I think it depends. Tax reasons or visa reasons, so Schengen and tax are not the same.

Hi @John_Scully - Indeed my thoughts on the system, however I was intrigued as to how the “system” figured out which country to allocate when was was bobbing around in transit.

It’s not a critical item but some like to keep count for curiosity.

I imagine in your case the important thing is to commute sufficiently to retain your frontalier status rather than just become an “ordinary” resident. But all that must have gone out of the window in these Covid times when travel has not been possible.

I think Chidders the onus is on the individual to prove they weren’t somewhere rather the tax authorities having to prove you were. If they hit you with an assessment then a paper trail could be importent. I always assume that with tax authorities one is guilty (i.e. liable) until one one proves otherwise

I imagine in your case the important thing is to commute sufficiently to retain your frontalier status rather than just become an “ordinary” resident. But all that must have gone out of the window in these Covid times when travel has not been possible.

Edit - site doesn’t really show the message I’m replying to very clearly does it?

yep, and I’m hoping natural justice or at least sympathy or common sense will prevale , along with a healthy dose of ‘we’re not going to chase every cent, thanks for the ones you’re paying us’!

This might help for UK tax purposes.

Izzy x

If you are talking about tax, there does not exist a ‘system’ that ‘allocates’ days to various countries. Each country’s tax authority has its own way of handling this. It is the individual’s responsibility (or their accountant’s) to know the rules in each country where that person has a tax liability and count days using that particular system when dealing with that particular tax authority.

In some circumstances it is a very critical item because a day this way or that can make the difference between having a tax liability in a country, and not.

If you are keeping count for curiosity, I suppose it would depend what aspect it is that you are curious about - Schengen rules, UK tax rules, another country’s tax rules, or something else entirely.

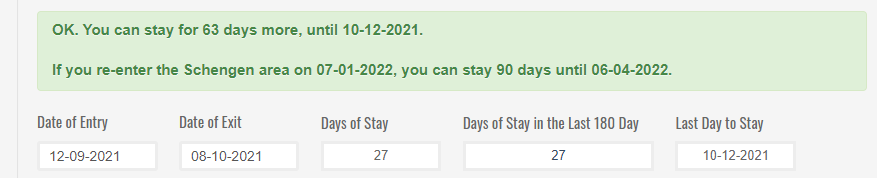

I cannot say I understand this. I have put in my real dates (12 Sept-8 Oct) and it states that I have 63 days left until 10/12/2021? Where do they get that date from as my first date of entry since Brexit is the 12 Sept 2021.

It then says I can re enter as from 7 Jan for 90 days - why 7 Jan ? What if I arrive on the 7 June - do 90 days start from then.

I don’t understand it at all!!!

Brexit really is the gift that just keeps on giving.

This is all proving complex.

It’s a rolling year, so like us, we came over on August 2nd that’s when our 90/180 days started. We stayed the full 90 days so now technically we can’t come back for another 90 days. But if we get the long stay visiter visa we can use the 90 days as well as the visa time?

I’m not sure if I have made this any clearer?

From what I can see, it seems to go back for some reason and chose a date to start which is earlier than you arrived. So if you only stay one or two months it goes back - I cannot possibly fathom it.

I guess if you take the full 90 days then the start date is more obvious.

I think maybe the issue is that the calculator is designed to tell you how long you can stay from the most recent date of entry. ie it calculates the exact date by which you must leave. It assumes that you are currently in the EU, or why would you be asking it how long you can stay.

In the screenshot above you may be confusing it because that is not your situation, you are not currently in the EU.

It is correctly telling you how many days you have spent in the EU (27 days between 12.09 and 8.10) and how many days you have left within the current 180 day period (90-27 = 63).

If you enter a new date of entry, it will then calculate 63 days from that date and tell you the date until which you can stay. That is what it is designed to do.

But without a new date, it does not know what you are asking. It cannot tell you the date on which you must leave, until you tell it the next date on which you wil enter.

In fact, what are you asking?

Interesting to read all you have said here. I am also very confused about when to count my residency days from - 183 days in France - as I am constantly told different things by the experts. A tax consultant and a well established organisation working with UK citizens resident in France. One told me the 183 days are within a calendar year just like the French tax return - January to December - and the other told me you count them from your date of first arriving in France. In my case that is 19 July 2020 - 18 July 2021. If I get a definitive answer I will let you know. Very important for me working between 2 countries and needing to schedule freelance work to fit in with days of residency.

Also I do not understand how the residency dates work exactly. If I arrived on the 19 July 2020 then does my first 5 years of residency last until July 2025? Or do I take my residency from the date my Carte de Séjour was issued in May 2021 which gives me residency until 2026. That is obviously what my card allows me and I only ask as I understand the conditions of needing to be in France for 183 days a year are more flexible after you have spent 5 days in the country. Again I may be wrong. Would be interested to hear your comments. Thanks et bonne journée.

I believe this is correct.

I believe that you are eligible to apply for a 10 year"permanent" card as soon as you have completed 5 years of residence, ie 19 July 2025, if you wish.

Or you can keep your 5 year card until it is about to in 2026, and then apply for your 10 year card.

It makes no difference to your rights. You will acquire full rights in July 2025, regardless of whether or not this is reflected in the type of card you hold.

When counting days relating to meeting the condition for retaining residence under the withdrawal agreement, you use the anniversary of your date of arrival.

When counting days for tax purposes, obviously you must use the tax year of the country concerned. Although in fact spending 183 days in a country is not the main or only criteria for tax residence, neither in the UK nor in France.

They are wrong, so I wouldn’t use them for tax calcs either.

Hi @Corona - you sound certain the 183 days is not related to the tax year (Jan - Dec) but understood the Tax Authorities whether UK, French or other Domain work on this factor for evidence of domicile???

@francine

Lets see, none of the calculation apps work that way and lets face it tax is a law to itself. Why tax has anything to do staying x amount of time in shengen when you are a 3rd country is anyones guess.

Perhaps you should say that tax is a lot of laws to itself, seeing as every country has its own tax laws, and then there are the tax treaties. But, I think it is in a person’s interests to know the laws of any country they are or even may potentially be classed as tax resident in.

Most countries’ tax rules do take into account the length of time spent in the country. Either as the main criterion as Spain, or as one of a number of criteria as France, or as one factor in a more complex set of rules as the UK.

I am also confused why tax would have anything to do with time in Schengen but I cannot see anywhere where anyone has suggested that it does? Likewise time spent in Schengen has nothing to do with qualifying for permanent residency in a specific EU country. The thread seems to have diversified from its title.

I queried this by email to one of the official organisations supporting people with WDA applications and received a written reply that confirmed you can apply for the 10 year card five years after residency started, so I can apply for in August 2024.

It isn’t five years from issue of a five year WDA card