Hi all,

I’ve finally come back to my tax return but I’m stuck on one point.

I cashed in a Predissime last year that I have to declare on my income tax. It was under 8 years old and the bank has written the following:

Primes versées non rachetés au 31 décembre 2019 qu’elle que soit la date de leur versement sur votre contrat:480€

Primes versées à compter du 27 septembre 2017 non rachetés au 31 décembre 2019: 480€

My question is where do I put it on the form?

The actions I hold with the bank are prefilled in cases 2ZZ &2DC, 2BH & 2CK. Do I have to add it to one of these?

a bit of unusual query, in 2020 tax year a friend paid £4,000 to DWP to buy additional (10?) years of Nat Insuran contr thereby getting larger future state pension which she also started getting immediately amounting to £3,000 in 2020.

She assumes she must declare the £3k as income and be taxed in France but can she set the £4k against it so in effect she would pay no tax on this element this year?

Is this an increase of £3000 every year or an element of catch-up?

If so it sounds like stunningly bad offer on UK govt & taxpayer part - how on earth can this sort of thing exist?!

absolutely

absolutely not!

Put it this way John, is she then going to ask the French fisc to give her an allowance against all the NICs she has paid since time began? Absurd in the n’th degree. It wouldn’t happen in the UK and it certainly won’t in France.

I think the figures must be wrong! I am trying to buy added years, and each year will cost between £800 and £1000. And for each extra year I have I will get a couple of £ extra a week, so would have to live at least 8 years after my pension age to break even!

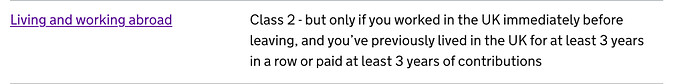

Jane, have you asked about the possibility of paying Class 2 contributions ? I think you probably qualify as I seem to remember you saying you worked in the UK before coming to France.

From this .gov document >

Your pressed the button for a rant there!!!

Immediately before coming to France I was self-employed for 4 years, but with very low earnings. Because I already (I thought) had enough years to qualify for a full pension I got the small earning exemption from NI although I could have paid a small amount.

It was only later that I found out that the Government failed to tell women of my age that not only had they raised our pension age and extra year to 66, but had also added on extra qualifying years. So I am missing 4 years… and self-employed means class 3

So I now have to pay class 3 if I want to top up. I have put it off for years as other priorities for extra funds, but now the piggy bank is fat enough. But I resent it!!

@JaneJones Don’t get me started on the UK’s 3 evil recent pension decisions which have far, far disproportionately affected women.

I have no idea in particular, how the recent case brought by the two women about lack of notice and completely unfair lack of tapering, was lost. I can only think they had useless lawyers.

Sorry Jane, I didn’t mean to rub salt in the wound.

Sorry Jane, I didn’t mean to rub salt in the wound.

The road to hell is paved with good intentions

1 Like

those were ones mentioned but may well be not right, it does seem too good a deal to refuse!

It was more about the principle of set off.

@graham …looking at the way you put it i can see why she couldn’t get set off here or in Blighty…!.I should have seen that and told her so

1 Like

Hello, wonder if anyone else has a similar situation.

We have unfurnished rental income from France, which last year and this year we declared under the regime reel. For 2020 we also have UK rental income - our old house - and I have entered that under the mico-foncier heading, and also as income from abroad.

However, when I come to the end of the retun with the summary of the entries, I get an error message, it does not seem to like the 2 sources of rent. I am wondering if, because we opted for regime reel last year for 1 property, this must apply to any property, regardless of country?

I can try phoning or contacting them via the online chat tomorrow, but just wondered if anyone has encountered this?

What error message are you getting exactly?

Our French LMNP rental business is regime reél, and we also have UK rental. It seems to be accepted without error messages.

In the Help Tax Form 2021 (at post 28 above):

French rental income (other than gite or chambre d’hôte) goes in box 4BE on Form 2042

UK rental income goes on 4BE & 4BK & 8TK on Forms 2042 & 2042C and section 4 Form 2047

@JaneJones Just for the record, did you manage to get your 30+ foreign bank accounts listed online on cerfa 3916(bis) and did you encounter any physical limit?

Turns out it’s only 27! But still typing…

1 Like

I’ll log in again later to check the wording, thanks

1 Like

And your UK rental income is declared as micro foncier, i.e. the simplified regime where you don’t have to list your expenses? Thanks.

Sorry Jane, I didn’t mean to rub salt in the wound.

Sorry Jane, I didn’t mean to rub salt in the wound.