Bots. Lots of bots.

Well some feel Twitter has a future:

Amusing the guy who wrote this article and claimed “plenty of websites cut and paste copy from The Register to scrape up a few cents from search ads. Scum who pursue that as a business model……” then filled his own article with cut and paste tweets  Personally, I think anybody who has made 52,000 plus tweets needs help, not a new Twitter subscription

Personally, I think anybody who has made 52,000 plus tweets needs help, not a new Twitter subscription

I couldn’t possibly comment.

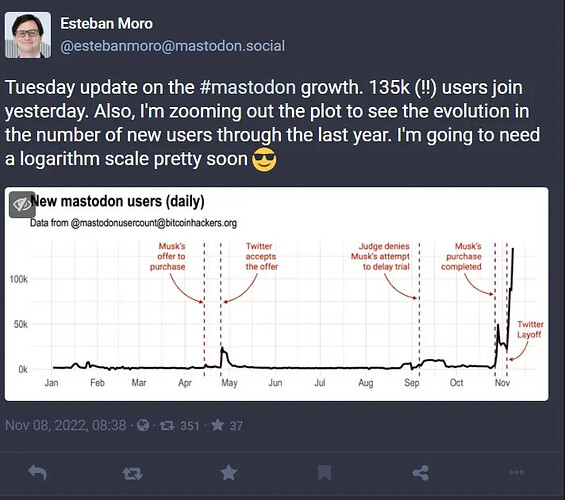

He has a point. There were some minor meltdowns with some instances having to halt accepting sign-ups because they were overloaded, but then one of the advantages of a distributed system is that there is no single point of failure.

Elon Musk yesterday addressed employees for the first time, saying that “bankruptcy isn’t out of the question”, according to multiple reports.

So, the Company (ie shareholders) forced Musk to complete the deal because of his attractive offer, which on completion tanks the Company causing all sorts of collateral damage.

Being an old fashioned sort of bloke, I’ve held on to the old fashioned idea that an enterprise has obligations to the shareholders, the employees and the community. In my opinion over that last thirty years that’s been significantly eroded, if not replaced, in US corporations at least, by the all and singularly importent shareholder value. Very effectively implemented through share option for executives.

I think that’s a pity, it has also seen once great companies hollowed out in the evermore frantic search for quarter on quater earns per share increases. It has also been a factor in the reckless transfer, intentional or otherwise, of IP to Chinese and other cheap foreign manufacturing facilities, which now poses a threat to the originators’ economies. .

…not just a threat to the originators’ economies but to their security

I see Centrica (British Gas) has just used some of its windfall profits to buy back its own shares - ie. to artificially inflate its share values so top executives can cash in tax-free. Meanwhile, millions of people in the UK are afraid to turn on their heating.

Adding to the inequality endemic in Fortress UK.

This pisses me off (even though it’s entirely possible that I benefit given that I hold investments that might, in turn, hold shares in energy companies).

It is literally the opposite of trickle down - it’s trickle up from the less well off to the rich. Though at least it won’t be entirely tax-free as gaining benefit would need shares to be sold back, the proceeds of which should attract capital gains tax.

I doubt it - they will be in a tax efficient share option scheme - or they will split the sale across financial years to use their CGT allowance.

And in any case of course CGT is only 20% even if your marginal income tax rate is 45% !

I suspect that large investors selling back shares to Centrica will not think much of a mere £12k allowance

True.

Ah - but they don’t gain - or don’t only stand to gain - by the immediate buy-back - the reduction in the number of traded shares increases share prices permanently, other things being equal, so the gains can be anytime - eg. another £12,000 or so tax free every year.

If someone has a few shares and £12k means a lot to them this is fair enough. They will be paying 10% on the gain if they are not a higher rate tax payer.

If someone is wealthy they won’t give a rat’s arse about the £12k allowance, nor keeping £12k a year as a tax free gain (I’ll bet such a person would not be relying on one set of investments).

However only taxing the 2nd person at 20% might be seen as a sop to the already well off. I might not argue very hard against that one.

Not my experience, though possibly in smaller companies. Options are issued as part of a remuneration and/or bonus package with a phased vesting over, say five years. 20%, 20%, etc. When you exercise the options the difference between the option price and the market price will generally be treated as in year PAYE income, not a capital gain, because you never actually owned the asset. Maybe things have changed.

You could exercise your vested tranches each year, pay PAYE and then only CGT on the difference between the share price you paid and the market value when you sell. If the shares are going well that’s a good option but you are taking the risk of the shares you have accumulated tanking. I’ve seen people loose their homes because they borrowed rather than cash in options, and then the options went under water. Tragic.

…CGT will be interesting to see what Sunak/Hunt does with that in the budget next week. That, and pension contributions taxfree at highest marginal tax rate, have been left alone in these very difficult recent years by the Conservatives.

How to lose your job and influence people.