an incentive to kill off the excess then this year

What does compte d’actifs mean? Actif seems to be the word often used as opposed to retraité but that doesn’t sound right here… It can’t mean active accounts because they want closed ones as well…

AFAIK it would refer to active accounts in the year in view and any closed during the year in view will go in the closed section which in the following year won’t need to be disclosed.

I thought that was the new category of compte actif (numerique) for bitcoins and the like?

Previously I have identified all my accounts as compte ordinaire, épargne or à terme. As in current accounts, savings accounts and fixed term bonds…

that makes sense… it’s from the previous 3916-BIS form :doh!: should have looked on the form ![]()

This still begs the question though… if you have a Revolut a/c (for example) do you put the base account on 3916 and the wallet on the numerique section? I didn’t last year, I just gave the base Revolut account details.

Oh good! Don’t have any of those

A couple of contributions / suggestionable queries?

-

Exchange rate : Pretty sure the previously posted guides on the impot website direct to use the Bank of Paris rate on the day of the transaction. That said, I have been in comms with an SF contributor and they said last year, they just agreed the rates with the local tax person they were in communication with - they accepted whatever was the best method in his interest.

-

Account declarations - how pesky. The guy down the impot said to me just write them down on a sheet and attach to my first paper declaration. I’m already thinking for next year - what about -

just doing a paper return each year, OR

why not just type them on a document and put them in the ‘notes’? OR

just say in the notes the previously declared accounts remain the same, no changes except for the new ones added

I also like @JaneJones idea of squeezing as many as possible into one form with separated account numbers.

I guess i’m showing my anglo-saxon free enterprise buckaneering ‘throw those custom declarations in the bin’ spirit.

But seriously, what is the law here - declare them in a prescribed manner (in the law) or just declare them - would be be fined for declaring them but not on the form?

Obs that sounds unlikely if my impot guy is saying just put them on a bit of paper - but I suppose I should get that on a bit of paper!

They tend to be pretty relaxed about the first one, Dave. Just keep copies of everything!

Everything I have read in the guides or on the website indicates that you either use the exchange rate on the day OR you can use a yearly average. I have done both in the past (if you have dozens and dozens of small amounts coming in it’s a terrible faff using the exchange rate on the day).

When I first went to the Tax Office, the conversion rate they showed me was the one Graham described and thats the one that the accountants in Connection recommend but this year I’m using actual on-the-day rates.

Regarding paper returns next year - you can’t, basically, unless there is a VERY good reason

Just to add - while they are relaxed about format on the first paper return, you had better do it on the proper forms in future unless you want to practice your French in a confrontational situation

I think JJ is referring to where the accounts are with the same account provider but I don’t think that will be acceptable for different banks/institutions.

It is a bind but once declared in the proper format on line there shouldn’t be a need to repeat the process year on year. Its only this year because of the combination of the two 3916 forms to account for the increase in numerique type accounts, bitcoin and the like. The 3916-BIS wasn’t a well known or understood form until it began prominence last year as a result of increased activity in this area.

Personally, I’d take the time to do it properly this year and then you can sit back and relax. There are obviously those who will qualify to continue using paper returns but that will diminish over time and people requesting paper returns may find increasing pressure on them to justify their reasons (whether sur l’honneur or not remains to be seen).

Don’t tempt fate - nor give them a reason to select you for a contrôle. Blend in to the background and become less conspicuous ![]()

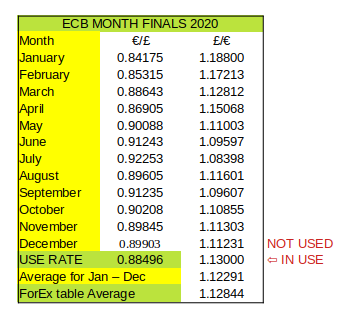

That can be quite challenging. I use a spreadsheet (self designed) which provides 3 tables from which to select:

Table 1 = amounts paid in € remainder £ converted on ECB rate

Table 2 = amounts due in sterling converted to final ECB rate

Table 3 = Table 2 annualised ECB rate.

The ForEx average is the sum of all £ amounts converted during the year and is mainly just a check-sum against the basic average for Jan - Dec finals (and thus not used - just for information).

The only issue that arises is what to do with remaining sterling which is spent in sterling in the UK and not converted to €. This is where the tables take account of it.

Thanks Graham - very useful! As it happens I have very little left in the UK that doesn’t come to France immediately, which is why I am starting to change my calculation method. The tax authorities seem happy with whichever way you do it provided you can justify it, which is very reasonable in my view…

well, in the grand scheme of things, there’s isn’t really a lot of difference between the rates which would generate a significant tax take…

Exactly - and the French authorities have always been very accommodating in my experience so far - provided you’r not trying to take the p*** of course.

There are, of course, general guides to pensions for the tax form, but foreign (incl. British) pensions are a particularly complicated issue. We have been to the tax office once, and that worked for that year, but then the form changed the year after. I have not seen yet a guide to this particular issue, which must affect a lot of people. Perhaps a separate thread?

@Peter_Whitfield

The guide (which covers this issue) is at post number 27 above

see link here

It’s quite comprehensive if you follow it through. The Help Tax Form 2021.pdf in the linked post specifically mentions the boxes to use for private and Govt pensions.

Teachers and university staff pensions can be either governmental (taxed in UK) or non-government (taxed here) depending on specific details.

This explains

Thanks, Graham.

I’ve got both types of unversity pension -The Teacher’s Pension Fund for school teachers and lecturers in former polys (post 1993 universities), colleges of HE/FE etc is classed as a government pension and is taxed at source in the UK. The USS (University Superann. Scheme) - mainly older, Russell Group universities is classed as non-governmental and is taxed in France.

For euro rate conversion I think I read some people use the actual rate they get when converting - i.e. just declare the actual euro amounts received? If that’s allowed some sort of calculation might be able to deal with any residual amounts.

Some people have said they get a good rate for getting the state pension paid direct to a euro bank account. Does anybody know what the rate is - e.g. better than transferwise’s 0.35% to 0.37% on the day. Then one could just declare these amounts received directly?

Of course, with time on one’s hand one would compare the different treatments to find the most effective method unless they were not a fan of arithmetic!