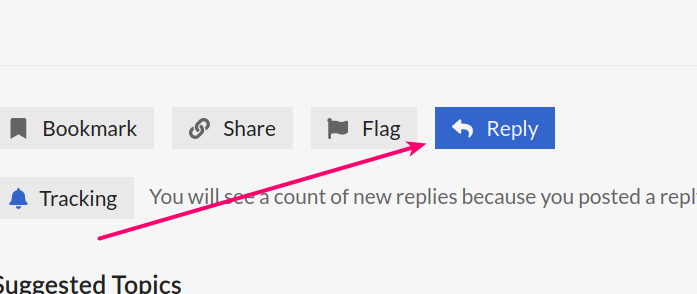

In an existing thread under Tax and Social charges (as opposed to starting a whole new thread which @Stella alludes to) click on the big blue Reply option at the bottom of the screen as opposed to the grey one under a post - comme ça

Starting a new thread per question can be counter-productive as an answer in an existing thread can often benefit a wider audience and group like questions together.

2 Likes

well done Graham… must admit… I immediately thought of a “new” question…

1 Like

I’m so close to submitting my on-line form. My question is, can anyone explain why the boxes that I used to use for our private pensions are greyed out? I used to put them on the 2042 into boxes 1AS and 1BS but I can’t add anything to them boxes now. I have now put them into 1AM and 1BM because they are private pensions that are taxed in France. Do you think that’s right? Thank you everyone.

did you follow the advice set out in the links provided in this post in this thread?

I’m guessing not! I’ll go back and read them. You know what happens, when you start going round in circles - you forget what you’ve read. (Well I do!).

1 Like

It’s very easy to follow @Terasa and you should manage to get it done (apologies for using Doris speak lol)

Thanks Graham. I’ve sent it off (on-line). It went a bit quicker than I had expected actually, I had expected to be able to look at it a few more times first! But it’s gone now. I’ll spent an hour or two tomorrow just checking through it. I am quite good on a computer and quite good with figures but I didn’t find it that easy.

1 Like

Funny you should say that. Just been getting ours done and Bingo, no box for gov pension.

It could only be in the 8 section. I’ve gone boss eyed searching the remaining boxes.

Just completed it on line. 3 forms.

Fairly easy and it’s possible to use Google translate. All income from the UK, one a Gov pension. The box missing on the printed forms was available on line. Must be an error on their part.

.

The fisc make an error? quel horreur! rien!!

Having submitted our return last week with UK earnings & Tax on it. Should I expect to receive the results of the submission and details of any taxes & cotisations due ?

Eventually…you will get an Avis. Prob not until September.

Thanks - does that come via the post before any money is taken from account?

done on-line… there is usually notification on-line well before any monies are sought…

Does the notification come by email? Or do I have to check periodically?

It comes at the end of your submission Mat…

You can of course log into your account and do the simulation based on what you submitted

I got a confirmation of submission but i assume taxes due will be calculated and I will in someway be notified I am trying to find out what format the notification will be and if I have to periodically look for it in the impôts website.

For us at the end of the submission it suggested because of overseas earnings it could not give us an automatic indication of taxes due.

We get a paper avis around the same time it shows up in our online account. And then get told the amount of the future prélèvement, plus the amount of the lump sum we have to pay - usually taken from our account on christmas eve. This will be months away yet.

(Edit OH reminds me that last year our tax submission had a mistake in it so had to be re-submitted which delayed things, and normally we get Avis in Sept to pay any amount outstanding in Oct/Nov. )

1 Like

Thanks Jane - is this both for taxes and any other social charges due?