It is a valeur locative (ie assumed rental value) but often set 30 years ago and not reassessed.

But they increased it by about 7%. Was this to keep pace with inflation?

I seem to recall reading that this was so… 7.1% set by the government…

Sorry I was not being clear. Normally the base valeur locative doesn’t change unless there are alterations (eg new extension) but the multiplier does. I attach a link as to how this valuer locative is arrived at. This year the State has imposed a nation wide increase, plus the percentage increases voted by the communes.

Our TdF nearly doubled the year the TdH was ceased on our property. ![]()

I did read that there was going to be an increase in TDF after the TDH went. I guess they still have to collect the same amount of tax.

A bit unfair for those that have to pay TDF and TDH.

This morning I authorized payment of our TF, just under 700€. This will be the first year of not paying TdH which was more +/- for the same amount, so net gain of +/- 700€ ![]()

That’s only 2nd home owners isn’t it?

Be that as it may it would mean paying about 50% extra in local taxes - which is quite a burden.

But if you sell it, console yourself with the knowledge that if you’re a French resident and you’ve owned it for more than 10 years, unlike the UK you’ll pay very little in Capital gains tax.

I think the TdH for 2nd home ownership is partly based on the the family revenue up until a certain point. (That was my situation before this year).

It’s a luxury to have a second home and be able to drive to it in one’s own car, pay the electricity, water, internet etc. Use the local aminaties, have a fonctioning municipality. When only putting back into the local economy a few weeks a year.

Alright it *is* slightly less than the UK’s 28% but not by much - at 10 years you still have to pay 70% of the CGT (19-25% depending on the amount gained) and 91.75% of the social charges (7.5%**). I was contacted by the agent at the height of the pandemic and offered roughly double what we paid, I suspect that was a bit optimistic and prices have fallen back since then but I’d be looking at approx 25% CGT if I sold now and 22% if I sell at 10 years

** I see that the fisc have confirmed UK residents only have to pay 7.5% social contributions, not the full 17.2 % that some non-residents have to pay.

Yes, I’m aware it is a privilege.

However I use significantly *less* of the actual civic amenities by dint of not being here, yet pay the same price as someone resident permanently - indeed with the removal of TDH, I will be paying more.

Name one government in history that reduced the total taxation on its citizens.

I’ll wait.

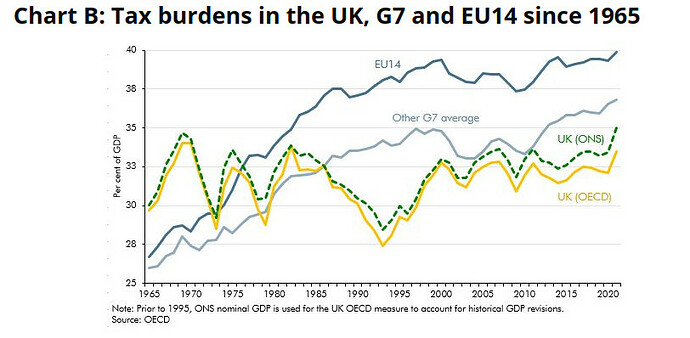

Here you go

Source OBR

UK 1980 to 1994 or so (that would be when we had a Tory government which actually believed in low taxes rather than the one we have now which believes in high taxes so it can bung billions to the already fantastically wealthy).

If it has been your maison principal for at least a year you pay no capital gains at all. If not then still get full exemption after 22 years and after 30 for social charges.

Life is unfair. Think of all the younger and poorer people who are completely priced out of their local market due in large part to second home owners.

Reading the local paper for where I moved from, seems the neighbouring commune are now only building new houses for principal residences and young families who can afford to get a mortgage, no building for holiday homes any more! I have friends from Paris who landbanked parcels back in the 70’s and 80’s for future construction for retirement and family, the land has now been refused and declassified for any construction at all so they are left with odd parcels, too small for farming and of no use!

Yes, you use them less, but they are there for the rest of the year and if 2nd home owners spend more time in the commune it’s up to them, but can hardly whinge saying we’re only there for a few weeks a year and pay a few hundred euros more than the rest. Full time residents keep the local economy turning. I imagine that a lot of the people in the commune would love to have the same financial capacity as most of the 2nd home owners

The full time residents still need the commune to supply water and waste disposal, keep things tidy and maintenance of all sorts of things, they also buy in local shops, markets, keep local traders in work that pay taxes too.

So a few hundred more € is a small price to pay to find the village tidy and local butchers, bakery etc open when 2nd home owners arrive.

Agree. Also worth remembering this applies to the French who have second homes