have family residing in Brazil for work and since the country has no tax treaty with the US, their income is fully taxed by both nations!

Any American residing in France for 183 days or longer is currently considered a “tax resident" by France and their tax obligation is to France first ( as it should be, living there). Retirement pensions have been excluded from actually being taxed, but is added into the formula to determine the world wide income if any income comes in from other sources ( investments, rental properties, businesses, etc).

There has been an unintended loophole that allowed Americans who only have social security ( the average monthly amount is $1900 USD for men) to completely avoid any tax while still signing up for health insurance. It looks as though attempts are being made to justifiably close the loophole.

But I think some of the rancor that came from the issue is that a few bad apples have been on Youtube and other social media channels gleefully telling others how they get “free insurance” and instructing others to do the same. It’s crass and appalling to watch.

That said, it is complete chaos over here. We have politicians lining their own pockets while refusing to tackle problems with real solutions and instead point the finger of blame at the most vulnerable in our society. I am a low level health care provider myself and I am appalled at our “for-profit” healthcare system, where vast amounts of money go into the pockets of insurance company CEOs and shareholders and not to patient care nor providers.

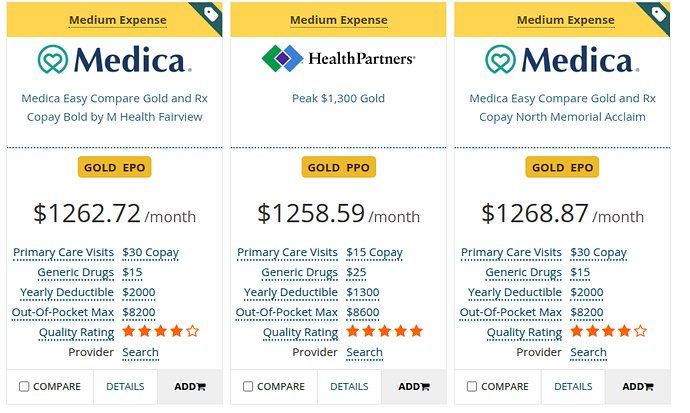

Our full retirement age is currently 67 and politicians want to raise it further. Healthcare insurance premiums are already sky high and the current administration wants to allow subsidies to expire that will cause undue hardship for millions.

I believe this is why some retired Americans have been looking to France as their lifeboat away from a sinking ship. I took a screenshot of what 2026 monthly premiums for insurance covering a 63 year old female are, they are projected to go even higher.

I had jaw surgery in 2018 to correct several serious issues. I checked into the hospital early in the morning; the surgery lasted for 9 and a half hours. I was taken to recovery, then my room. I have a very hard time waking up from anesthesia, so basically I slept in my room from around 6PM to the next morning, with the exception of using the bathroom three times. There were two night nurses who helped me with that. The next day my surgeon came by to check on me; my mouth and entire head were very swollen, so I didn’t eat anything. I slept on and off all morning. In the early afternoon, a nurse came by to check to make sure that I could use the bathroom by myself without passing out, and he walked me up and down the hall with a harness in case I fell. He also showed my husband how to do the same. I was released in the late afternoon. So, the use of the operating theater, one night in the hospital, a few times help with the bathroom, and a walk up and down the hall. Total bill was over $200,000. This did NOT include fees to the surgeon or the anesthesiologist, those were separate.

I had insurance, and I’m sure that if I had not, the cost would have been less; they soak the insurance companies, who pay up. I still needed to pay over $10,000 out of pocket. It’s the biggest scam in the world.

Health care provider here; what kind of serious jaw issue did you have that required a 9 hour surgery yet you were released after one night? And a $200,000 bill? Without surgeon or anesthesia fees? That doesn’t seem correct at all. Did you get a full accounting of what the charges were for or challenge them?

Healthcare isn’t a “scam” in the US, it’s become a for-profit business driven industry. This is why we need government sponsored healthcare like every other sane country in the world.

I’m a Brit and have a rough idea what private care costs in the UK. I struggle to see how the figures are so high in the US. It seems that even having a baby (without complications) can cost a fortune.

Maybe you could enlighten us please?

Hi Jennifer,

Healthcare costs are high due to a ruling made by former President Nixon in the 1970’s to allow medical care to follow a “for profit” business model and other factors unique to US laws. Care decisions have mostly been taken out of the hands of providers and placed into the hands of accountants working to maximize profit, not the health of patients. We have a political system whose flaws are now being exposed for the world to see and exploited by those with sociopath-like personalities.

Each state in the US determines what, if any, medical care/support is given to those without insurance or very low income. Unfortunately we have become a nation groomed to think of what individuals want rather than what is for the common good, so most states here are sorely lacking in any sort of help for people.

Many employers do not offer health insurance, so due to the rising costs of insurance premiums, many people are taking the chance at going without insurance coverage. When they show up for emergency care as a result, they are unable to pay and are either turned away for care ( legal in some areas) or the cost of their care is absorbed by the care facility and passed on with higher costs to everyone else.

It’s like watching a snake eating its own tail at this point.

People complain about the high costs of healthcare, but refuse to do anything about it and refuse the idea of government sponsored healthcare like every other western nation has. They worry about how their own taxes will rise but don’t realize the “for profit” business model they’ve chosen instead will ensure healthcare costs will continue to rise unabated.

Thank you for explaining, Kate. That all sounds very sad.

If you’re squeamish, don’t read this.

It’s long, but you asked: I did not have condyles connecting my lower jaw to my skull, so my lower jaw was just basically floating around. I had an overjet and could fit my thumb in the gap between my lower teeth and my upper teeth. Needless to say, I was very limited in what I could eat. My teeth were also very crooked, despite having ten years of braces (which included retainers) when I was a child; back in those days, they just straightened my teeth and didn’t correct the jaw, so my teeth started moving again after I stopped wearing the retainers. There was extreme overcrowding; when I started orthodontia again, they removed two teeth. In addition, my lower jaw was too narrow; they could have corrected it with orthodontia but my surgeon decided that it would be better to do it surgically, so he sliced it down the middle in the front, and widened the jaw. I had over two years or orthodontia leading up to the surgery so that my teeth would line up correctly, and a year more of braces afterward. I’ll wear retainers at night for life.

I’m not sure what all the surgeon did; he started to go over everything with me at the pre-op appointment, and I told him that I didn’t want to know. I was nervous enough and I had a general idea of what would happen. He is literally world-renowned - when I had my initial consultation with him in Seattle, he had patients in the waiting room from Qatar, so I trusted him. I had had titanium condyles made, so he used those in the surgery. It took about three hours longer than it was supposed to - he said that things were just not wanting to move. My teeth had been in that position for decades, after all. I have scars running from the top of my head, past my ears, and under my chin. The lower jaw widening was from the inside, so I don’t have scars from that. I had almost no pain - although I was prescribed oxycodone (I think), I just took Advil and was fine. Tons of swelling, of course, and I looked terrible, but I was pretty comfortable.

I was amazed at how quickly I healed. We had to stay in Seattle for several days until my post-op appointment. The first day out of the hospital, I went for a walk (a shuffle, really) in a nearby park for about half an hour. By that day, I was drinking smoothies. The next day, I walked around the hotel for about an hour. The day after that, longer walks. The next day was my post-op, so we went to that, and then my husband drove me four and a half hours home. After we got home, I drove myself to the grocery store and did some shopping, and, other than not being able to open my mouth fully for about 8 months, that was it. I felt totally fine. I can’t imagine what use it would have been to stay in the hospital for any longer than I did.

As far as the bills, it took almost a year to get the full accounting. I was told that that would happen and that I shouldn’t pay anything until they’d gotten it all worked out. At one point, the bill was for over half a million, but they’d actually double charged me. Yes, of course I looked at all of the accounting. My insurance company paid it, except for my portion, without any pushback. Maybe they paid less, I don’t know - all I know is that it was ridiculously expensive. The surgery fees were quite reasonable IMO - I’ve had other surgeries and the fees were in line with those.