Hello Dear SF aficionados

Does anyone have knowledge of how the system calculates days in France versus UK (or others) when you are travelling between the two?

For example, I wake up in France, catch the Ferry midday and in UK in afternoon and vice versa. Is that a “French” day or a “UK” or both or none?

If one was concerned on the 90/180 or 183 rule for example, then had multiple trips between different Countries.

Thanks.

Not sure what you are seeking…

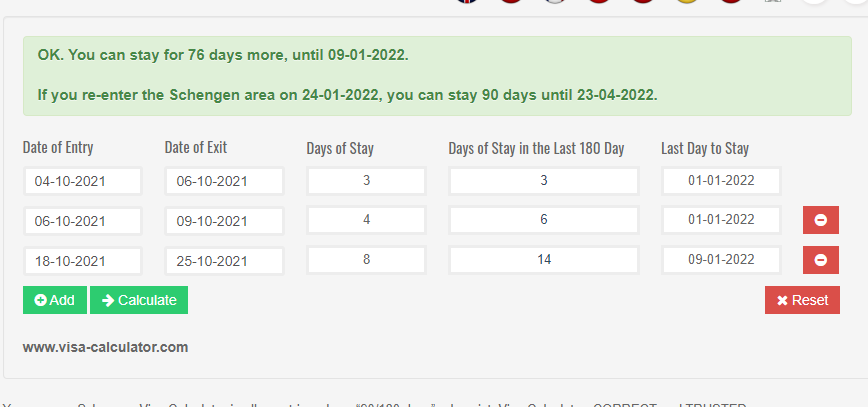

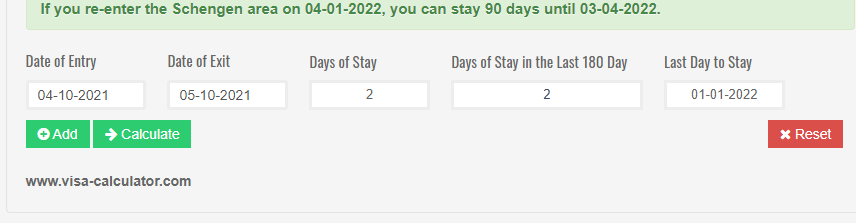

there are simulators already on the forum for testing the 90 out of 180 thingy for testing travel limits for CdSWA holders and Schengen travel

EDIT: here’s one…

I’ve just moved from in and out of Schengen on the same day… to give it a whirl… inbterestingly, it counts the day in/out twice to work out the length of stay.

why not give it a whirl…for yourself.

Is it, where you are at midnight?

There is some calculation method that uses that method, and if you are travelling then it uses your departure time with the result that a 23h59 departure and an 00h01 departure time make a difference of a day. But I may be thinking of HMRC’s method rather than Schengen. No doubt it will tell you somewhere since it is an important factor.

Thanks @Stella - I will give it a try.

So if I check the Schengen calculator it claim the entry and exit days as full days in Schengen regardless of time of exit etc. So leaving late Friday night and returning late Saturday night having possibly 20+ hours outside of Schengen does not show up as having left according to calculator.

I’ve not seen where time of day matters… going In/Out (Friday) and In/Out (Saturday) counts as 2 days

we used to plan our Day Trip to Calais to get the earliest ferry to France and the latest one back to UK… to give us the longest day possible…

So in effect the cut off point is midnight, based on time of arrival in Schengen and time of departure from Schengen. Good to know. And nice and simple.

why are you talking about the time???

I can’t see where it asks you to put the time… am I missing something ???

… the link simply asks for dates…

If you arrive at 23.59 tonight you will put the date as 25 October. If you arrive at 00.01 tomorrow morning you will put the date as 26 October. To me, that makes 00.00 the dividing line between one date and the next. Do you not agree?

Ah… see what you mean… OP was talking about same-day Out/In or In/Out

Hi @Stella @Sandcastle - my question was more directed at the Tax viewpoint, trying to give my Accountant the number of days in UK verses those in France or Belgium (but I didn’t want to complicate the question with a 3rd Country in Schengen) !

There are only 365 days but who gets my travel days ? Leaving Country or Receiving Country ???

Thanks for the responses however.

Ah well that is a bit different because each tax authority will have its own rules which you should find out. Certainly I know the UK has very specific rules on how travel days must be counted. You can’t just use Schengen rules for tax purposes.

Each country can count it differently.

Each country can change its rules for calculating whether a day counts or not, from time to time

The last time I looked, for a day to count as being in the UK the person had to spend from 00:01 through to 00:00 in the UK, otherwise the day did not count as being in the UK. So if I arrived at 00:01, but left at 23

59, that did not count as a day in the UK for tax purposes. Actually if my aircraft was scheduled to leave the UK at 23.59, but they hadn’t actually boarded till 00:20 the following day, and wheels up at 00:45 and actually left UK airspace at 00:50, I read somewhere that the day you were scheduled to leave at 23:59 generally still wouldn’t count.

I am not going to comment here about the UK establishment believing the enormous wealth brought to the UK by foreign High Net Worth individuals is worth having rather relaxed rules. Some of the UK establishment being well known industrialists, in fact household names, that although born and bred in the UK now live in places like Cyprus but may need to spendvsubstantial amounts of time (although not days, ahem) in the UK.

A long long time ago the UK rule did not require the whole day to be spent in the UK, for that day to count as being spent in the UK for tax purposes - part of the day made it count, I forget the earlier criteria exactly but only a part day was needed. Your UK accountant will either know the current rule already or can check it in 2 clicks. All this for the UK I know through semi-professional sources.

I read somewhere recently, not in a professional source, that if you spend even 1 minute in France on a day then that day is counted as a day in France for tax purposes. I am sure there are exemptions for things like being in transit from one country to another and not spending more than, say, 24 hours in France.

So it’s perfectly possible for your days in a year not to add up to 365 - each country has different rules.

![]()

![]()

![]()

![]()

![]()

I’ll leave it to you and the Tax Man to figure that one out…

This is an interesting question not just from a tax point of view, but also from a 5 year CdS POV. Having done all the work getting the cards, one definately doesn’t want to become unstuck.

Mme and I’s French soil requirements are diametrically opposed = she’s to be here 182 (183?) days ‘a year’ (whats that? calender year, consecutive year…),

I’m supposed to be here one day a week (weekend?).

The teletravail restrictions have been suspended up to 11 November now last time I looked, and I’m presuming I can switch mode of EU defined legal residence between frontalier and ‘inactive’ - (I’ve got a pension too). But like RIFT advises, you wouldn’t want to NOT pay the requirements close attention.

I know there’s frontaliers on the site who haven’t been commuting (like me) during lockdown / travel restrictions - wondering how they’re feeling about their ‘legal residence status’? Maybe best not to post too much on a forum  That said I’ve always been upfront with HMRC I haven;t been ‘commuting’ according to the EU frontalier definition - not least because the UK removed travel restriction exemptions for this class of worker!

That said I’ve always been upfront with HMRC I haven;t been ‘commuting’ according to the EU frontalier definition - not least because the UK removed travel restriction exemptions for this class of worker!

Itis based on the date you arrived, your year starts then, so different for everyone.

Hi Tory, hope you and all are well - makes sense, one arrives 1 July 2020, each year is 1 July to 30 June.

Now here’s the rub - present 1 July to 1st Jan, then absent 2 Jan to 30 December, then present 30 December to 30 June (maybe + a day, haven’t done the exact arithmetic here for the example).

So maintain legal residence? Obviously for 'inactives here…

It is a long time since I have heard anything about this, but my recollection from what I used to hear from other people was that the UK rules were heavily weighted to add up to maximum time spent in the UK and minimum time spent in other countries. Presumably the idea was to make it as difficult as possible to avoid being classed as tax resident in the UK.

I believe France’s criteria are less obsessed with the counting of days. If France is your “foyer”, or the centre of your economic life, you are classed as tax resident even if you spend fewer than 180 days in France. However, that is different again from the residence requirements for the CdS, which is specifically to do with days.

But personally I think it is unlikely that anybody will check. I believe normally you are simply asked to sign an attestation on your honour.

Indeed, as I so am as a frontalier! (except of course to date its been the other way round…)