They didn’t mine so I entered them on the 3916 form on line last year (first online submission).

I had an email yesterday "inviting " me to do an online return (always done a paper one as that’s what’s been sent) so was quite surprised to get all 3 déclarations in the post this morning.

There seems (at least in our area) to have been a “rationalisation” of tax offices so my attempts to contact my usual one failed. I have always received an email telling me that the on-line forms were now available and this year I haven’t. I think there may be some confusion! Not helped by the non-delivery of the Connexion Tax Guide I always get to help. Can’t blame any of this on Brexit though

awww, why not? ![]()

Oh all right then…

I’ve decided to blame the perpetually cold weather in the UK this year on Brexit!

Izzy x

I have just been out for a walk beautiful sunshine but a biting cold wind

Ok folks… here we go.

With permission from @cat, I’ve now tagged this thread from this point as #stayontopic as important information comes to hand regarding completing tax returns for 2021.

Please do keep this topic on-topic as it will contain very important information which people will not wish to miss out on.

There are some important changes this year. and I’ll start off with two pdf references from a reliable source (as last year) to help you through the process of completing your on-line tax return.

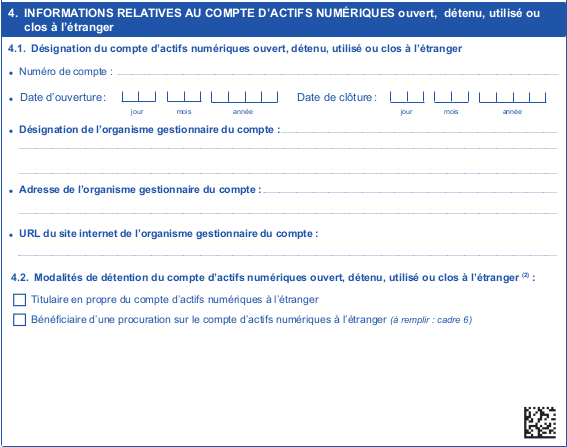

The most significant change notified is to the 3916 form Bank Accounts Outside France and how is should now be completed. Unfortunately, the form has to be completed from scratch this year because of the changes (but should be remembered for next year).

The issue of Paypal accounts is also resolved this year - they have to be declared

HELP TAX FORM 2021.pdf (134.2 KB)

Also Transferwise accounts if you are holding euro / £ / etc “pockets”

Yes even if they are not in pockets, just in the open accounts. I think I declared mine last year but will double check for this year! Thanks Sue and Graham

Will also apply to Revolut both the sterling base account and any wallets eg Euro

All sources of info gratefully received, and perhaps raises the question of which to use or all of them? When they state different or additional things?

The guide added above has to put foreign pensions into the 2047.

From the 2020-21 France declaration guidance: (page 117) (from the links previously posted) it has

EXEMPTED SALARIES AND PENSIONSFOR THE CALCULATION OF THE EFFECTIVE RATE

If you are domiciled in France and have received salaries or pensions exempt from income tax in France but retained for the calculation of the effective rate, you only have to complete lines 1AC or 1AH and following, page 1 of 2042 C , that whether or not you had other foreign source income. If you do not have other foreign source income, you are exempt from subscribing to a 2047 .

Does this mean if one does do a 2047, say for interest payments, one then also puts in the figures in 2047 according to the guidance just posted above?

When I ran the calculation on the full simulator also posted (again thanks) with the figures just in the 2042 it worked out the expected amount. Haven’t repeated for the above instructions – there wouldn’t be a risk of ‘double declaring’ would there?

For what it’s worth, the 2020-21 declaration guidance also says to deduct the foreign tax on the pensions first!

I’ve never seen that before anywhere – but I guess it makes sense otherwise one would be paying tax on the UK tax? (through the UK tax potentially putting one into a higher France band).

IIRC there used to be a section to indicate any UK tax paid. I’ve never had experience of that tbh because our Govt pensions are not of sufficient volume to attract UK tax as they are below the “free pay” element but something for people to look out for. Thanks for the comment.

We complete a paper return each year - Last year, for our revenue from Government pensions, the Box 8TK was missing from the Form 2042 and l was advised by our local friendly tax office to create one and fill it in on the form. That caused no problems. This year, as well as the 2047 and 2042 we have received a Form 2042CK which happily, at Section 8.1 DIVERS, includes the elusive Box 8TK - Revenus de source étrangère ouvrant droit a un crédit d’impot égal a l’impôt français.

Hope this helps other Luddites with a Government pension.

You didn’t read my post Graham l was talking about last year

Thanks for posting these again Graham

Just one query, on your Help Tax form, it states the rate being 1.13

We have just received an e-mail from the Tax office stating the rate is 1.143.

Does this need double checking

Regards

Andy

The author of the help guides is in the Charente (16) and usually knows what she is doing.

It’s a grey area. Different Depts often give different rates which can be quite confusing.

I have to admit that the annualised BdF and ECB rates for 2020 calculate to 1.14297 (which conforms with your Tax Office notification) but AFAIK there is nowhere on the tax form for you to indicate what exchange rate was used. Indeed, there is a school of thought that suggests the exchange rate to be used is the one at which the currency was converted or a mixture of the different mechanisms.

Personally, I would (I will) keep personal notes in my own tax file about how I arrived at my declaration - our State pensions are paid directly into our French Bank in Euro by HMG which the fisc seem to regard acceptable to be on hand if I am challenged some time in th future about what mechanisms were used and why.

I know that doesn’t answer your question directly, but…

My task for this afternoon is the bank accounts form, 391@

Despite trying to reduce the number of accounts we hold, we still have rather a lot (more than 30). Do you think it is possible to do an entry for each institution and then somehow put in the reference numbers for the different accounts? For NS&I we have 10 accounts between us…

Just looking at the form on line (not in the declaration system) and it looks to be that they have combined the 3916 and the 3916-BIS forms (they were separate before).

This is the link to the new form 3916_3425-2.pdf (341.9 KB)

From what I can see, there is very little space in which to expand into different accounts for the same institution (page 2 of the form)

So it seems lots of forms to fill in I think unfortunately.

Just don’t break the system with 30 plus accounts in one return!

I could just put commas between the account numbers…

Last year we did sort of fill in different forms, but pretty scrappily so not complete info. I was going to improve it this year but now having to start all over again is a bit annoying…