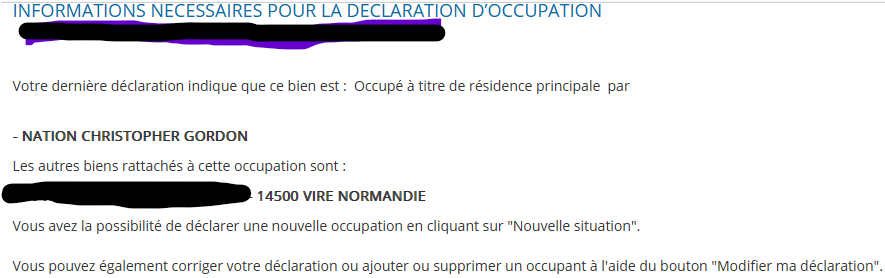

Not only seperate buildings but also my swimming pool has a seperate declaration.

We have done the main house, but which box do we tick on the form for our 19m2 outbuilding? It certainly isn’t occupied or occupiable!

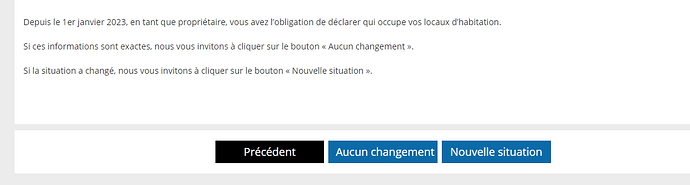

If you believe you have to declare it, the image posted by @Wozza holds the clue…

Click on Nouvelle situation

But if the outbuilding is already listed and remains the same it isn’t a new situation.

Our house, pool and outbuildings appear separately and all that is being asked is if the status quo continues, yes, no or new situation.

So I just click the box for part of main residence?

And once one has dealt with the house and, in my case, the cave under it [considered a separate ‘building’] I see that I am correctly identified as the ‘owner/occupier’ of these two immobs.

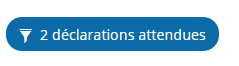

However, the page does not show any sign of me having done this declaration. In fact it still shows

Have I missed summat?

Two possibilities. One is that they want a separate return for each and every ‘building/structure’, even though you may have referred to both/all in your house return. I had 5 separate returns for garages, outbuildings etc. Second (not mutually exclusive) is that there appears to be a tech issue. I found that it refused to acknowledge I’d completed each of my 5 returns, regularly throwing me out of the system after each one. Whenever I went back into Impôts it then acknowledged I’d successfully done the previous return. Took rather a long time to process them all.

I do have the two properties and both show this

So these ‘derniere declarations’ for the two biens are correct - they needed correcting because they originally had me down as a landlord renting them out. But the now correct entries are not reflected in the ‘2 decs attendues’

@captainendeavour you may wish to redact your address from the image posted…

I am such a wuss when it comes to that sort of thing. I can’t imagine anyone having any interest beyond the topic of a thread.

I found these FAQs which answered a question for me, about what measurements they use and what counts as a room. It seems quite comprehensive and includes the question about non residents.

My husband and I looked up our space online today and I am wondering if anyone here can help us to understand.

Where do the listed property measurements come from? I’m guessing the Notaire when we bought? I have gone through the Acte de Vente and found no measurements beyond an indecipherable thing that may be hectares and covers in one the whole cadastral plot.

Thing is we had an architect draw up internal plans of the house and the square meterage doesn’t quite match what is listed on our .gouv web page.

And, what is this 1-8 ‘condition’ about?

I am a little concerned because contrary to what is said in the Connexion article (that I know is not a legal declaration):

“What about other types of property?

The form only applies to property that can be lived in, so properties such as a parking space or a commercial building are not included. Rental properties are included.”

our Espace webpage lists both the pool house, which we use for storage and is not ‘liveable’ with no loo, plus separately, the pool itself. Both as category ‘4’.

We are fine with paying taxe for these but do not understand why there is no mention of the garden, which is not huge but a good few square metres. And does the pool house being category 4 mean that it can be taxed as a gîte?

We live here permanently but are now mildly confused about how to complete/update the census form.

Any advice would be gratefully appreciated!

Hi All has anyone made the Declaration Biens Immobilier yet.

Do your details online for the house, sheds, swimming pool match your measurements.

Finally should barns and parking spaces be included?

Regards

Nick

Yes and no

House was all fine (well near enough) and just clicked.

Gîte a bit odd so have messaged to get it corrected.

And this explains how you deal with dependences

Impôts sur l’immobilier : les pièges de cette nouvelle obligation du fisc pour les propriétaires

There’s already a topic on this subject:

Hi Graham

Thanks I searched before I posted but did not find it.

Rgds

Could ask @billybutcher to merge your topic with that one if you wish…

Useful to be reminded @NickTarn . I’d completely forgotten about it. ![]()

Hi Graham yes it would be good to move this to the previous topic could @billybutcher please do this.

I have quite a few follow up questions which we will put to the impôt such as how our wooden garden shed can be a bien immobilier with luxury level the same as the house at 5.

Rgds

Nick