I think its all balls!

I found a couple of articles on this & none of them mention illegal taxes or refunds to householders, although a limit for high consumers is proposed. Your bill will only go down, it seems, if you run a steelworks or similar.

EDF are probably having a good laugh at all these silly letters Brits are sending in & La Poste are making a few euros, too!

This from the EU site Europa.

State aid: Commission approves aid for on-shore wind power in France; opens in-depth inquiry into tax reductions for large energy consumers

European Commission - IP/14/327 27/03/2014

Other available languages: FR DE

Expand

European Commission

Press release

Brussels, 27 March 2014

State aid: Commission approves aid for on-shore wind power in France; opens in-depth inquiry into tax reductions for large energy consumers

The European Commission has concluded that a French scheme providing support to the production of electricity from on-shore wind installations is compatible with EU state aid rules. Under the scheme, producers of renewable energy are compensated for additional production costs in line with EU guidelines, and do not receive overcompensation. In parallel, the Commission has opened an in-depth investigation to assess whether three types of reductions of renewable energy surcharges granted to large energy consumers in France (so-called CSPE) are in line with EU state aid rules. The opening of an in-depth investigation gives interested third parties an opportunity to submit comments on the measures under examination. It does not prejudge the outcome of the investigation.

France supports on-shore wind installations by imposing tariffs above market price on distributors for buying the electricity produced in these installations (feed-in tariffs). The annual value of this support is estimated at €500 million. The feed-in tariffs allow producers of renewable electricity to cover the additional production costs they face compared to traditional electricity generation. The Commission's investigation has shown that the feed-in tariffs only compensate for these additional costs and allow for a reasonable rate of return in line with the 2008 Environmental Aid Guidelines (see MEMO/08/31).

To finance the support for on-shore wind, every electricity consumer in France has to pay a uniform levy per kWh consumed (the so-called "contribution au service public de l'électricité" – CSPE). However, the law provides for three exceptions:

-

No CSPE is due on own consumption of auto-produced electricity below 240 GWh per year.

-

No CSPE is due beyond €550 000 (indexed) per consumption site per year.

-

For industrial companies consuming at least 7 GWh per year, the CSPE is capped at 0.5% of their annual value added.

These three reductions appear to give large electricity consumers a selective advantage that could distort competition in the Single Market. The possibility of such reductions is not foreseen under the 2008 Guidelines on Environmental Aid which are currently applicable. The Commission therefore has doubts about their compatibility with EU state aid rules. In parallel, the Commission is in the process of revising its guidelines and is considering including provisions allowing reductions for energy intensive users under certain conditions in order to preserve competitiveness (see IP/13/1282). If adopted these new guidelines would apply to this case as well as to other ongoing cases.

The in-depth investigation will allow interested third parties to submit information to the Commission that can help better understand the effect of the surcharge on the risk of relocation of activities and the impact of reductions to the surcharge on competition in the Single Market.

Background

A judgment of the EU Court of Justice of December 2013 (case C-262/12) confirmed that the French support for the production of electricity from on-shore wind installations involves state aid within the meaning of EU rules.

The Guidelines on Environmental Aid, which are currently applicable, entered into force in 2008 (see MEMO/08/31). The adoption of new guidelines on state aid in the fields of energy and environment for the period 2014-2020 is foreseen for 9 April 2014. Amongst other things, the new guidelines envisage that Member States could partially relieve energy intensive companies from financing renewable energy generation. The Commission carried out a public consultation on the draft guidelines (see IP/13/1282).

On 18 December 2013, the Commission opened an in-depth investigation into reductions granted to energy intensive companies on a surcharge for the financing of renewable energy in Germany (see IP/13/1283).

The non-confidential version of the decision will be made available under the case number SA.36511 in the State Aid Register on the DG Competition website once any confidentiality issues have been resolved. New publications of state aid decisions on the internet and in the Official Journal are listed in the State Aid Weekly e-News.

Nothing about illegal tax there...

EDF made this press release a while back.

This from EDF.

Press Release

Agreement on the repayment of the CSPE deficit

EDF and the French State have reached an agreement whereby EDF will receive full compensation for having borne the cumulated financial deficits related to the Contribution to Electricity Public Services (CSPE) mechanism over the years.

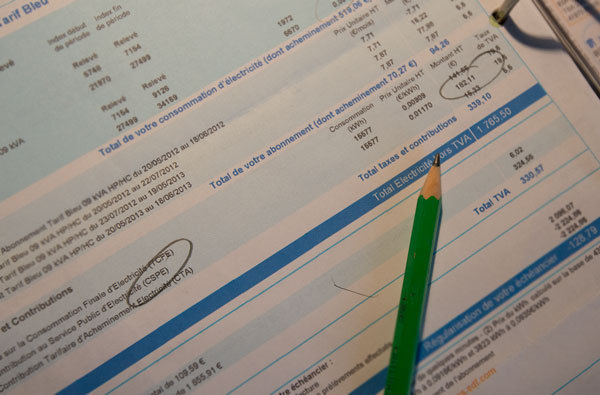

The CSPE was designed as a tax levied on electricity end-customers’ bills. Its level is set by the State and its purpose is to enable French electricity incumbent players, like EDF, to recover the extra charges incurred in performing their mandatory public service assignments. As such, the CSPE contributes to the financing of the development of renewable power generation, of the social electricity tariffs and of the nationwide equalization of electricity tariffs. Since 2007, the level set for the CSPE collection has been insufficient to compensate for the increase in the charges. This resulted in the accumulation of a CSPE deficit, borne by EDF only, which weighs on the group indebtedness.

The agreement found between EDF and the French authorities will provide the reimbursement by the French State of the receivable made of the CSPE deficit as of 31 December 2012 of c. €4.3 billion(1) and of the cumulated implied financing costs of this deficit of c. €0.6 billion. This receivable of c. €4.9 billion will be staggered according to a gradual schedule and will be fully repaid by 31 December 2018. The outstanding receivable will bear interest at market rates.

Following the above-mentioned agreement, EDF will account for a financial income of c.€0.6 billion stemming from the recognition of repayment of the historic CSPE deficit financing costs as of 31 December 2012(2).

Discussions between EDF and the French State continue in order to relief the Group net financial debt, on which the CSPE deficit currently weighs.

1 The final receivable amount will be confirmed later in 2013 when the French energy regulator (CRE) will validate the actual CSPE deficit for 2012.

2 The detailed accounting impacts of the agreement will be published with EDF’s 2012 financial results on 14 February 2013The EDF Group, one of the leaders in the European energy market, is an integrated energy company active in all areas of the business: generation,