So I pay cotisations monthly to URSSAF but now discover that this doesn’t necessarily entitle me to chomage but does entitle me to sick pay - or am I wrong? It says I pay to CIPAV not RSI - aren’t they basically the same thing?

Does this mean that as an auto-entrepreneur you have to find a private insurance to pay CSG cotisations in order to be covered for chomage?

@fabien may well be able to enlighten you!

(Sorry but I’m at work and having a sneaky post during my break!)

Self-employed cotisations don’t normally entitle you to unemployment benefit. It’s the same in the UK, and AFAIK in most countries.

CIPAV is a pension provider, so not the same thing as RSI. Plus, RSI no longer exists, or soon won’t.

There was a bit of a dialogue last year about opening chomage rights up to micro entrepreneurs, not sure if it is still on the table. The Federation sent round a survey asking members if they thought this should be obligatory, optional or not an option, and how much they would be willing to contribute. Discussed here, as you’ll see it’s not a simple issue and there are various aspects to be resolved, or not. https://www.federation-auto-entrepreneur.fr/actualites/auto-entrepreneur-et-ouverture-droits-chomage

Private insurance companies offer various policies to cover loss of revenue, accidents of life etc, not cheap and no doubt various get out clauses, but fabien will no doubt be able to guide you through this.

Traditionally it’s always been one of the factors you have to take into account when you decide to be your own boss. The other option is to set up a company structure and employ yourself; as an employee of your own company you will be covered for chomage, but obviously this will be reflected in the cotisations you pay. (Also of course, your company would have obligations towards you and would have hoops to jump through to make you unemployed…)

Hope this helps.

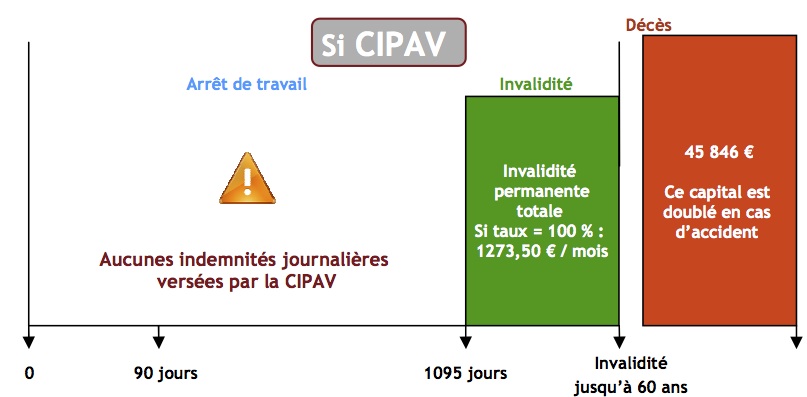

Hi @Evelyn, you are indeed entitled to sick pay but the scheme they offer you is… useless to say the least. I’m attaching a graph (in French sorry) and I’ll explain it below:

To sum it up:

- You get nothing in case of a “regular” sick leave

- You get something only if you are considered disabled and only if your “percentage” (defined by a doctor from the Social Security) is higher than 66%.

Example: If you make 50k€ a year and are considered 66% disabled you’d get 10.5k€ a year as a pension from the URSSAF (roughly 16k€ if 100% disabled).

So yes you are covered but I let you see by yourself how low the cover is, unfortunately.

I just looked at one of your previous posts and see you describe yourself as a “full time entrepreneur working full time”. If this means that in fact you work full time for one company, ie you are a full time employee but they won’t give you an employment contract so you have registered self employed to get round it (ie salariat déguisé) - well, the reason why registering self employed when in fact you should be employed as a salariée is not allowed, is exactly this issue. It means you end up without the rights that an employee is entitled to because your employer is not prepared to pay their dues, and this not legal.

Hopefully this is not your situation.

Hi @anon27586881, 100% right except for the part where you consider you can be eligible for the employment cover if you are an employee of your own business. This is, unfortunately, not the case as, in order to be eligible to the “chômage”, you have to fill-in two requirements:

- Being employed (under a payroll)

- Being someone else’s subordinate (you cannot be in charge)

That last bit wouldn’t be true if that’s your own company and therefore they wouldn’t accept you at “Pôle emploi” (even if they may accept you paying the fees on your payroll ![]() ).

).

I thought that if you actually work for the business (as opposed to just run it) the business can give you an employment contract. For instance, I set up a translation business and the business employs me to translate for 30 hours per week at a rate of X€ per hour. The business markets itself and signs contracts with clients, then it gives me the work, sets the deadlines, makes a profit because it charges the client more than it pays me, and in theory, penalises me if I deliver work full of mistakes ![]() Is that not the case? If not, there is a myth going round the industry…

Is that not the case? If not, there is a myth going round the industry…

They have offered me a CDI but the pay is not enough (it would mean I earn 3 times less than as an auto-entrepreneur, though with social cover that the CDI contract would give me).

Jeez…so what do the cotisations we pay cover??? To be allowed to work?!

Mmm… seems to me that perhaps it is better to be employed than to be going it alone… when things go wrong…

10 euros an hour seems to be like slave labour though…

Well that’s the dilemma isn’t it. Either you have the social cover, or you have the cash. You can’t have it both ways.

One way and another, cake and eat it is rarely an option

I’d need a second job to be able to pay the bills though. I’ve 3 kids…

It’s above minimum wage, and with cotisations added it will be costing the employer getting on for double that per hour.

How much do you consider that particular service is worth to the employer?

It depends who actually owns the business that is employing you. If you are the main shareholder then you won’t be eligible to the “chômage”. If the business belong to someone else then you are eligible (but then that’s not your business you are a “regular” employee)

There is a 3rd alternative which is what we call the “portage salarial”, basically, instead of being self employed you are under a contract with a company that will be invoicing for you (the “portage” business) and therefore you’re under a payroll AND entitled to the chômage as that’s not your company. You have to find “sociétés de portage” which are willing to accept you though (in regard to your turnover or expected revenues) and, of course, they’ll take a cut on your business (on top of the extra social charges of being employed + chômage + pension, etc.).

The best way to go is usually to seek advise with professional if you’re unsure as everyone’s situation is specific.

Well, I’ve previously worked for 17euros an hour. For me teaching (which requires prep) should at least pay that much.

If you’re on a low wage with 3 kids and your paperwork is in order you should be entitled to prime pour l’emploi, have you looked into it?

Have no idea about this. Thank you! Will look into it.

Indeed it is, minimum wage is 9.88€ per month (including social taxes) so the net equivalent is roughly 7.50€ per hour… 10€ per hour is 33% more than minimum wage in France

Although I understand that it seems very low, especially considering that even a mecanic rarely charges less than 50e per hour.

A cleaning lady is usually paid around 12e per hour, when paid using a “chèque emploi service” (very good option as the employer has tax deduction with that  ) The “chèque emploi service” (usually referred to as CESU) is a good option as you don’t have to be registered as self employed, the guy or girl who uses your services should declare he is employing a CESU and you get the payroll net of charges/taxes (except national taxes), the employer has to pay the social taxes (quite low though) so everyone wins. Major downside is that it only works with regular customers otherwise they won’t bother getting through the CESU stuff. But if they do, you get a higher net income, some social cover AND he/she will get tax deductions so that’s kind of a good alternative don’t you think?

) The “chèque emploi service” (usually referred to as CESU) is a good option as you don’t have to be registered as self employed, the guy or girl who uses your services should declare he is employing a CESU and you get the payroll net of charges/taxes (except national taxes), the employer has to pay the social taxes (quite low though) so everyone wins. Major downside is that it only works with regular customers otherwise they won’t bother getting through the CESU stuff. But if they do, you get a higher net income, some social cover AND he/she will get tax deductions so that’s kind of a good alternative don’t you think?

Thanks for all the info Fabien! Is there a particular place where we can find out if we can apply for tax deductions in general?