Since myself and my partner have taken recedency we thought it would be helpful to open a joint bank account here as the likes of insurances and phone companies don’t accept our TransferWise BE IBAN numbers even though they should by law.

Cue going in last week spending two hours as they tried to photograph/scan/email all our documents and signed countless forms (half a tree went in the bin  ), back in today and we can’t open a joint account as you don’t have a recent P60 you can give us, but we can open an account for your partner though.

), back in today and we can’t open a joint account as you don’t have a recent P60 you can give us, but we can open an account for your partner though.

Explained that I don’t get P60’S now as I don’t work as I am retired and don’t have/get a pension yet, everything else is still in the UK as we have not been able to get back to collect everything, but I have another account with you and have had for 7 years, nope does not make any difference I am afraid, gave up after that as life is too short to bother, but my partner has an account now

My partner asked if everything was excruciating like this here, ,O yes you get used to it though

That all seems a bit mad - any higher authority to appeal to?

I opened a CA account here when I arrived 6 months ago. A few months later we added my wife to the account and converted it to a joint account without too much hassle (for France). Maybe that’s the easiest way to go? We did it all via email.

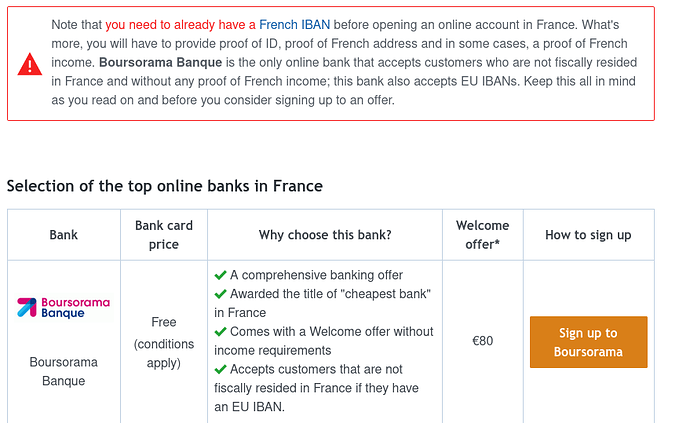

It is not the answer to your issues necessarily but it’s always worth remembering that two British fintechs have, or will soon have, native FR IBAN accounts.

Revolut have said it is coming,  , although in fintech the word

, although in fintech the word  could mean anything from a week to a decade, and Monese are already there and allow those with a french address to exchange the standard BE IBAN for their euro account for a FR one if you have two proofs of ID (to fulfil the stricter french requirements) and proof of address I think.

could mean anything from a week to a decade, and Monese are already there and allow those with a french address to exchange the standard BE IBAN for their euro account for a FR one if you have two proofs of ID (to fulfil the stricter french requirements) and proof of address I think.

For newcomers it may be easier as you can obviously open the account in the U.K. using your U.K. info, receive a GBP and BE EUR account, then when you’re actually here can contact them by chat, say ‘surprise, I’m french now!’ and they’ll then switch it to an FR IBAN which also gives you the all important FR RIB which you can then use to pay bills or get into the french banking system easier.

Not the solution for most perhaps, but always worth throwing it out there in case it’s useful to anyone.

Credit Agricole.

should have put money on guessing which one

Wise have recently launched a campaign with others in regard to the illegal practice of many companies in refusing IBANs

I know of a few folks that have had problems with SFR, it now allows you to put in a non FR number but falls over when you try to pay the 1euro for the SIM with anything but a French card, it goes through the motions and then once your bank has authorised the payment comes up with payment failure, I know folks that have tried 3 or 4 cards and it won’t accept them, use a French IBAN and all is ok

Don’t blame the bank itself, blame the folk – usually an outside firm – who built their account opening / payment systems.

I’m not an IT person, but I have worked as a consultant / journalist relating to technology for more than a few years.

The process goes like this. WannabeBank wants to be at the bleeding edge of tech, having spent squillions being persuaded this is the route to success. It calls in Supertech Developments, which pledges " our system will be super secure… with lots of ways to keep the horrids at bay"

One of those ways is “input and reference validation”. Well that’s what one outfit called it. In other words the system sets rules for data entry fields. And an easy rule – that they already have in their library of pre-coded tools – is one that rejects postcodes / IBANS or other “identifiants” which don’t conform to the local taxonomy.

For instance, I wanted to buy some stuff from a supplier in the UK with which I did business worth thousands when I lived and worked in London. But I wasn’t been able to since moving to Normandie. Because the change of address page on my account record would not accept a postcode that did not match the UK format.

Eventually, in the last of several online chats, the operator recognised me: “Didn’t I sell you that XXX stuff a few years ago?” And escalated the issue to the sales director, who also recognised me from an earlier deal. But without that, I would never have been able to cut through the technical thicket.

HTH

Ken

We never had any problem with opening a joint CA account, and have never had any problems since…

I am an IT person, these companies could make their systems accept any IBAN and validate it but they choose not to.

Hopefully, the more complaints made, the more pressure will be applied to these companies breaking the SEPA rules.

It’s a good while (16 years) since my wife and I opened a joint account with Credit Mutuel Bretagne so things may have changed since then. But it was simplicity itself. The branch was round the corner from the notaire’s office where the sale had just been concluded; the notaire’s negotiatrice (actually his wife) phoned the bank and told them she had new customers for them; we went there immediately and were signed up on the spot. She did the same with the local insurance agency. In both cases a local introduction/recommendation made all the difference.

I never had any problems 7 years ago, quite quick and painless, this time however…

The rules are tightening everywhere. It’s hard for me to find a British bank that will let me have an account as a French resident, NatWest flat refused to make me a signatory on my dad’s account and we’ve literally just sacked HSBC for business banking, as I found myself spending literally days every quarter satisfying and re-satisfying their identity checks. I also spent this morning at the Spanish consulate in Montpelier to satisfy the new ID requirements of our bank in Valencia we run Spanish payroll out of.

Many are terrified of anti-money-laundering legislation. Some banks have adopted a reasonable approach, most have not. If they don’t flat refuse your business, they’ll make you jump through untold hoops.

For what it’s worth, in the UK we found Co-Op and Nationwide are still on the “reasonable” list. In France only LCL were able to help us open an account for a British owned French company in a timely fashion. Everyone else either gave us a “non sec” or wanted to send dossiers off to Paris with lead times of months. INCLUDING Crédit Agricole, who know us and with whom we had no trouble setting up personal banking and joint accounts 12 years ago.

Times change, rules change, but it’s certainly not a French thing. It’s everywhere. Banking is becoming a real pain.

One can understand the reluctance of the bank to open an account for someone who apparently has no income.

@Vieillevignes Welcome to SF

A small administrative matter… could you please amend your registration to show your first name and last name as per the site T&Cs Thanks

@cat

The sale proceeds from one of my house’s is sitting in the other account I opened 7 years ago and they had a copy of the statement from one of my other accounts in the UK where the money from another is sitting + I have an income from a benefit that isn’t means tested so does not generate a P60 they had a copy from as well😉

Sorry. Didn’t mean to pry.

I think that perhaps your trouble relates to the fact that the type of proof you can supply about your income and financial circumstances is simply not what the French bank expects.

Perhaps an interim option would be for you to have a second card on your partners account, and perhaps also a power of signature granted by your partner, and then in the fullness of time the account could be converted to a joint account.

Another option would be to obtain an interview with one of the advisers at your local post office whom I have always found to be most understanding and helpful in relation to accounts with La Banque Postale.