Anyone know anything else about this?

That would appear to aimed at French Residents and Citizens who own more than one property.

Unless I’m mistaken, non-residents would be paying the full amount of TdH as they aren’t tax resident (paying Impôts).

Not restricted to those that have two properties, but anyone that owns a French property whether as a principal or second home.

Doesn’t mention non-residents tho’.

It does seem to be an unusual requirement… a requirement date by 30 June 2023 to complete the task with no official notification that I’m aware of…

I’ll log in to my imôts account directly (not through the link provided though) to see if there is any information and report back later.

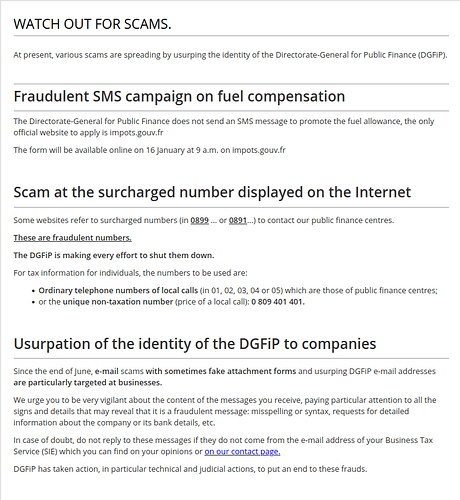

In the meantime there is a warning on the impôts site about scams doing the rounds:

Declaration submitted.

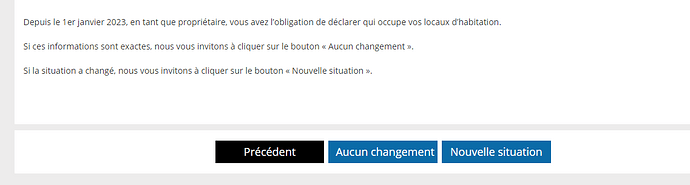

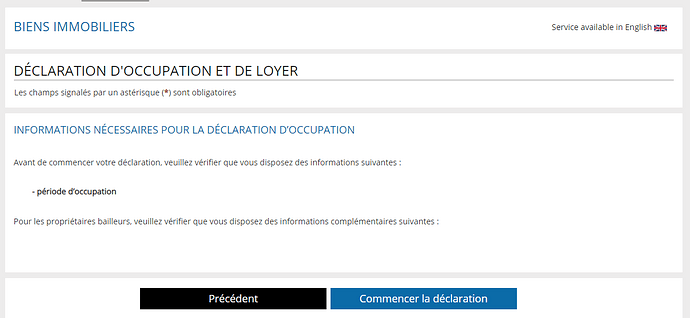

Having logged in to my impôts account through a direct route, it does seem genuine:

On completing the task, the current situation was already correctly recorded with an invitation to confirm as such or change the situation as required.

Pretty straightforward.

I guess that the current situation is already recorded and that, since 1st January 2023, there is a legal requirement to notify any change in circumstances although strangely, this does not seem to have been given wide circulation.

Given that non residents don’t have a tax number & can’t register on impots.gouv, we can’t register the properties anyway.

Interesting point…

But are you able to create a login to the impôts even so?

You clearly would have a “presence” somewhere in the system… ![]()

No, without a “numéro fiscal” it isn’t possible to register - there’s provision to pay individual TdH and TF bills on line using the reference numbers on the bills but it doesn’t result in an account on the website.

Have just checked [Mon Espace particulier] & yes you do have to declare your situation

Thanks for the heads up @JaneJones ![]()

Oh dear - I’ve just looked at this and it looks like it’s copied at least one of the dates from the census - I wonder if that’s possible? Anyway, it’s correct as to our current situation but not as to the period as it gives the same start date for both of us, which isn’t right. I think this could get very messy. I think I’ll leave worrying about this until the other stresses we’re under at the moment have passed.

Thanks for letting us know about it though, @JaneJones

Bizarrely the system seems to want separate declarations for our garage (2 returns, probably as one was extended in the past by previous owner) and outbuilding (2 more returns as there is a sort of covered area attached to the outbuilding, which the system thinks is a separate building?), as well as obviously for our house. I’ve included all these structures on the main declaration, and hope the system will cancel the declarations outstanding for the garage/outbuilding. I wonder if others have found similar?

Thanks @JaneJones for the tip off

Yes, out hangar/garage is a separate building to the house so we had two declarations to make.

Mmmm…. I wonder how the system handles gîtes.

interesting point… has anyone done a Declaration involving main house plus Gite… ?

Incidentally.,… apart from seeing the Declaration mentioned here on the Forum… it has passed me by…

I’m wondering … will the Govt be advising Everyone of this requirement…??

Our declaration was for the house and the (separate) hangar/garage building on the same land which is how we declared the completed project after the building work finished.

Nothing sinister in that that I can see as it just confirms the situation about the buildings on the parcel.

I have just looked at our espace. We have two entries, one with our names already attached which is I presume our house. The other has no names attached so I presume the gîte. The sq metres for both properties are slightly wrong. It may well just be the way that the odds and ends like garages, barns, and buanderies are calculated. It is the right ball park (300m2) and we have always filled in declarations for works, so I will leave this sleeping dog in peace.

I have just completed mine its a straightforward questionaire, and it gives you opportunity to add extra buildings . I have only one entry which is correct so very simple and straight forward.

@billybutcher I applied for a tax number whilst a non French resident via an email to my local tax office. They were only too happy to issue me one, and one for my wife who applied separately. We could then open our personal tax account online/manage timing of payments for TdH/TF etc. I wonder if this approach works currently - it was what the Impôt website advised at the time.

No idea, as I understood it the magic numéro fiscal wasn’t allocated until your first French tax return, and TdH and TF could be dealt with online but on an ad hoc basis.